$57 Billion US Marine Industry Offers Huge Growth Opportunities for New IPO Company Already Established as One of the Largest Dealers in Pre-Owned Boats: Off The Hook YS Inc. (NYSE: OTH)

By:

Get News

November 25, 2025 at 11:06 AM EST

OTH Has Locations in Multiple States Including Newest in Florida to Serve as Headquarters for Luxury Brokerage Division

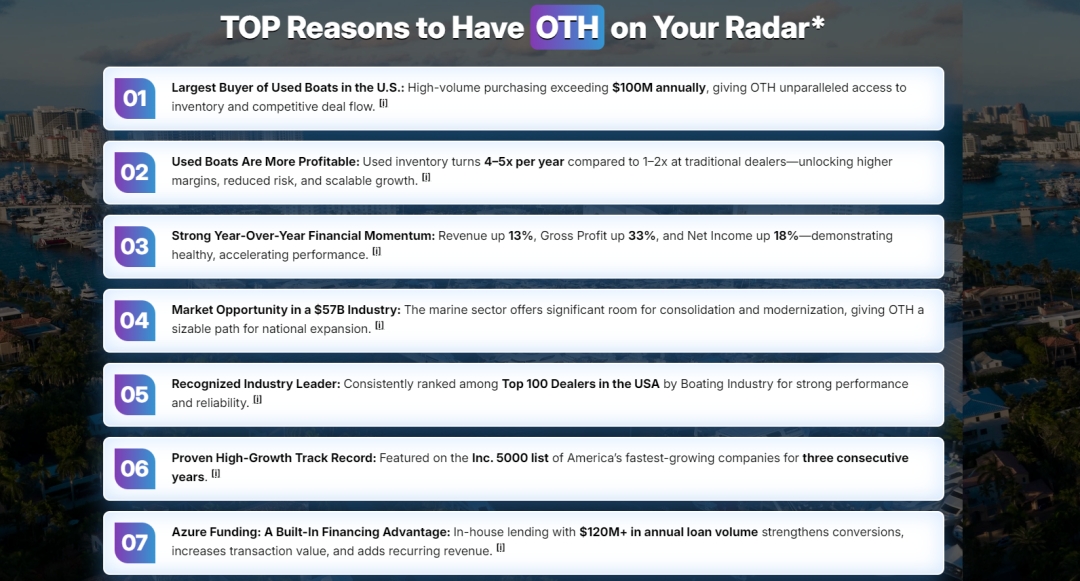

OTH has consistently earned recognition on the Inc. 500, ranked among the Top 100 Dealers in the USA. OTH continues advancing after its successful 2025 IPO, supported by strong technology adoption, expanding market reach, and participation in a U.S. marine industry valued at $57 billion. Additionally, the U.S. Ship Repair and Maintenance Services Market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033 at a 7.52% CAGR, highlighting substantial long-term growth potential. OTH appears well-positioned to capitalize on this opportunity in a large and growing market. Development of New Florida Office On November 25th OTH confirmed the development of a new office location in Jupiter, Florida. The facility will serve as the headquarters for Autograph Yacht Group (AYG), a recently established luxury brokerage division of OTH led by industry veteran Mike Burke. In addition to housing members of the OTH C-level leadership team based in Florida, the site will strengthen the company’s footprint in one of the nation's most active yachting markets. The new OTH Jupiter site includes office space and six on-site boat slips, allowing for streamlined inventory access and storage. The build-out is currently in progress. “We expect the build-out of this location to be completed and move-in ready in the beginning of 2026. The location will also have six boat slips for some of our best inventory,” stated Brian S. John, CEO of OTH.

Closing of Initial Public Offering On November 14th OTH announced the closing of its initial public offering of 3,750,000 shares of its common stock at a public offering price of $4.00 per share, for gross proceeds of $15,000,000, before deducting underwriting discounts and offering expenses. In addition, OTH has granted the underwriters a 45-day option to purchase up to an additional 562,500 shares of common stock to cover over-allotments at the initial public offering price, less the underwriting discount. OTH intends to use the proceeds to service its floorplan, to advertise and market its inventory, to repay a promissory note and for working capital. ThinkEquity acted as sole book-running manager for the offering. For more information on OTH visit: www.offthehookyachts.com and https://compasslivemedia.com/oth/ DISCLAIMER: https://corporateads.com/disclaimer/ Disclosure listed on the CorporateAds website Media Contact More NewsView More

Why Gold Loves Trump as Much as Trump Loves Gold ↗

November 26, 2025

Google's Gemini 3 Sends Broadcom Soaring: TPUs Take Center Stage ↗

November 26, 2025

Palantir Isn’t Just Riding the AI Boom—It’s Orchestrating It ↗

November 26, 2025

Insiders Are Snapping Up This AI Stock—Is a Big Bounce Coming? ↗

November 26, 2025

These 2 Energy Titans Just Scored Major Wins to Close Out November ↗

November 26, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|