GM and Ford Make Merry Amid EV Woes: Which Stock Is a Better Buy for 2026?

By:

Barchart.com

December 17, 2025 at 14:24 PM EST

The U.S. automotive industry landscape has changed greatly over the last few months. After phasing out the electric vehicle (EV) tax credit, the Trump administration is now easing fuel economy standards. The pivot in U.S. energy policy shouldn't come as a surprise, as President Donald Trump’s stance towards green energy was no secret, and he had talked about ending the (nonexistent) “EV mandate” during his campaign. Meanwhile, the phasing out of the tax credit is expected to hit U.S. EV adoption rates, and even Tesla (TSLA) CEO Elon Musk sees a “few rough quarters” ahead. While Tesla bulls can still argue that EV deliveries won’t matter much for the company, which is now increasingly a play on physical artificial intelligence (AI) with products like Optimus humanoid and robotaxi. The expiration of the EV tax credit has amplified startup EV companies’ woes. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

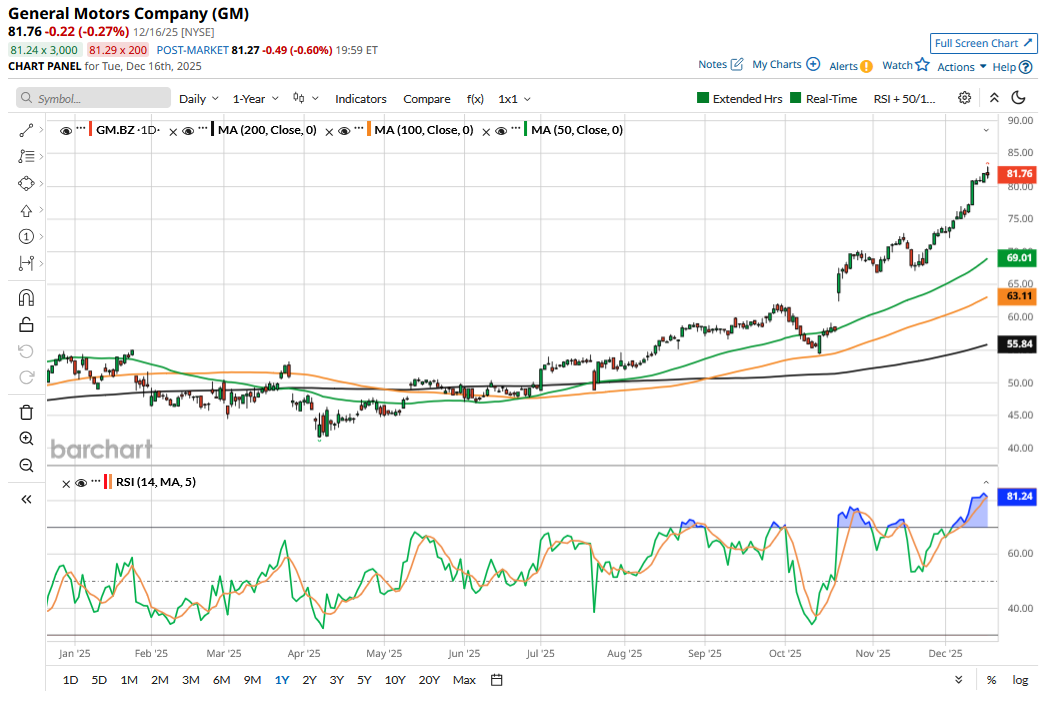

Ford and GM Have Rolled Back Their EV AmbitionsLegacy automakers have also been hit by the slowdown in EV sales and have had to incur massive charges on the investments they made to boost their EV production capacity. In Q3, General Motors (GM) took a $1.6 billion hit related to the pullback in its EV business. Now, Ford (F) has announced a $19.5 billion hit, of which $5.5 billion would be in cash, as it rejigs its EV strategy. The company has stopped production of the all-electric avatar of the F-150, whose internal combustion engine (ICE) has been America’s best-selling pickup for decades. Instead, Ford would double down on hybrids and extended-range electric vehicles (EREVs). The latter are quite popular in China as they come with a gasoline tank to recharge the battery, thereby extending the range. Meanwhile, despite the burgeoning losses in their flagging EV operations, Detroit auto giants have been reporting stellar profits, thanks to the strength of their ICE operations. GM particularly stands out and expects to post adjusted pre-tax profits between $12 billion and $13 billion in 2025. The company also raised its 2025 adjusted earnings per share (EPS) guidance to between $9.75 and $10.50 and projected adjusted automotive free cash flows between $10 billion and $11 billion. GM Has Outperformed FordThe splendid financial performance of Ford and GM hasn’t been lost on markets, and they have gained 38% and 53%, respectively, so far this year. Amid the tariff chaos that would add billions of dollars in costs for legacy automakers, not many would have given Ford and GM much of a chance of being top-quartile gainers in the S&P 500 Index ($SPX) this year.

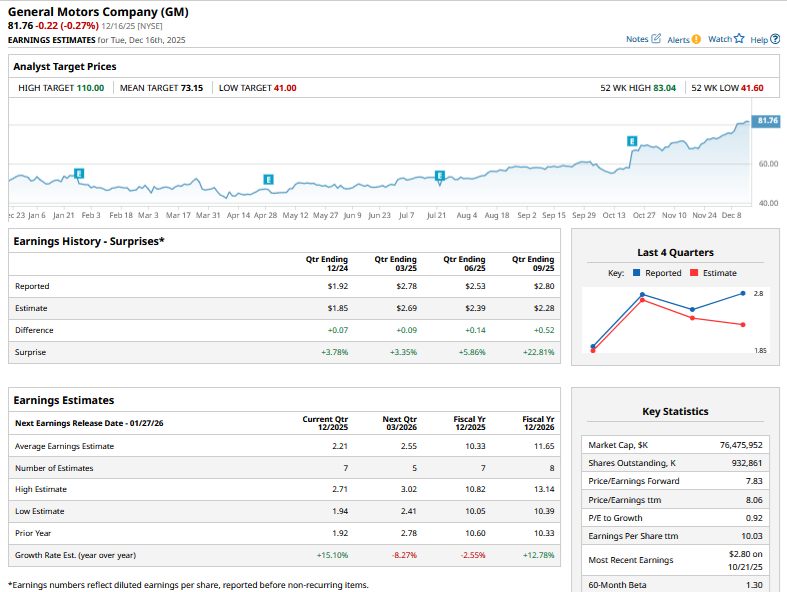

General Motors' performance has been particularly impressive, as tariffs hit it harder than the Blue Oval since it imports cars from South Korea and China to the U.S. However, the company was able to mitigate some impact from the tariffs. GM has been outperforming Ford for quite some time now, and while F had closed in the red last year, GM rose by around 49%. Markets have given a thumbs-up to GM’s strong operating and financial performance, which it has bolstered with a prudent capital allocation strategy, including aggressive share repurchases. GM’s outstanding share count fell to 954 million at the end of Q3, 15% lower than the corresponding period last year, and it expects it to dwindle further as it doubles down on share repurchases. As I have noted previously, share repurchases make perfect sense for GM given its single-digit price-to-earnings (P/E) multiples. If anything, the company might accelerate the buyback pace over the coming quarters as it scales back on EV capex. Notably, one of the reasons Morgan Stanley cited while upgrading GM was the company’s capital discipline. The brokerage, however, downgraded Rivian (RIVN) and long-time favorite Tesla amid the EV industry woes. Can GM Continue to Outperform in 2026?GM now trades at a forward price-to-earnings (P/E) multiple of 7.8x, which, while still in single digits, is higher than what it has averaged over the last couple of years. GM’s earnings are expected to rise by 12.7% next year, which gives us a P/E-to-growth (PEG) multiple of 0.92x. The multiples still look reasonable to me, especially considering the strong execution that we have seen from GM in recent years. Overall, while 2026 might not be another year of 50% gains from GM, I still see some heat in the rally as the company makes merry from its legacy ICE business, even as pure-play EV companies brace for the impact of the worsening slowdown.

On the date of publication, Mohit Oberoi had a position in: F , GM , TSLA , RIVN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Post 35% Surge, Analysts Eye More Upside in Copper Giant Freeport ↗

December 17, 2025

Via MarketBeat

Why a SpaceX IPO Could Be a Major Catalyst for GOOGL Stock ↗

December 17, 2025

Can Upwork Maintain Its Comeback? Reasons to Be Bullish and Bearish ↗

December 17, 2025

Via MarketBeat

Is Tesla Overvalued? 2 Reasons It Might Be a Bargain ↗

December 17, 2025

Via MarketBeat

Tickers

TSLA

How These 2 Stocks Won 2025's AI Race—And What's In Store for 2026 ↗

December 17, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|