Two Reasons to Like ARLO and One to Stay Skeptical

By:

StockStory

January 09, 2025 at 04:07 AM EST

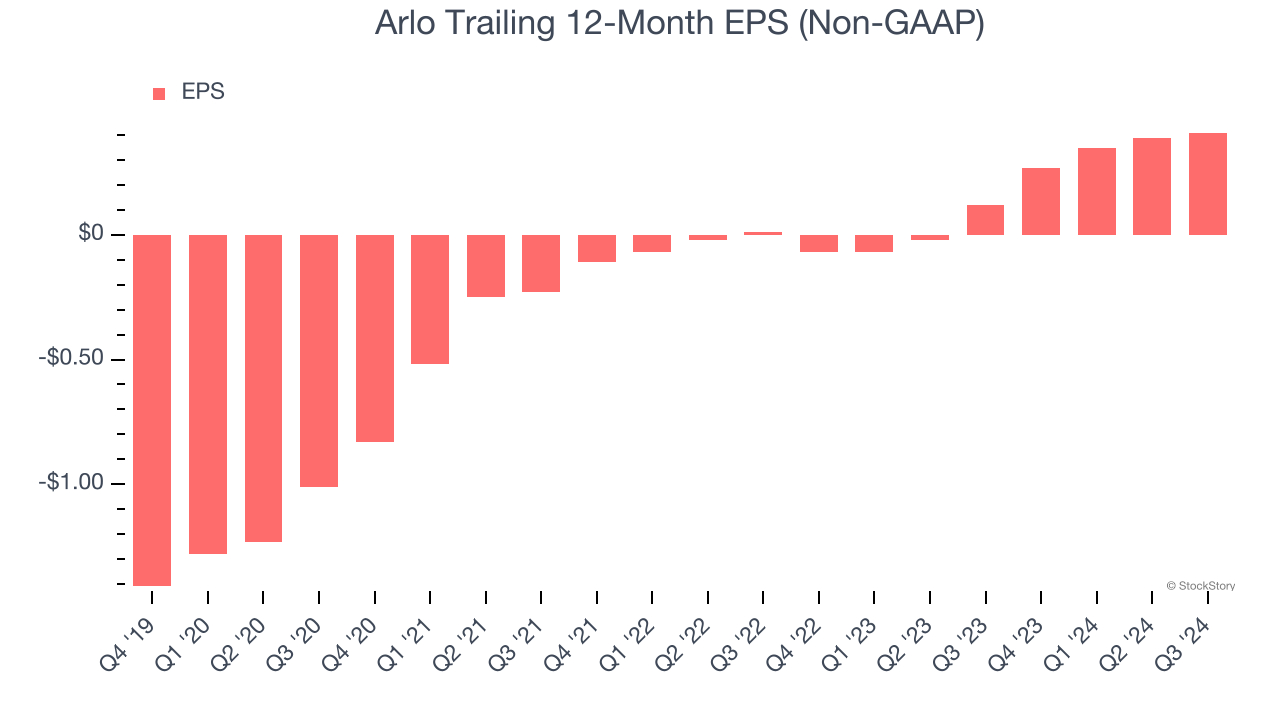

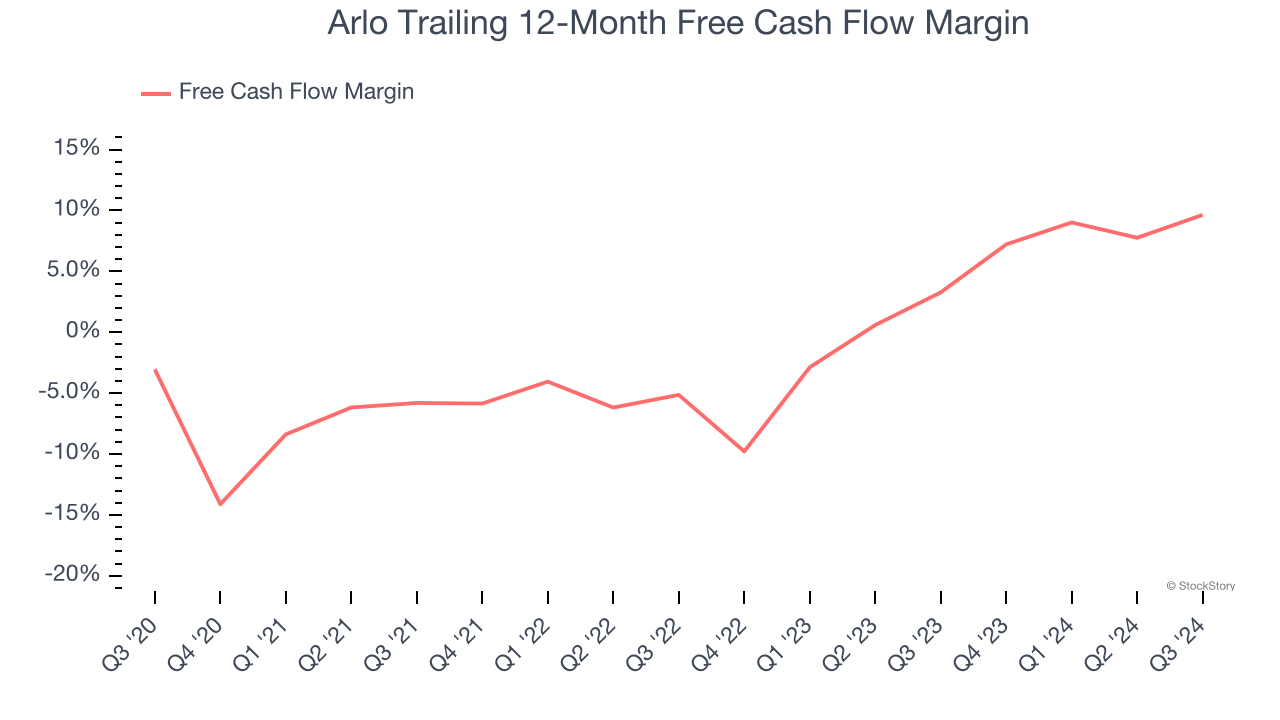

Arlo’s stock price has taken a beating over the past six months, shedding 28.4% of its value and falling to $11.83 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation. Given the weaker price action, is now an opportune time to buy ARLO? Find out in our full research report, it’s free. Why Does ARLO Stock Spark Debate?With its name deriving from the Old English word meaning “to see,” Arlo (NYSE: ARLO) provides home security products and other accessories to protect homes and businesses. Two Positive Attributes:1. Outstanding Long-Term EPS GrowthWe track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable. Arlo’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.  2. Increasing Free Cash Flow Margin Juices FinancialsIf you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. As you can see below, Arlo’s margin expanded by 12.7 percentage points over the last five years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality. Arlo’s free cash flow margin for the trailing 12 months was 9.6%.  One Reason to be Careful:Long-Term Revenue Growth DisappointsA company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Arlo grew its sales at a mediocre 7.2% compounded annual growth rate. This fell short of our benchmark for the industrials sector. Final JudgmentArlo’s merits more than compensate for its flaws. With the recent decline, the stock trades at 24.6× forward price-to-earnings (or $11.83 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free. Stocks We Like Even More Than ArloThe elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely. Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years. Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free. More NewsView More

Wall Street’s Sleeping Giant: Is Amazon About to Wake Up? ↗

Today 18:29 EST

Via MarketBeat

Checkmate in the Cloud: ServiceNow's Shopping Spree ↗

Today 18:16 EST

Via MarketBeat

The Contrarian Case for MSTR Amid MSCI Delisting Debacle ↗

Today 17:46 EST

Via MarketBeat

Tickers

MSTR

Worried About Mag 7 Concentration Risk? This ETF Could Help ↗

Today 16:16 EST

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|