J&J Snack Foods (NASDAQ:JJSF) Posts Q3 Sales In Line With Estimates But Stock Drops

By:

StockStory

November 13, 2024 at 16:27 PM EST

Snack food company J&J Snack Foods (NASDAQ: JJSF) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 3.9% year on year to $426.8 million. Its non-GAAP profit of $1.60 per share was 13.3% below analysts’ consensus estimates. Is now the time to buy J&J Snack Foods? Find out by accessing our full research report, it’s free. J&J Snack Foods (JJSF) Q3 CY2024 Highlights:

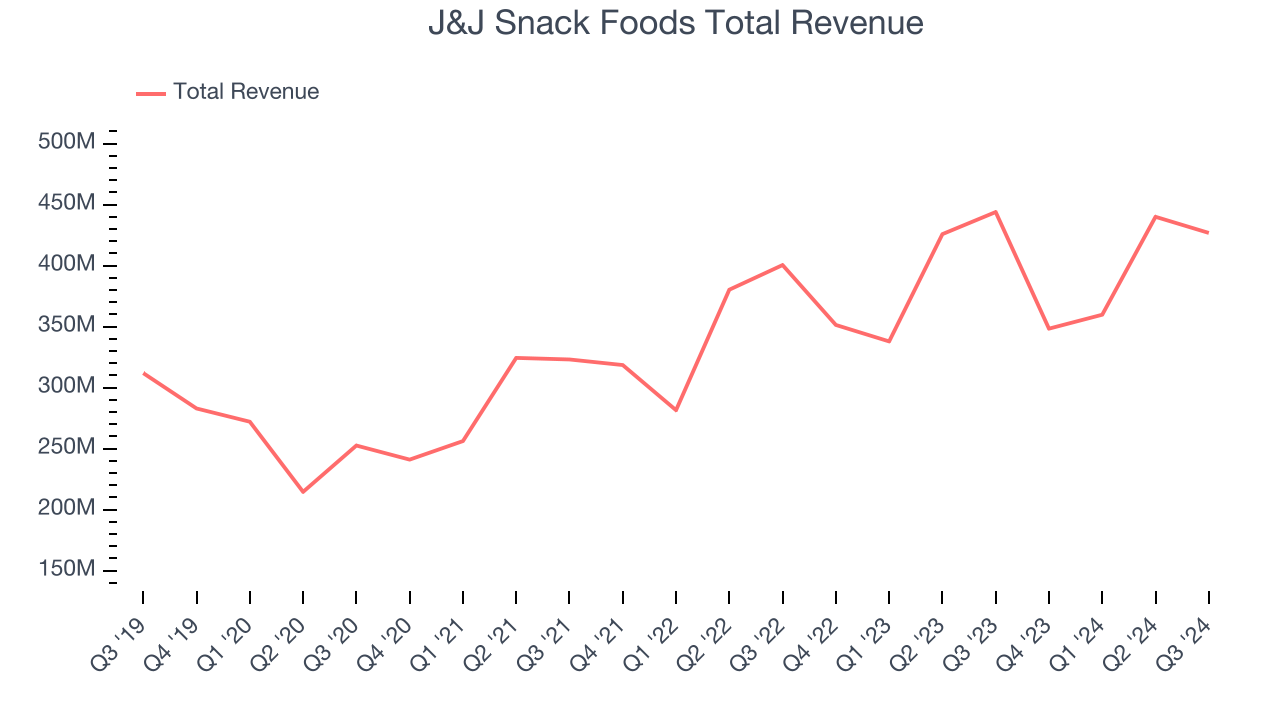

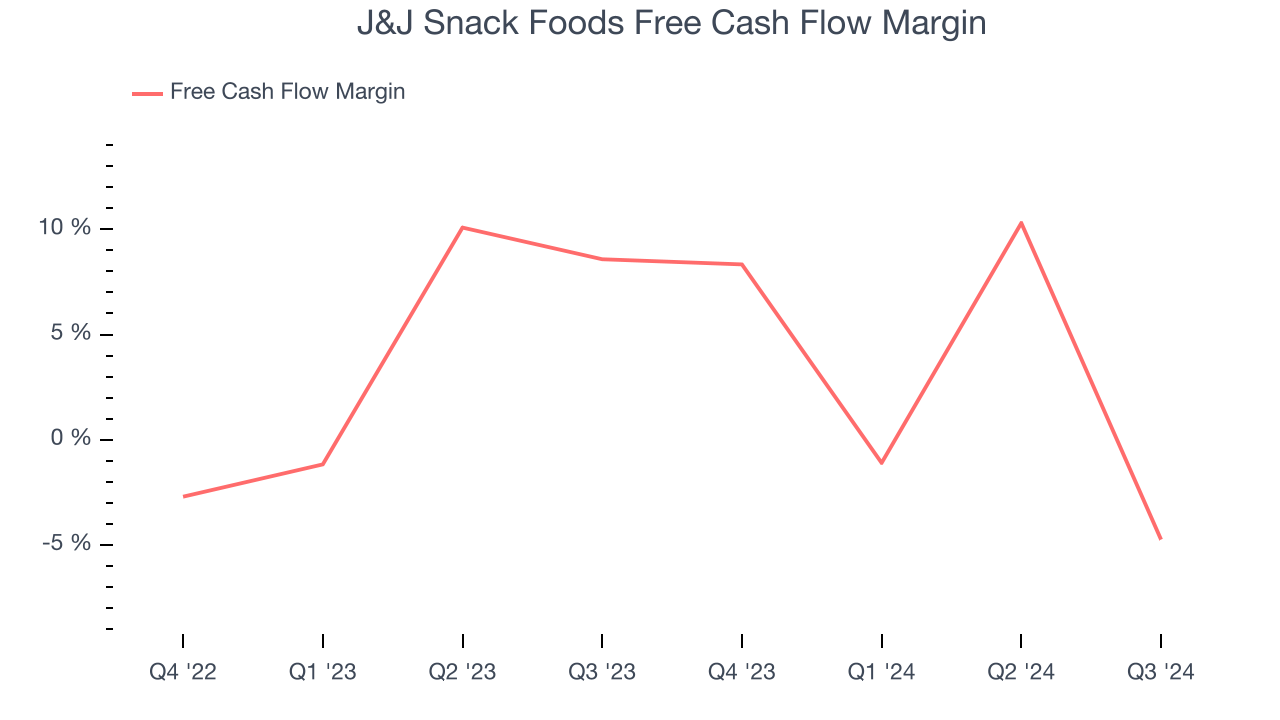

“J&J Snack Foods delivered another year of strong financial performance in fiscal 2024,” stated Dan Fachner, J&J Snack Foods Chairman, President, and CEO. Company OverviewBest known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers. Shelf-Stable FoodAs America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations. Sales GrowthA company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale. As you can see below, J&J Snack Foods grew its sales at a decent 11.2% compounded annual growth rate over the last three years. This shows there was demand for its offerings, a useful starting point for our analysis.  This quarter, J&J Snack Foods reported a rather uninspiring 3.9% year-on-year revenue decline to $426.8 million of revenue, in line with Wall Street’s estimates. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates. Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story. Cash Is KingFree cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king. J&J Snack Foods has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for a consumer staples business. Taking a step back, we can see that J&J Snack Foods’s margin dropped by 1.1 percentage points during that time. If this trend continues, it could signal it’s becoming a more capital-intensive business.  J&J Snack Foods burned through $20.24 million of cash in Q3, equivalent to a negative 4.7% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from J&J Snack Foods’s Q3 ResultsWe struggled to find many resounding positives in these results. Its EBITDA missed significantly and its gross margin fell meaningfully short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.3% to $164.08 immediately after reporting. J&J Snack Foods’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free. More NewsView More

Synopsys Sees Bullish Shift as Ansys Integration Drives Growth ↗

Today 18:37 EST

Via MarketBeat

The Best Holiday Present You Can Give Yourself? Costco Stock ↗

Today 17:33 EST

Via MarketBeat

Tickers

COST

Why Zscaler Stock Could Be Ready to Bounce After a 30% Selloff ↗

Today 16:32 EST

Via MarketBeat

Tickers

ZS

Via MarketBeat

Tickers

CRWD

Chewy Stock Just Flashed a Major Buy Signal for 2026 ↗

Today 13:13 EST

Via MarketBeat

Tickers

CHWY

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|