Why Short–Term Bond ETFs Might Be the Best Income Investment for 2026

By:

Barchart.com

December 17, 2025 at 19:30 PM EST

I know, I know. Short-term bonds? As great investments? Blasphemy, right? But hear me out. I think there’s more than a puncher’s chance that among all of those fancy covered call option ETFs, closed-end funds with double-digit yields, and dividend stocks “due” for a rebound in 2026, the year might belong to some of the most boring ETFs on planet earth. I’ll name names below. First, allow me to make the case for why ETFs owning U.S. Treasury securities with maturities between 1-7 years might just surprise some folks in 2026. More Yield, Less Trap: Sign up free to get Barchart’s daily Dividend Investor newsletter straight to your inbox.

The economy heading into the new year is a tossup. At least if you listen to all of the financial chatter I do on a daily basis. One thing that concerns me is that the same people bragging about how great the economy is also want a stimulative rate cut? What are we even doing here? I’m a technician, and don’t buy into political or even broad economic approaches to assessing the markets. I look at pictures all day. Pictures of price trends, in stocks and ETFs, as well as the market “headline” indexes. And what I see is high risk for the stock market. And a push from enough big-money sources to guide short-term interest rates down. So to summarize, there are two different reasons short-term U.S. rates can decline in 2026, perhaps significantly.

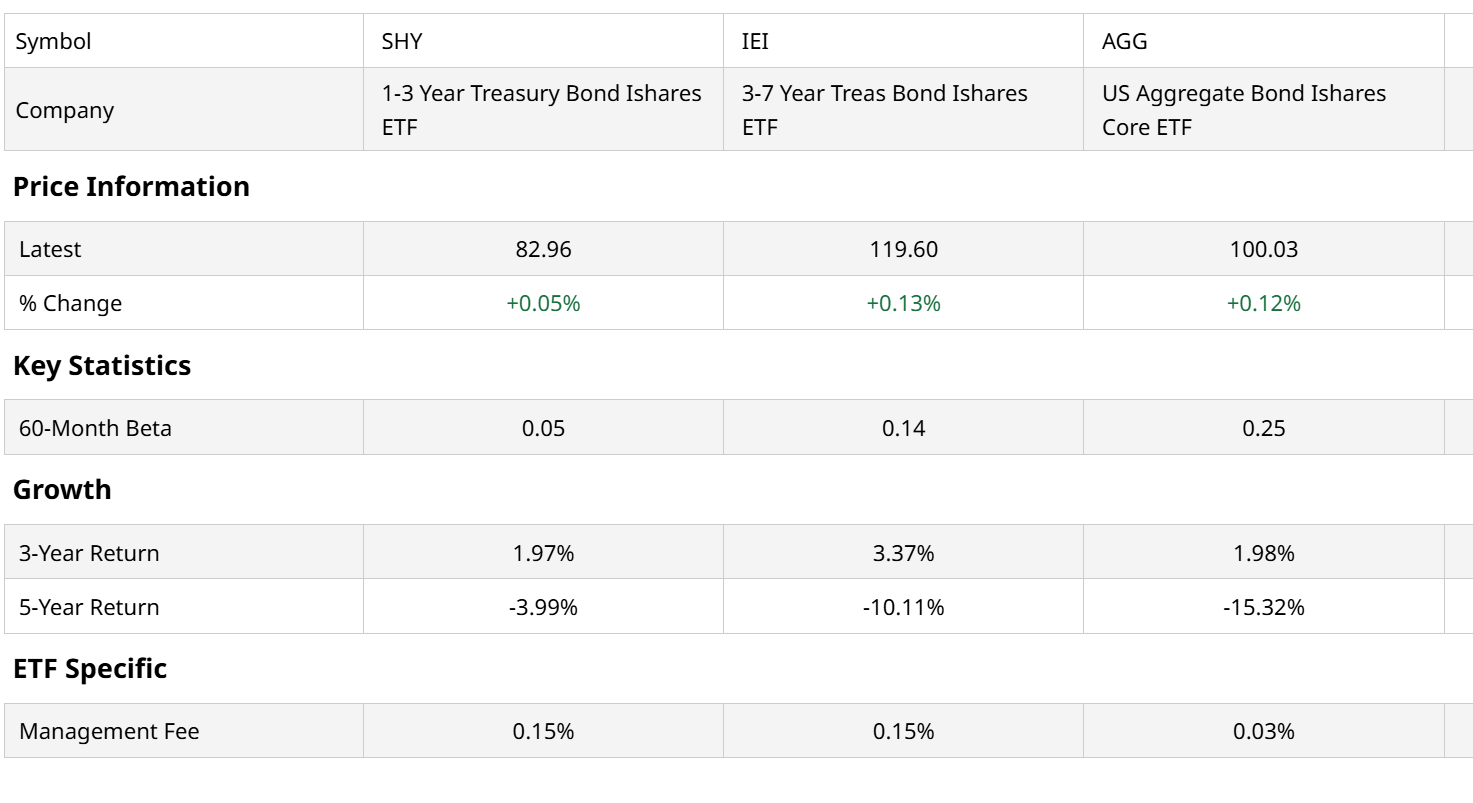

So, that’s my case in brief. And while stocks and longer-term bonds are potentially winners in that scenario, they both come with more risk than ETFs like this pair, and others like them. The two I’m focusing on are 1-3 Year Treasury Bond iShares (SHY) and 3-7 Year Treasury Bond iShares (IEI). They are both in my unofficial “ETF hall of fame” for how they bailed me out in past market cycles.

I am a big fan of inverse ETFs, which help us to profit directly from falling stock prices. But this pair, when conditions are right, as they might be in 2026, have all of this going for them:

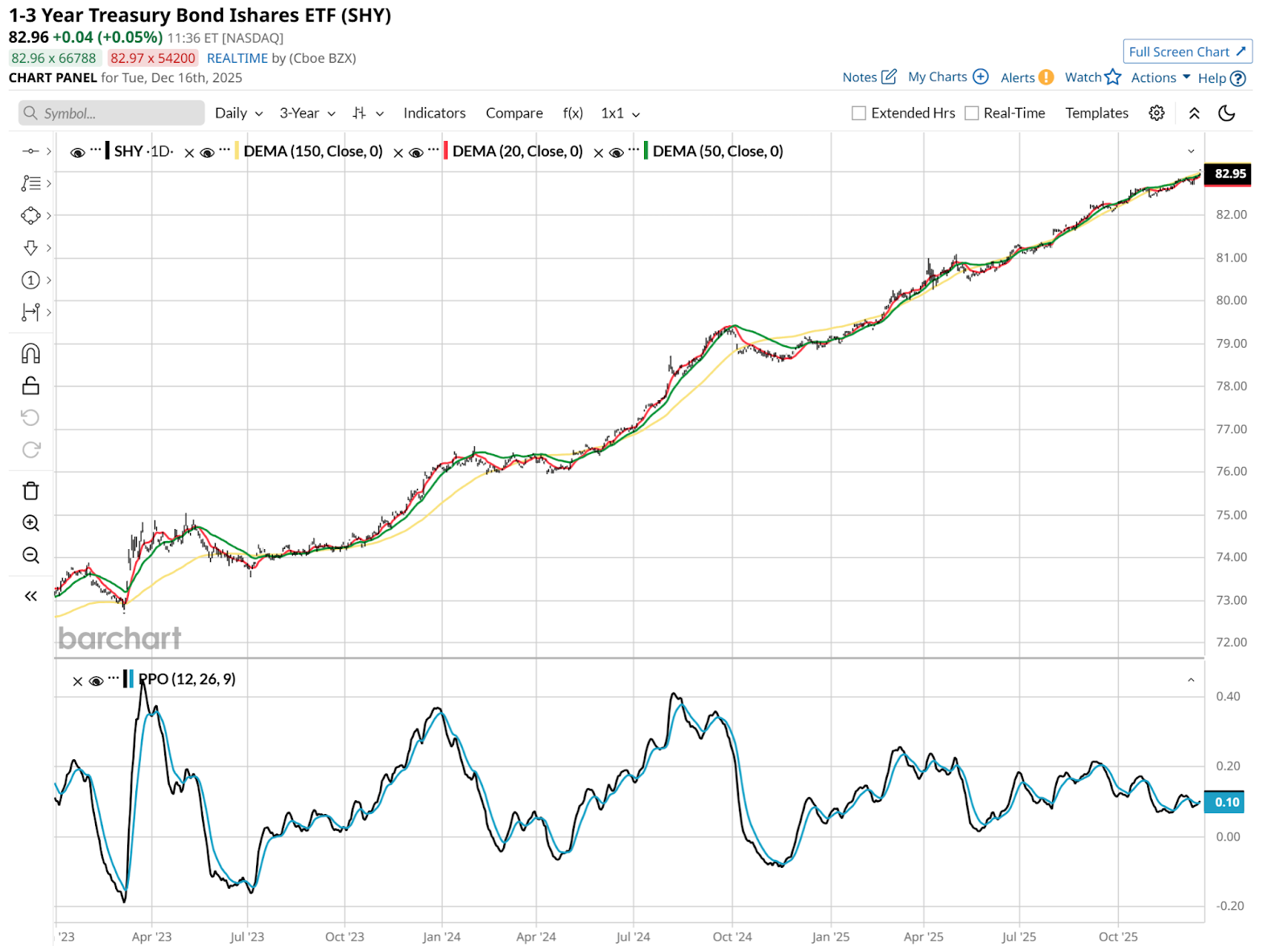

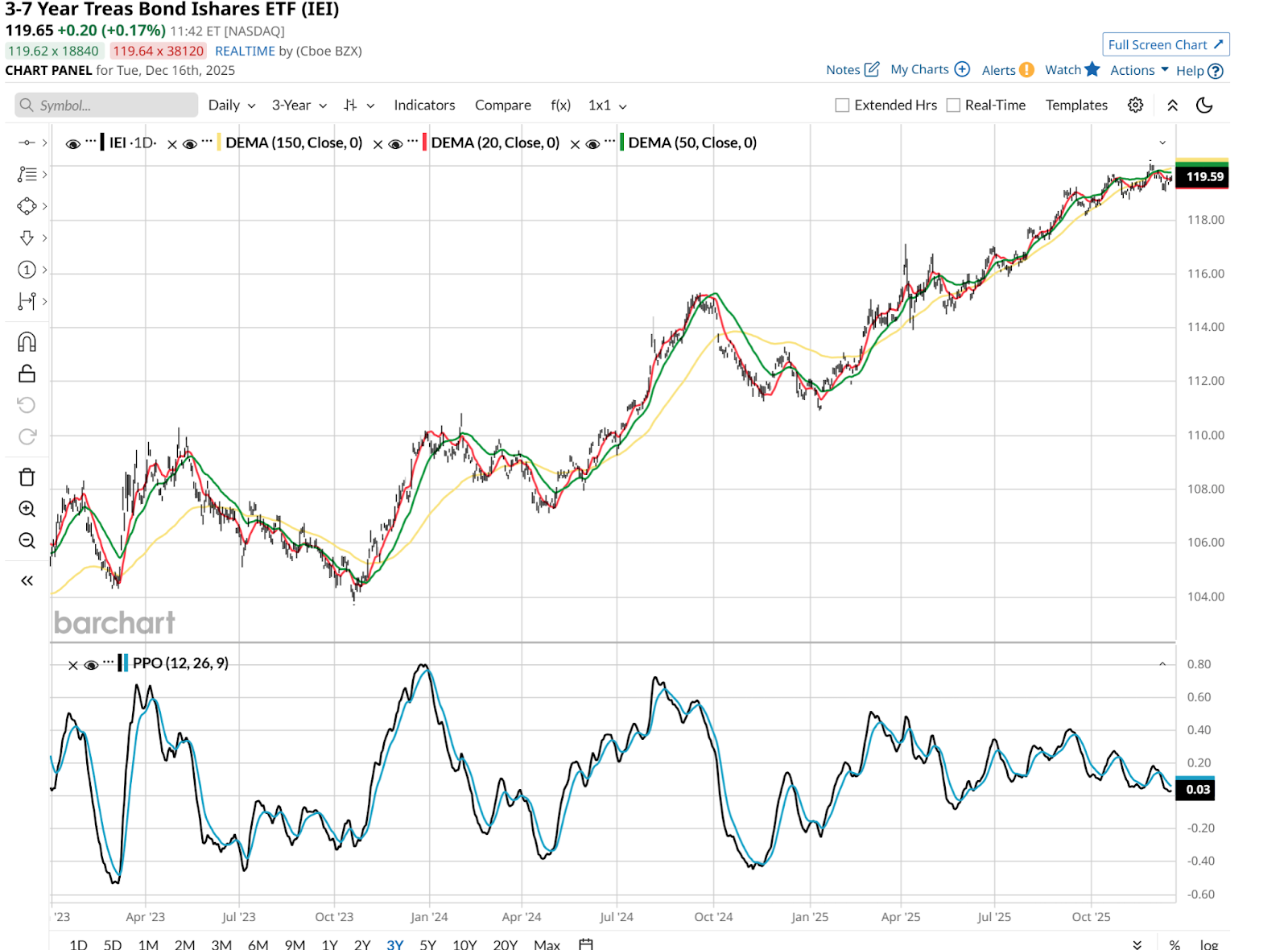

Let’s explore that last one. These two ETFs don’t move around in price much. Check out their betas in that table above. But they will appreciate in price if rates fall. That, plus their present yields of around 3.2%-3.4%, looks uninspiring after a year like we’ve had for stocks. But put the price gains and that starting yield together, an in a down slide for stocks and perhaps an increase in the long end of the yield curve, SHY and IEI could fill a gap. The gap between the ultra-safety but no price appreciation of T-bills, and the wild west of everything else in a market disruption. In other words, a chart like this will suddenly look very desirable. IEI has a bit more price action, which also means that if rates decline out to its 3-7 year maturity range, it can add a few percentage points to that 3%-4% yield over a year’s time

Looking at ETFs like this is something akin to a combination of risk management and cash management. It is not likely the moment in the market cycle where “everyone” will be clamoring for ideas like this. But if history rhymes, there will come a time when you’ll be glad you bookmarked this article. Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app. On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Post 35% Surge, Analysts Eye More Upside in Copper Giant Freeport ↗

December 17, 2025

Via MarketBeat

Why a SpaceX IPO Could Be a Major Catalyst for GOOGL Stock ↗

December 17, 2025

Can Upwork Maintain Its Comeback? Reasons to Be Bullish and Bearish ↗

December 17, 2025

Via MarketBeat

Is Tesla Overvalued? 2 Reasons It Might Be a Bargain ↗

December 17, 2025

Via MarketBeat

Tickers

TSLA

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|