Avantor (NYSE:AVTR) Misses Q3 Sales Expectations, Stock Drops 17.9%

By:

StockStory

October 29, 2025 at 06:16 AM EDT

Life sciences company Avantor (NYSE: AVTR) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 5.3% year on year to $1.62 billion. Its non-GAAP profit of $0.22 per share was in line with analysts’ consensus estimates. Is now the time to buy Avantor? Find out by accessing our full research report, it’s free for active Edge members. Avantor (AVTR) Q3 CY2025 Highlights:

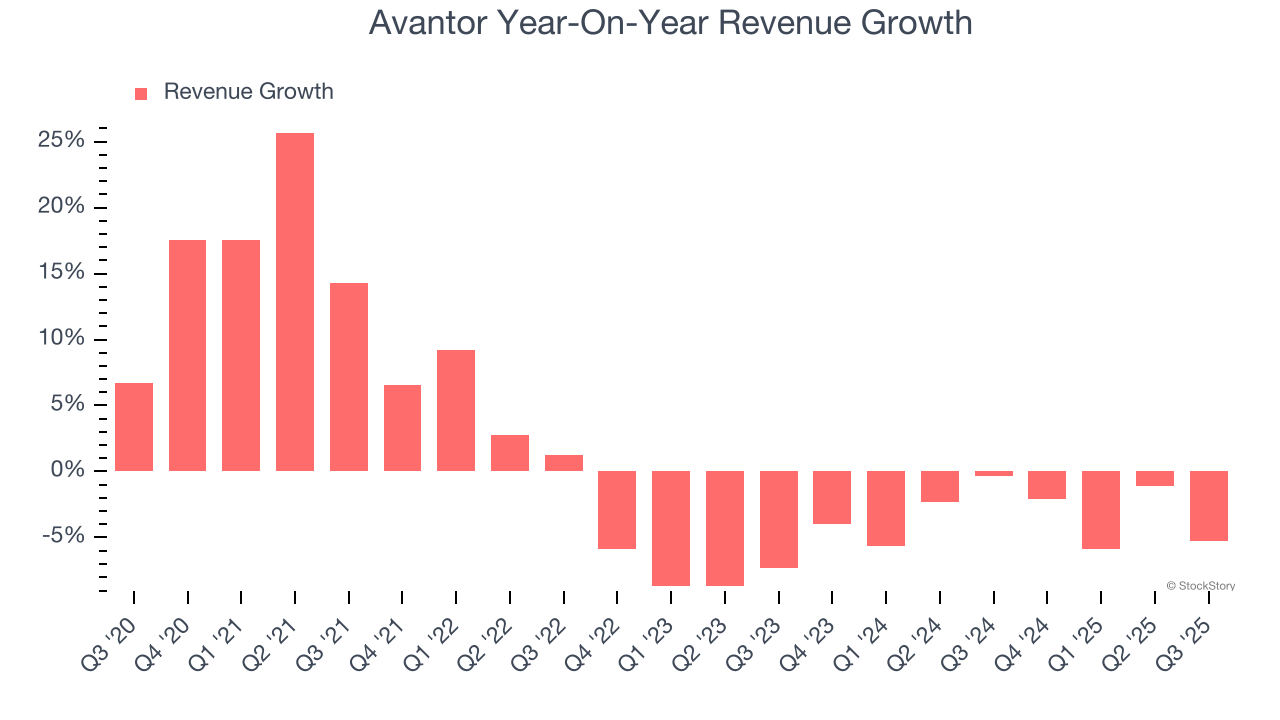

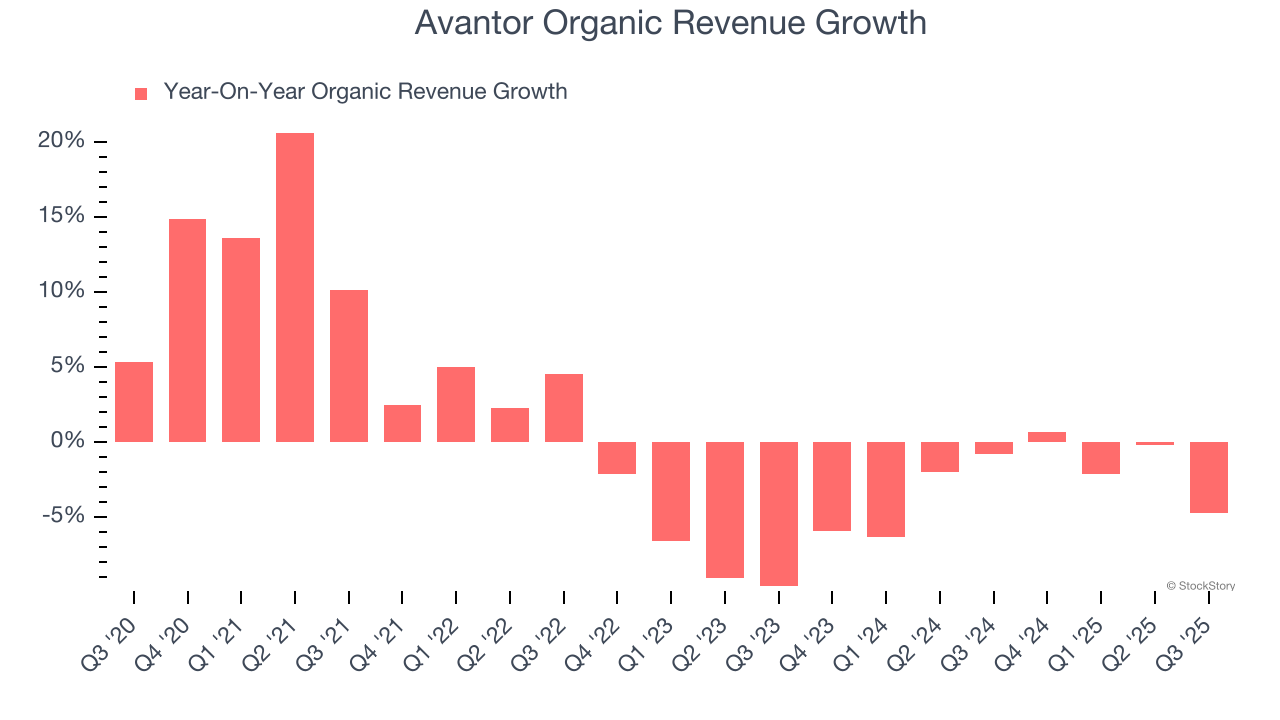

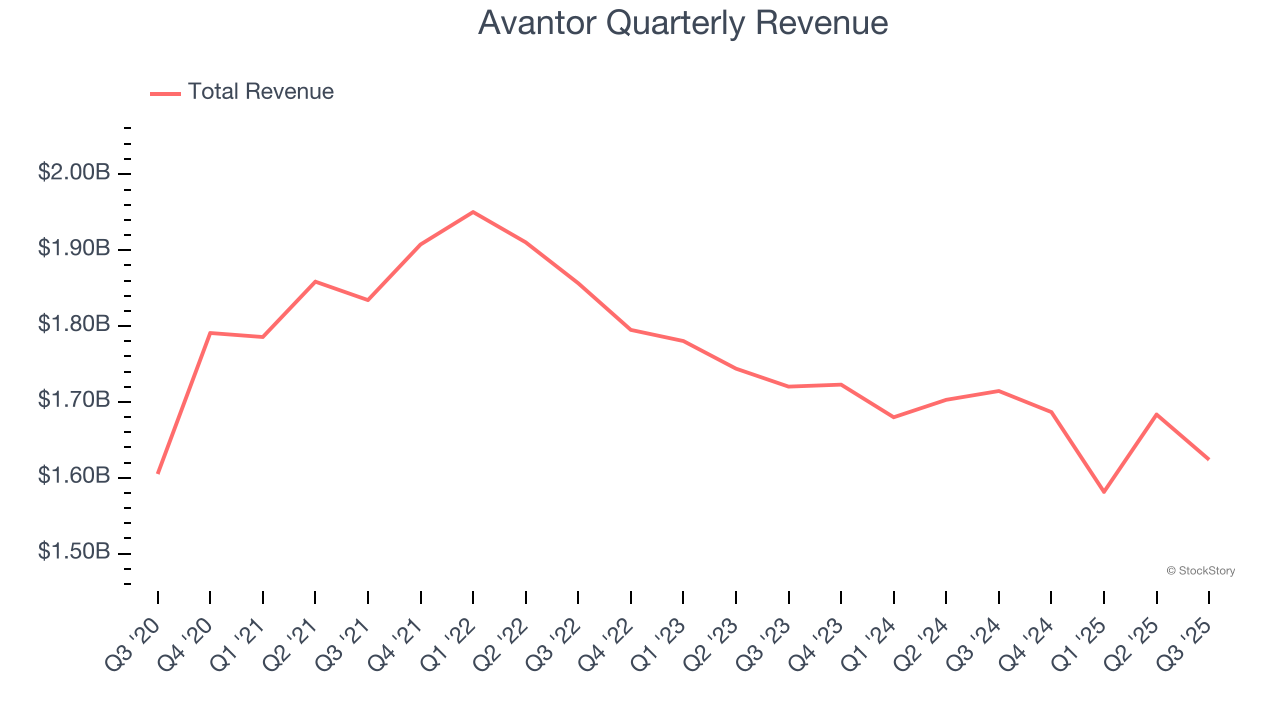

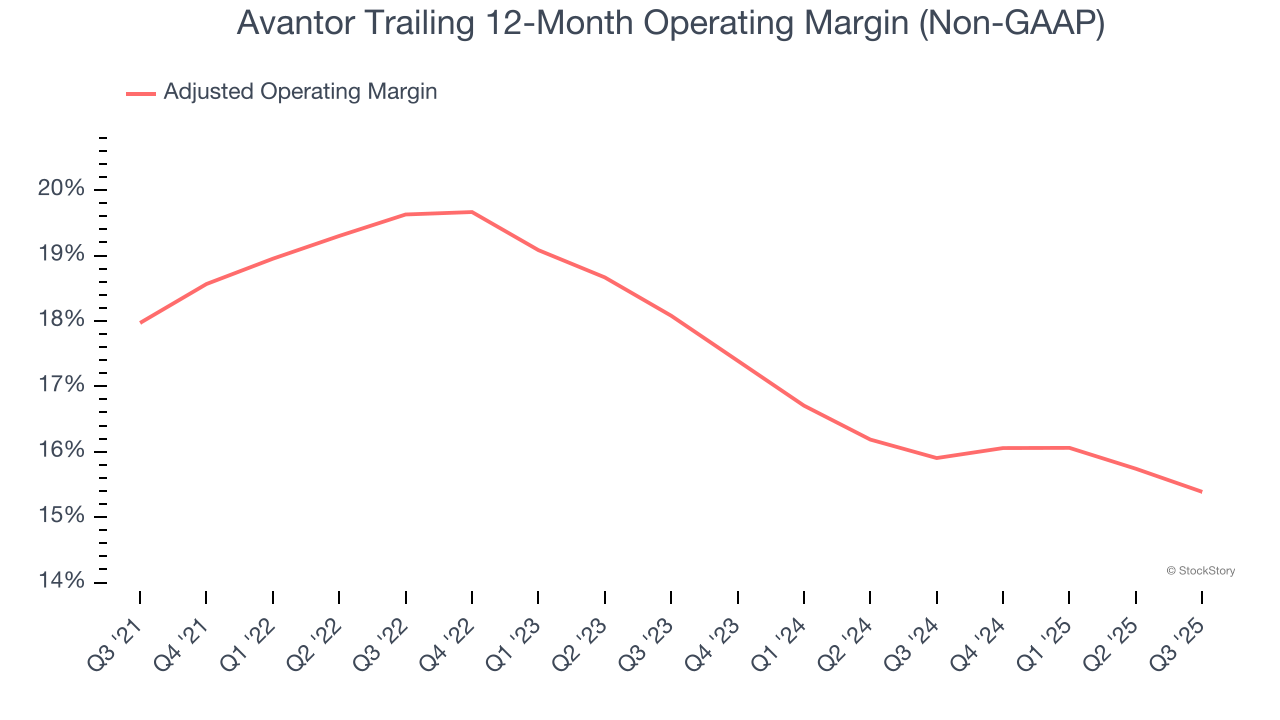

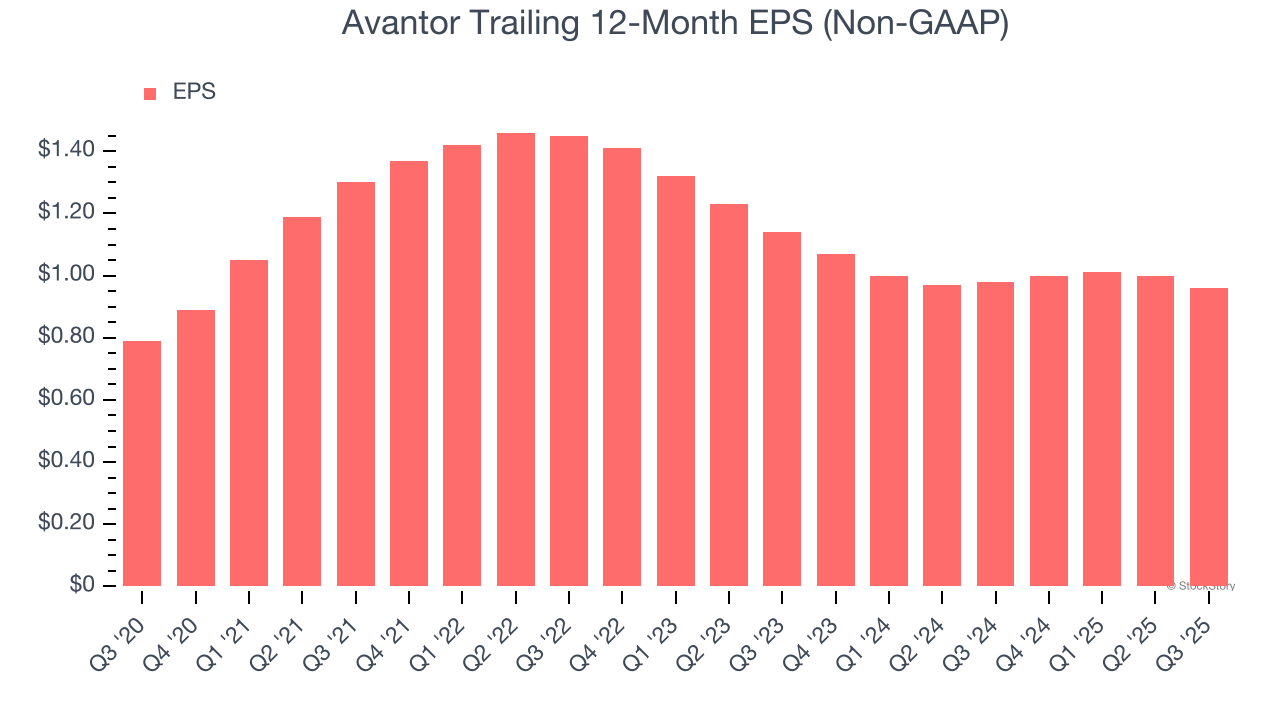

"Avantor's diverse portfolio, strong production capabilities, and long-standing customer relationships provide a strong foundation for sustained value creation," said Emmanuel Ligner, President and Chief Executive Officer. Company OverviewWith roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE: AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries. Revenue GrowthA company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Avantor’s 1.4% annualized revenue growth over the last five years was tepid. This was below our standards and is a tough starting point for our analysis.  Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Avantor’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.4% annually. We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Avantor’s organic revenue averaged 2.7% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results. This quarter, Avantor missed Wall Street’s estimates and reported a rather uninspiring 5.3% year-on-year revenue decline, generating $1.62 billion of revenue. Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average. Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next. Adjusted Operating MarginAvantor has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average adjusted operating margin of 17.5%. Looking at the trend in its profitability, Avantor’s adjusted operating margin decreased by 2.6 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.7 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.  This quarter, Avantor generated an adjusted operating margin profit margin of 14.6%, down 1.4 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable. Earnings Per ShareRevenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions. Avantor’s EPS grew at an unimpressive 4% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its adjusted operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.  In Q3, Avantor reported adjusted EPS of $0.22, down from $0.26 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Avantor’s full-year EPS of $0.96 to grow 2.9%. Key Takeaways from Avantor’s Q3 ResultsWe struggled to find many positives in these results. Its revenue slightly missed and its organic revenue fell short of Wall Street’s estimates. Overall, this quarter was bad. The stock traded down 17.9% to $12.38 immediately following the results. Avantor’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members. More NewsView More

Netflix Wins the Streaming Wars: The $82B Warner Bros. Deal ↗

Today 11:02 EST

5 Robotics Stocks Catching Momentum After New Policy Tailwinds ↗

Today 10:47 EST

3 Finance Stocks Leaving Coal in Investors Stockings ↗

Today 10:28 EST

These 3 Little-Known Stocks Are Analyst Favorites ↗

Today 8:48 EST

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|