Are Wall Street Analysts Predicting MetLife Stock Will Climb or Sink?

By:

Barchart.com

November 06, 2025 at 14:39 PM EST

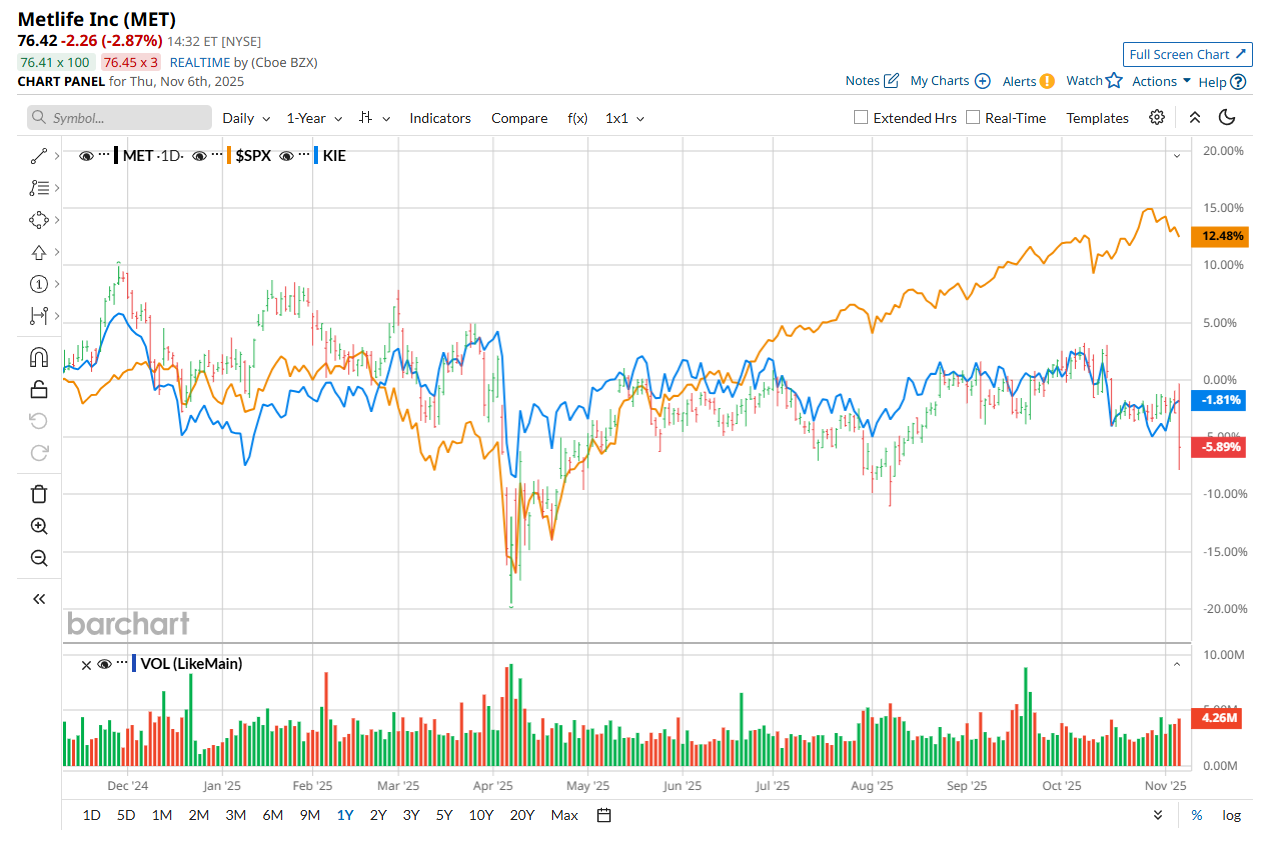

Valued at a market cap of $52.3 billion, MetLife, Inc. (MET) is a financial services company that provides insurance, annuities, employee benefits, and asset management services. The New York-based company is recognized for its financial strength, global reach, and focus on helping customers build a more secure financial future. This financial services company has underperformed the broader market over the past 52 weeks. Shares of MET have declined 8.7% over this time frame, while the broader S&P 500 Index ($SPX) has surged 13.7%. Moreover, on a YTD basis, the stock is down 7.2%, compared to SPX’s 14.6% return. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

Narrowing the focus, MET has also lagged the SPDR S&P Insurance ETF (KIE), which is down 1.8% over the past 52 weeks and up 1.9% on a YTD basis.

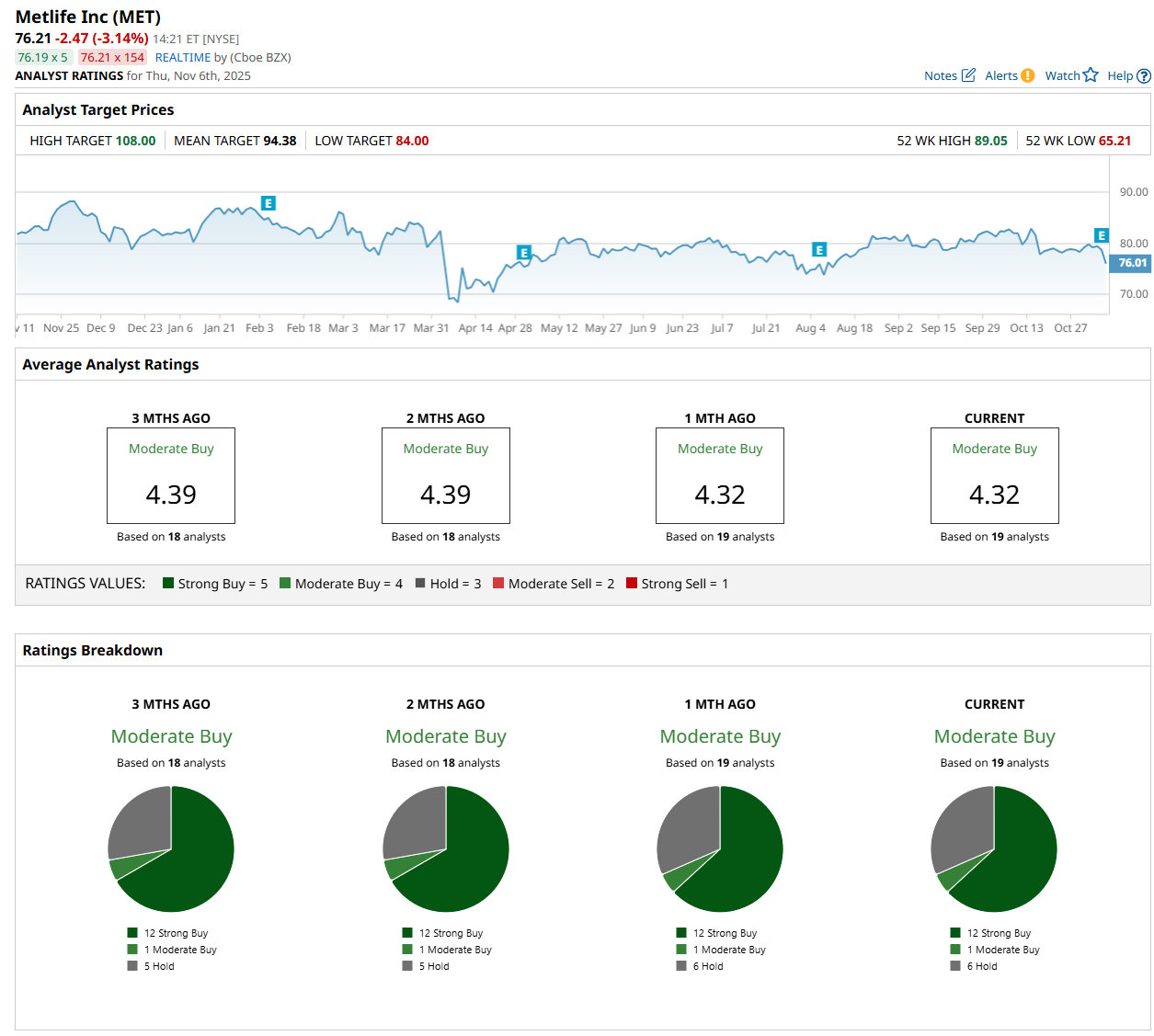

MET released mixed Q3 earnings results after the market closed on Nov. 5. The company’s total revenue declined 5.9% year-over-year to $17.4 billion and missed analyst estimates by 8.4% as net investment losses and derivatives losses pressured the top line. Nonetheless, its adjusted EPS of $2.37 improved 21.5% from the year-ago quarter, surpassing consensus expectations of $2.32. For the current fiscal year, ending in December, analysts expect MET’s EPS to grow 7.2% year over year to $8.69. The company’s earnings surprise history is disappointing. It missed the consensus estimates in three of the last four quarters, while surpassing on another occasion. Among the 19 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” one “Moderate Buy,” and six "Hold” ratings.

The configuration has remained fairly stable over the past three months. On Nov. 6, UBS Group AG (UBS) analyst Michael Ward CFA maintained a "Buy" rating on MET and set a price target of $95, indicating a 24.7% potential upside from the current levels. The mean price target of $94.38 represents a 23.8% premium from MET’s current price levels, while the Street-high price target of $108 suggests an upside potential of 41.7%. On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Via MarketBeat

Tickers

CRWD

Why 2026 Could Be the Year D-Wave Breaks Out ↗

December 22, 2025

Via MarketBeat

Tickers

QBTS

5 Stocks Using Buybacks to Drive Serious Upside Into 2026 ↗

December 22, 2025

Is It Time to Take Profits on These 2025 Winners? ↗

December 22, 2025

Via MarketBeat

Could These 3 Aerospace Firms Go Stratospheric in 2026? ↗

December 22, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|