Wall Street Is Betting That SNDL Stock Can More Than Double in the Next Year. Should You Buy Shares Here?

By:

Barchart.com

December 17, 2025 at 13:50 PM EST

SNDL (SNDL) shares gained nearly 12% on Wednesday. Dec. 16 following reports that President Donald Trump could reclassify cannabis as a “Schedule III” drug by the end of this week. The U.S. government is considering a policy shift that would offer some seniors access to cannabis products under Medicare coverage as well, the reports added. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

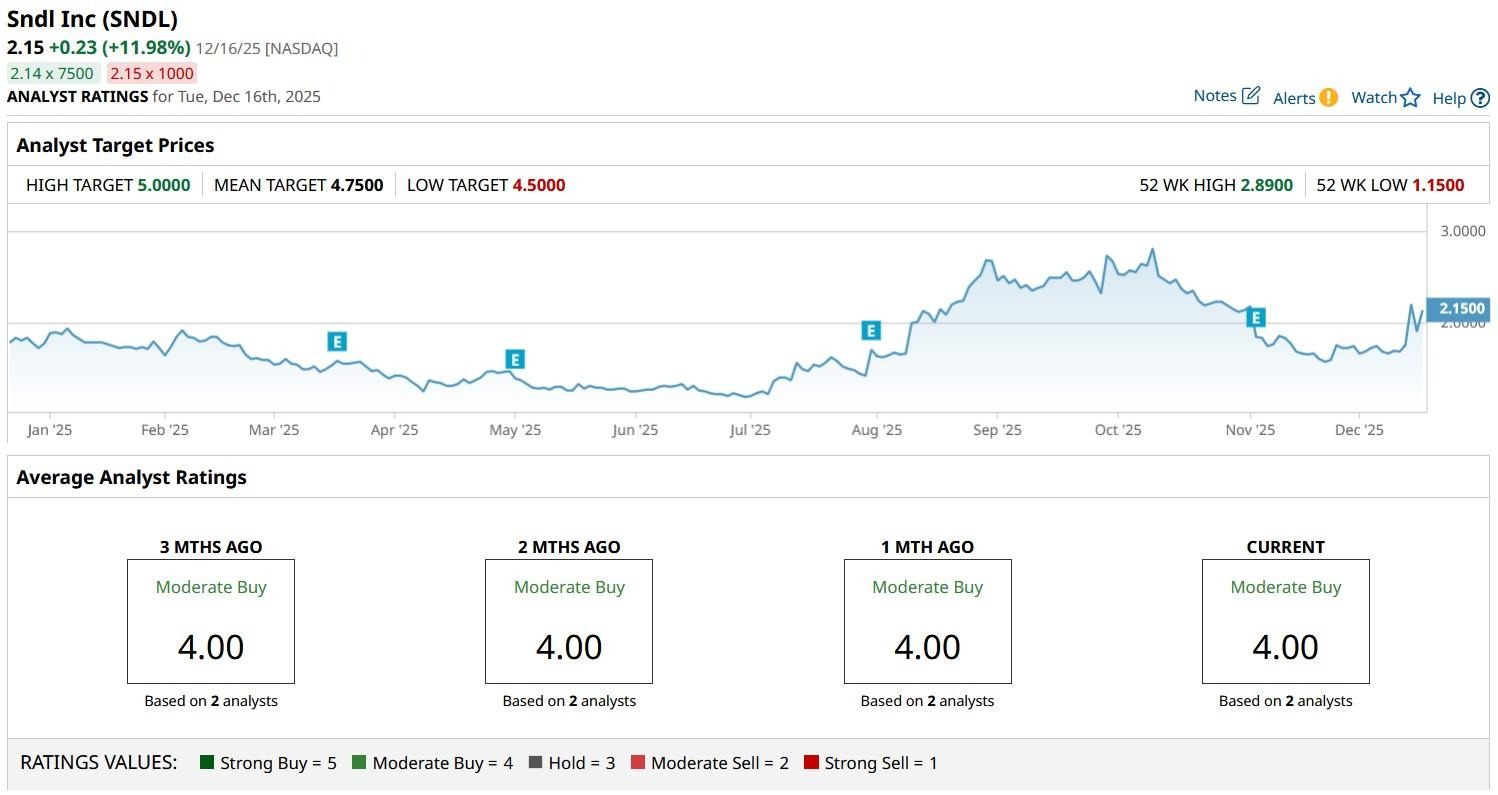

SNDL stock has been a volatile investment this year. Despite a sharp rally on Tuesday, it’s down more than 25% versus its year-to-date high in early October.  What May Drive SNDL Stock Higher in 2026?The potential reclassification of marijuana under the Trump administration is one of many catalysts that could drive SNDL shares higher over the next 12 months. These include the firm’s recent agreement to acquire 32 of 1CM’s cannabis retail stores in Canada, potentially strengthening its market share heading into 2026. Expanding its retail footprint, especially in key provinces like Ontario, Alberta, and Saskatchewan, could boost SNDL’s revenue over time. Additionally, the Nasdaq-listed firm posted a record $16.7 million in free cash flow for its Q3 last month, which means it’s better positioned to pursue growth initiatives in the coming year. Together with the expected policy tailwinds, these developments suggest SNDL is poised for further upside in 2026. Valuation and Technicals Favor Owning SNDL SharesValuation wise, SNDL stock is going for a price-sales multiple of less than 1x currently, making it an inexpensive name to play the cannabis industry’s long-term potential. Plus, the recent rally has pushed SNDL well over $2, effectively eliminating the delisting risk that had weighed on the stock for months. On Tuesday, the cannabis stock rallied past its 100-day moving average (MA) as well, indicating the uptrend could continue in the near term. In fact, options traders are pricing in a more than 20% rally in SNDL shares through Jan. 16, which means they could be trading at $2.53 in early 2026. How Wall Street Recommends Playing SNDLAccording to Wall Street analysts, SNDL stock could more than double from here next year on the back of policy tailwinds. The consensus rating on SNDL shares currently sits at “Moderate Buy” with the mean target of $4.75 indicating potential upside of another 120%.  On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Post 35% Surge, Analysts Eye More Upside in Copper Giant Freeport ↗

December 17, 2025

Via MarketBeat

Why a SpaceX IPO Could Be a Major Catalyst for GOOGL Stock ↗

December 17, 2025

Can Upwork Maintain Its Comeback? Reasons to Be Bullish and Bearish ↗

December 17, 2025

Via MarketBeat

Is Tesla Overvalued? 2 Reasons It Might Be a Bargain ↗

December 17, 2025

Via MarketBeat

Tickers

TSLA

How These 2 Stocks Won 2025's AI Race—And What's In Store for 2026 ↗

December 17, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|