Interactive Brokers Launches Securities Lending Dashboard

By:

Interactive Brokers via

Business Wire

July 12, 2023 at 10:00 AM EDT

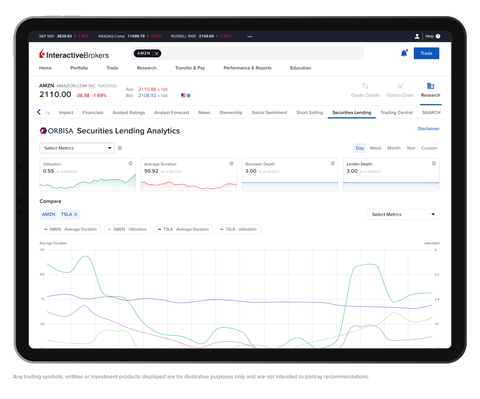

New Tool Helps Better Inform Short Traders Interactive Brokers (Nasdaq: IBKR), an automated global electronic broker, today announced the launch of the Securities Lending Dashboard designed to help clients assess the short-selling activity for specific securities and inform trading decisions. The new Securities Lending Dashboard allows sophisticated individual and institutional investors, including hedge funds, to view an expanded universe of securities lending data across key metrics. This complements Interactive Brokers’ Securities Loan Borrow (SLB) system, which is a fully electronic and actionable self-service utility that lets clients search for stocks available to short on the Interactive Brokers platform for free. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230712206765/en/  IBKR's Securities Lending Dashboard (Graphic: Business Wire) Powered by Orbisa, the new securities lending data includes information for securities that trade in North America, Europe and Asia and is provided to all clients of Interactive Brokers through Fundamentals Explorer on the Trader Workstation platform. Clients can now use both the Securities Lending Dashboard, as well as the existing Securities Loan Borrow system, which includes the quantity, number of lenders and current indicative borrow rates for securities based on IBKR client holdings. “Interactive Brokers continues to be at the forefront of transparency in the securities lending market,” said Milan Galik, Chief Executive Officer of Interactive Brokers. “The new Securities Lending Dashboard is a straightforward tool for advanced traders and hedge fund clients seeking to analyze potential short-selling investment opportunities. Our clients can now access a more comprehensive data set to evaluate their short trade ideas and use our Securities Loan Borrow system to identify shortable securities.” The new Securities Lending Dashboard lets clients view a snapshot of securities lending market data and then explore additional market intelligence, including:

Clients can also select two stocks and compare short-selling data across different date ranges. Additionally, there is a Premium subscription offering that includes the following data:

For additional information about Interactive Brokers’ Securities Lending Dashboard, please visit:

US and countries served by IB LLC: https://www.interactivebrokers.com/en/trading/securities-lending-dashboard.php

About Interactive Brokers Group, Inc.: Interactive Brokers Group affiliates provide automated trade execution and custody of securities, commodities, and foreign exchange around the clock on over 150 markets in numerous countries and currencies from a single unified platform to clients worldwide. We service individual investors, hedge funds, proprietary trading groups, financial advisors and introducing brokers. Our four decades of focus on technology and automation has enabled us to equip our clients with a uniquely sophisticated platform to manage their investment portfolios. We strive to provide our clients with advantageous execution prices and trading, risk and portfolio management tools, research facilities and investment products, all at low or no cost, positioning them to achieve superior returns on investments. For the sixth consecutive year, Barron’s ranked Interactive Brokers #1 with 5 out of 5 stars in its June 9, 2023, Best Online Brokers Review. View source version on businesswire.com: https://www.businesswire.com/news/home/20230712206765/en/ “Interactive Brokers continues to be at the forefront of transparency in the securities lending market,” said Milan Galik, Chief Executive Officer of Interactive Brokers. ContactsInteractive Brokers Group, Inc. Media: Katherine Ewert, media@ibkr.com More NewsView More

Five Below and Dollar Tree Earnings Signal a Shopper Shift ↗

Today 7:15 EST

Via MarketBeat

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|