Williams Companies Stock Outlook: Is Wall Street Bullish or Bearish?

By:

Barchart.com

November 05, 2025 at 08:20 AM EST

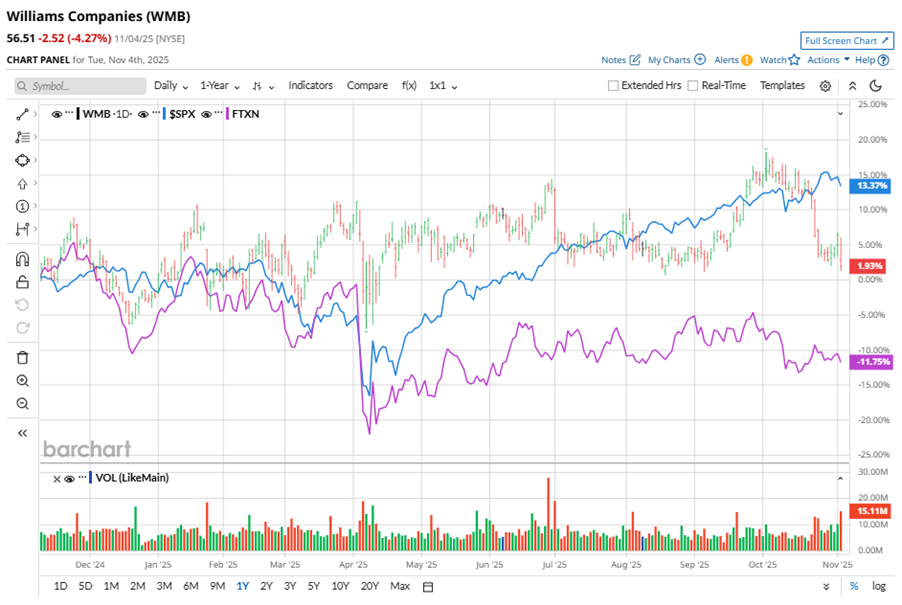

The Williams Companies, Inc. (WMB), headquartered in Tulsa, Oklahoma, operates as an energy infrastructure company focused on connecting North America's hydrocarbon resource plays to growing markets for natural gas, natural gas liquids (NGLs), and olefins. With a market cap of $68.9 billion, the company owns and operates midstream gathering and processing assets and interstate natural gas pipelines. Shares of this natural gas giant have underperformed the broader market over the past year. WMB has gained 8.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.5%. In 2025, WMB stock is up 4.4%, compared to the SPX’s 15.1% rise on a YTD basis. Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Narrowing the focus, WMB’s outperformance is apparent compared to the First Trust Nasdaq Oil & Gas ETF (FTXN). The exchange-traded fund has declined about 7.5% over the past year. Moreover, WMB’s returns on a YTD basis outshine the ETF’s 5.7% losses over the same time frame.

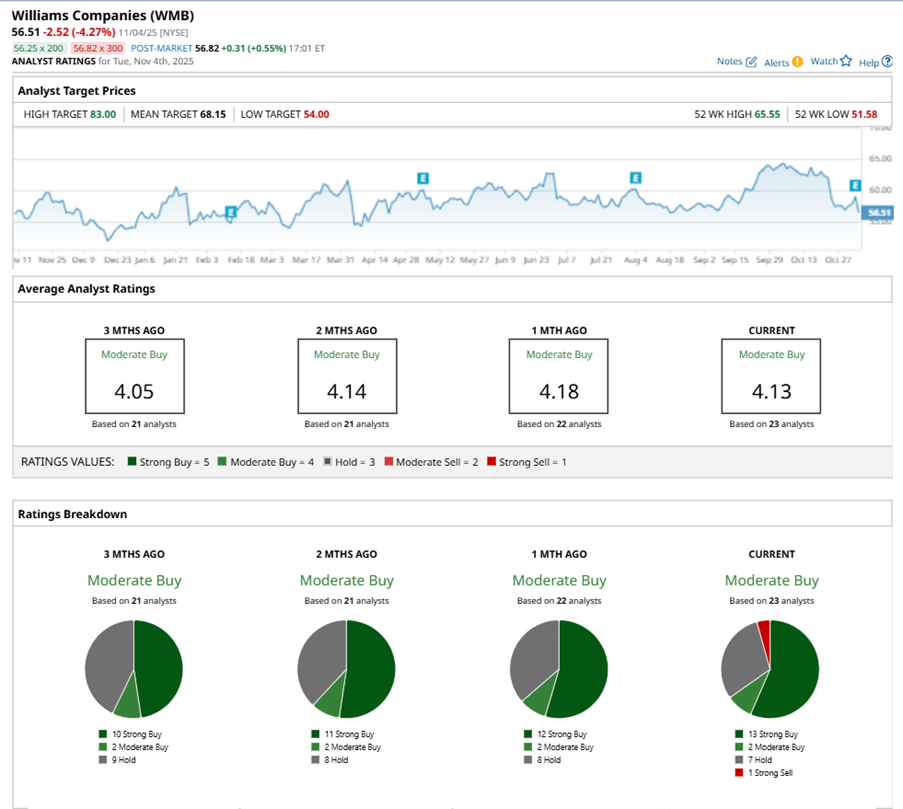

On Nov. 3, WMB shares closed up by 2% after reporting its Q3 results. Its adjusted EPS of $0.49 fell short of Wall Street expectations of $0.51. The company’s revenue was $2.9 billion, falling short of Wall Street forecasts of $3 billion. WMB expects full-year adjusted EPS in the range of $2.01 to $2.19. For the current fiscal year, ending in December, analysts expect WMB’s EPS to grow 14.1% to $2.19 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions. Among the 23 analysts covering WMB stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, two “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, with 12 analysts suggesting a “Strong Buy.” On Oct. 27, Elvira Scotto from RBC Capital reiterated a “Buy” rating on WMB with a price target of $75, implying a potential upside of 32.7% from current levels. The mean price target of $68.15 represents a 20.6% premium to WMB’s current price levels. The Street-high price target of $83 suggests an ambitious upside potential of 46.9%. On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Is CrowdStrike Ready to Rally After Its Recent Pullback? ↗

Today 11:33 EST

Via MarketBeat

Tickers

CRWD

SanDisk Joins the S&P 500: Inside the Index Effect Rally ↗

Today 10:45 EST

Via MarketBeat

Tickers

AMZN

Tesla Just Got Called a “Must Own” Stock—Here’s Why ↗

Today 7:01 EST

Via MarketBeat

Tickers

TSLA

Why Gold Loves Trump as Much as Trump Loves Gold ↗

November 26, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|