3 Reasons to Sell PATH and 1 Stock to Buy Instead

By:

StockStory

January 07, 2025 at 04:05 AM EST

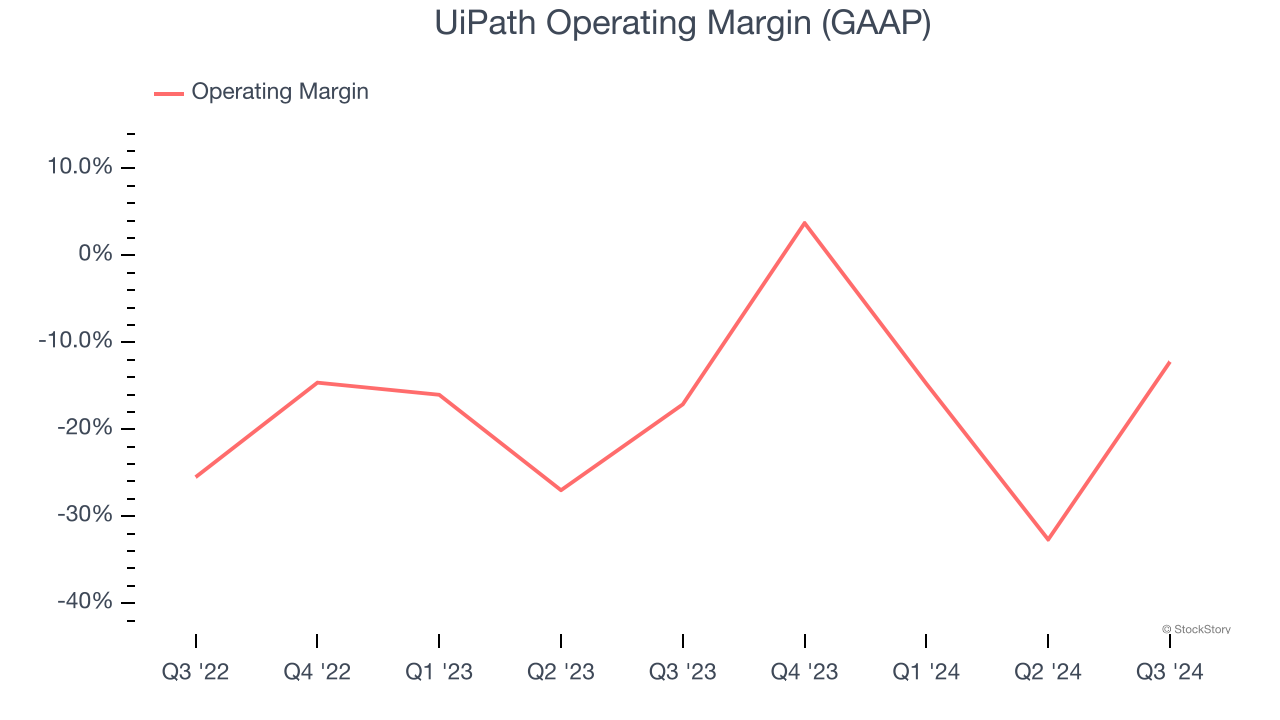

UiPath has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9.4% to $14.03 per share while the index has gained 7.3%. Is there a buying opportunity in UiPath, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We're swiping left on UiPath for now. Here are three reasons why you should be careful with PATH and a stock we'd rather own. Why Is UiPath Not Exciting?Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE: PATH) makes software that helps companies automate repetitive computer tasks. 1. Long Payback Periods Delay ReturnsThe customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments. UiPath’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow. 2. Operating Losses Sound the AlarmsMany software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D. UiPath’s expensive cost structure has contributed to an average operating margin of negative 12.8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if UiPath reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.  3. Cash Flow Margin Set to DeclineIf you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. Over the next year, analysts predict UiPath’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 23.3% for the last 12 months will decrease to 21.3%. Final JudgmentUiPath isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 5× forward price-to-sales (or $14.03 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy. Stocks We Like More Than UiPathWith rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle. Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years. Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free. More NewsView More

Post 35% Surge, Analysts Eye More Upside in Copper Giant Freeport ↗

December 17, 2025

Via MarketBeat

Why a SpaceX IPO Could Be a Major Catalyst for GOOGL Stock ↗

December 17, 2025

Can Upwork Maintain Its Comeback? Reasons to Be Bullish and Bearish ↗

December 17, 2025

Via MarketBeat

Is Tesla Overvalued? 2 Reasons It Might Be a Bargain ↗

December 17, 2025

Via MarketBeat

Tickers

TSLA

How These 2 Stocks Won 2025's AI Race—And What's In Store for 2026 ↗

December 17, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|