nLIGHT (LASR): Buy, Sell, or Hold Post Q2 Earnings?

By:

StockStory

October 28, 2025 at 00:05 AM EDT

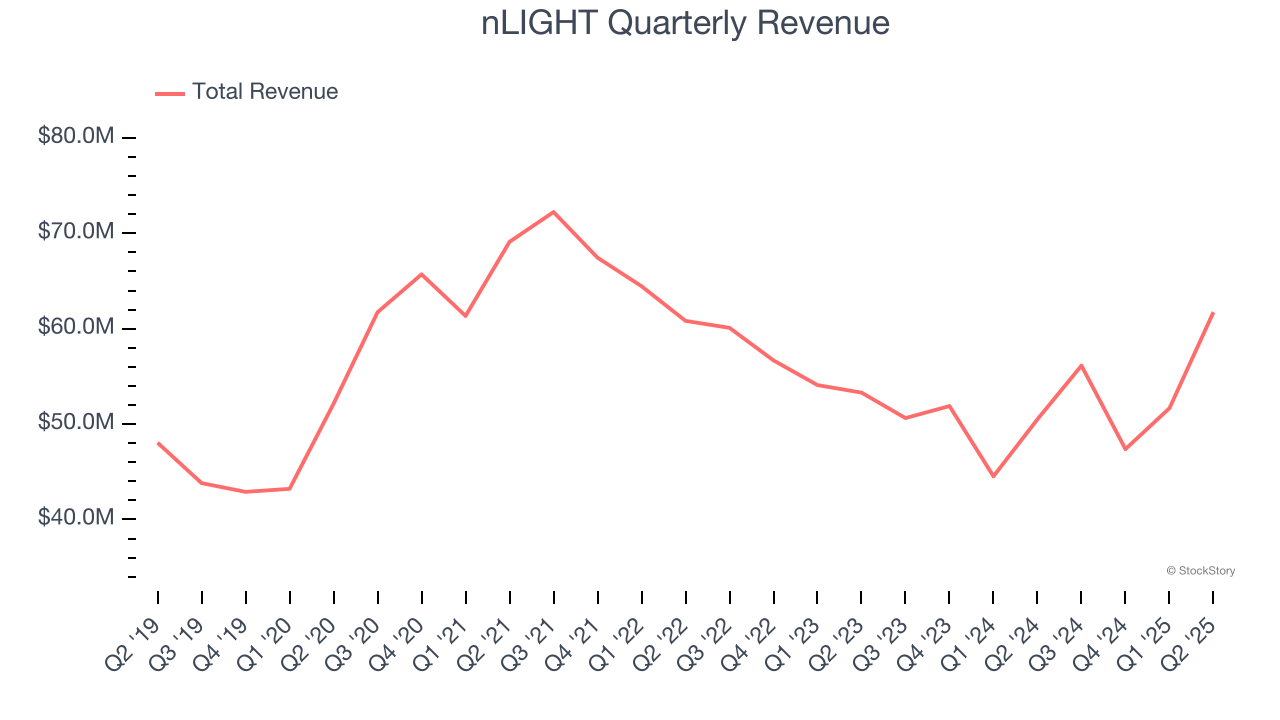

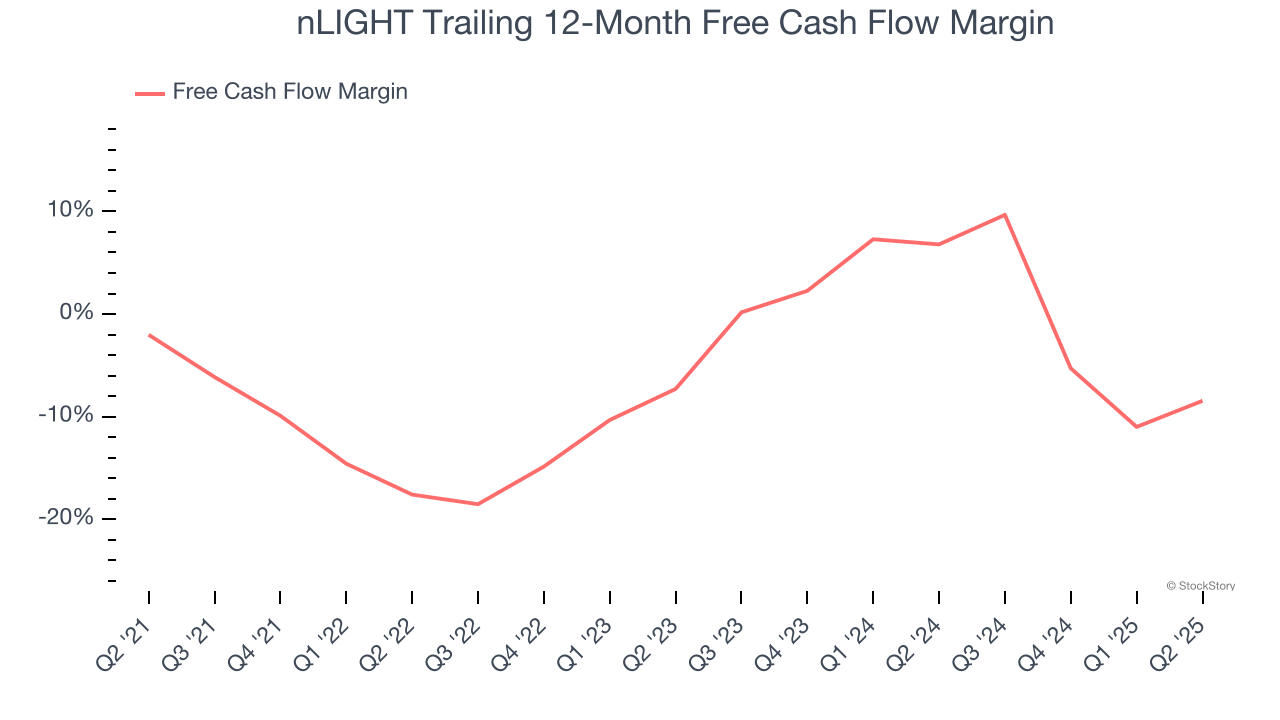

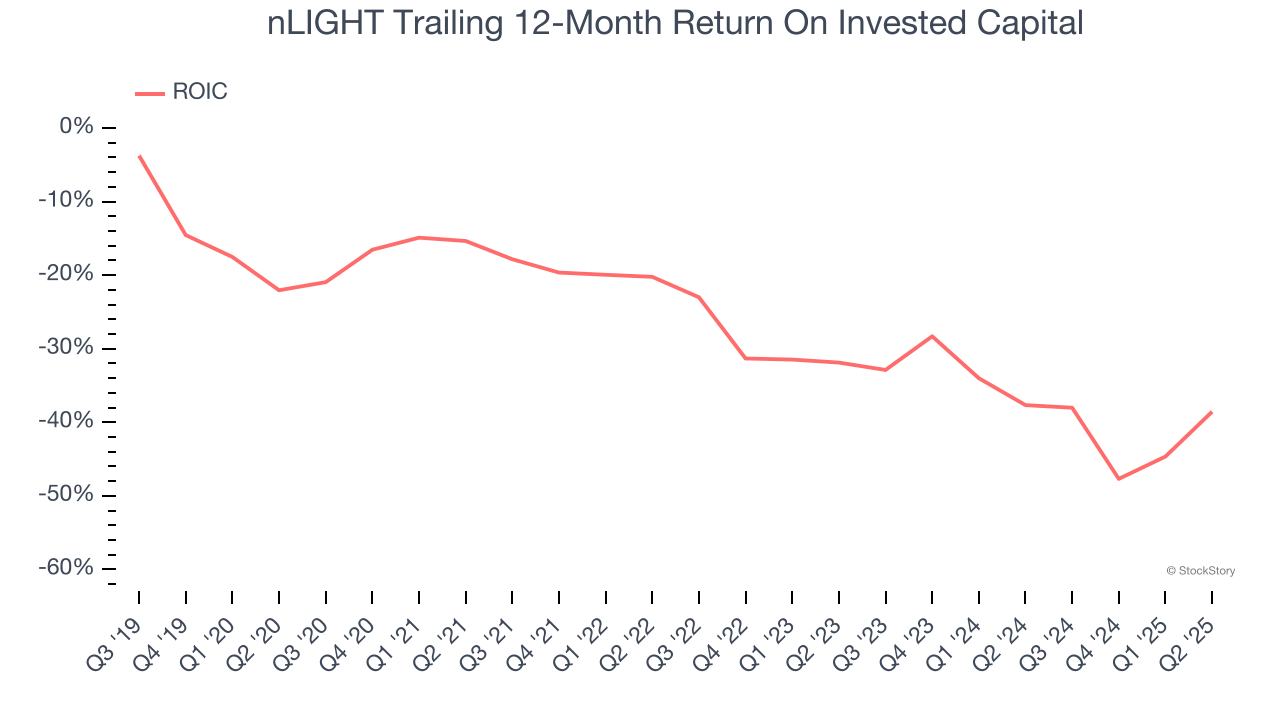

What a time it’s been for nLIGHT. In the past six months alone, the company’s stock price has increased by a massive 335%, setting a new 52-week high of $34 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move. Is now the time to buy nLIGHT, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members. Why Do We Think nLIGHT Will Underperform?We’re glad investors have benefited from the price increase, but we don't have much confidence in nLIGHT. Here are three reasons there are better opportunities than LASR and a stock we'd rather own. 1. Long-Term Revenue Growth DisappointsA company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, nLIGHT grew its sales at a sluggish 3.6% compounded annual growth rate. This fell short of our benchmark for the industrials sector.  2. Free Cash Flow Margin DroppingFree cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king. As you can see below, nLIGHT’s margin dropped by 6.4 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle. nLIGHT’s free cash flow margin for the trailing 12 months was negative 8.5%.  3. New Investments Fail to Bear Fruit as ROIC DeclinesA company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity). We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, nLIGHT’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.  Final JudgmentWe cheer for all companies making their customers lives easier, but in the case of nLIGHT, we’ll be cheering from the sidelines. Following the recent surge, the stock trades at 3,353× forward P/E (or $34 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce. Stocks We Would Buy Instead of nLIGHTDonald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities. The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

D-Wave's 22% Surge: What's Behind the December Rally? ↗

Today 12:32 EST

Via MarketBeat

Tickers

QBTS

Netflix Wins the Streaming Wars: The $82B Warner Bros. Deal ↗

Today 11:02 EST

5 Robotics Stocks Catching Momentum After New Policy Tailwinds ↗

Today 10:47 EST

3 Finance Stocks Leaving Coal in Investors Stockings ↗

Today 10:28 EST

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|