SPX Technologies (NYSE:SPXC) Surprises With Q3 Sales

By:

StockStory

October 30, 2025 at 16:21 PM EDT

Infrastructure equipment supplier SPX Technologies (NYSE: SPXC) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 22.6% year on year to $592.8 million. The company expects the full year’s revenue to be around $2.25 billion, close to analysts’ estimates. Its non-GAAP profit of $1.84 per share was 13.8% above analysts’ consensus estimates. Is now the time to buy SPX Technologies? Find out by accessing our full research report, it’s free for active Edge members. SPX Technologies (SPXC) Q3 CY2025 Highlights:

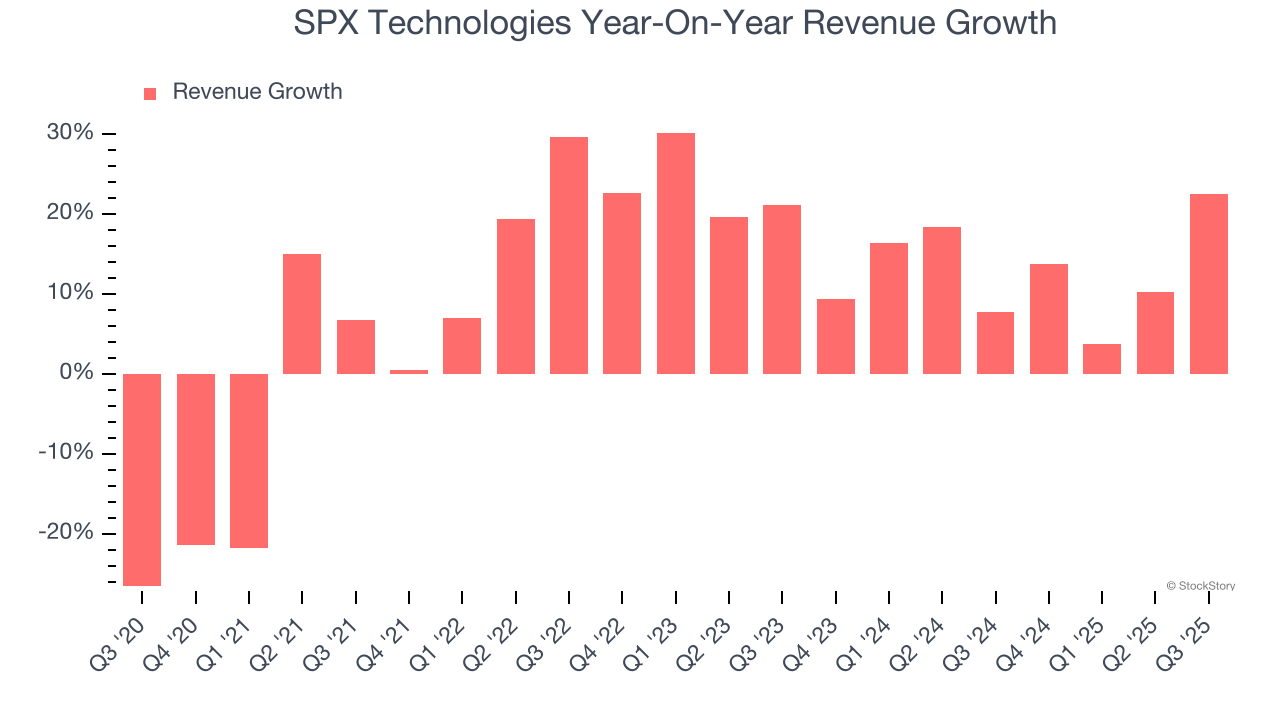

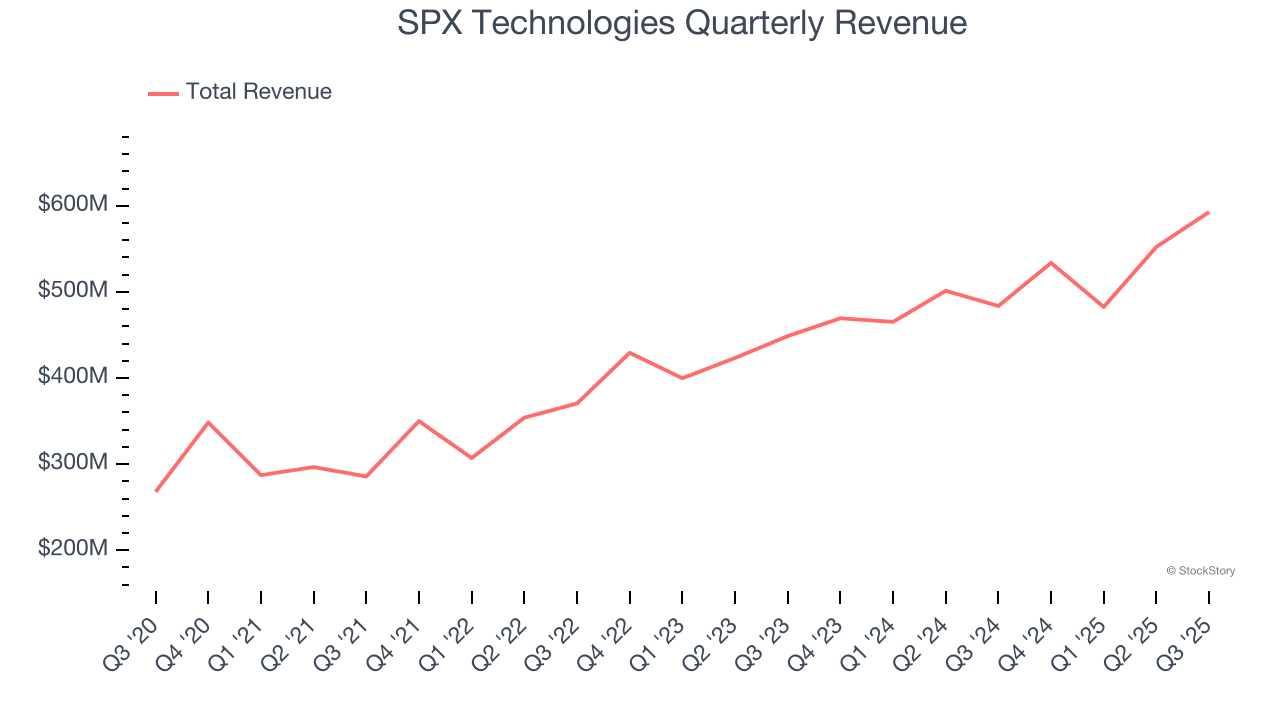

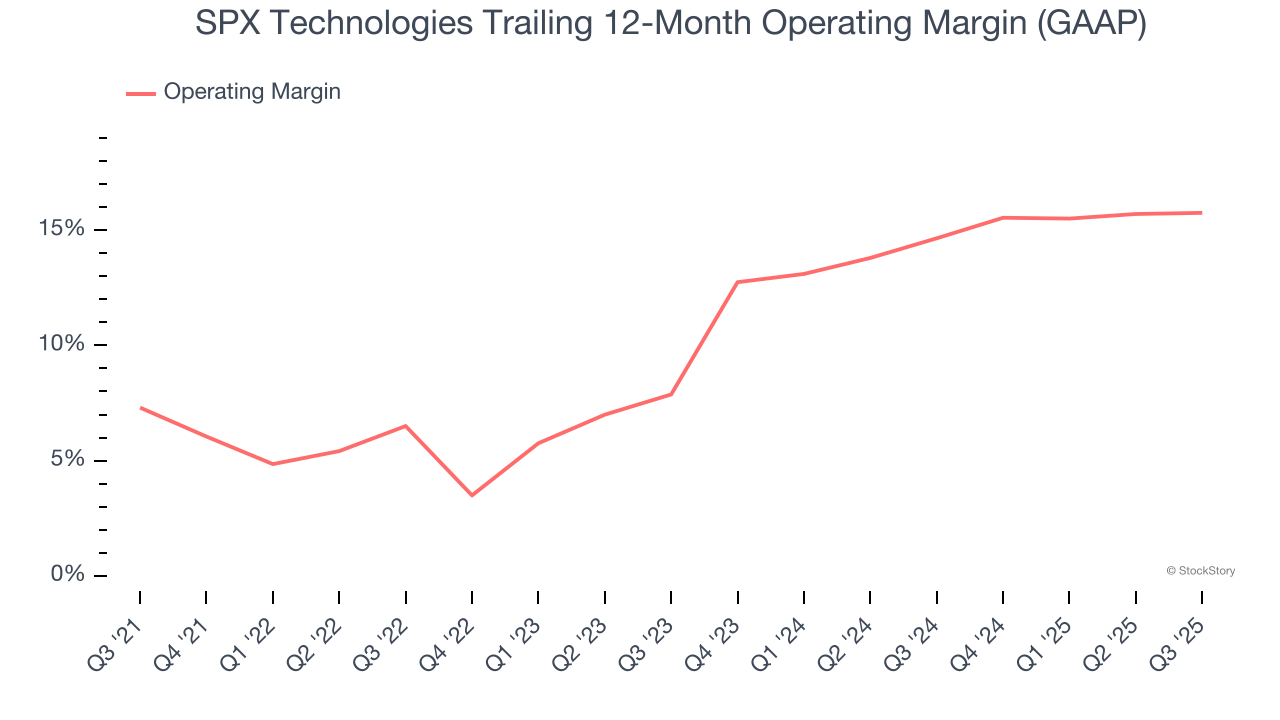

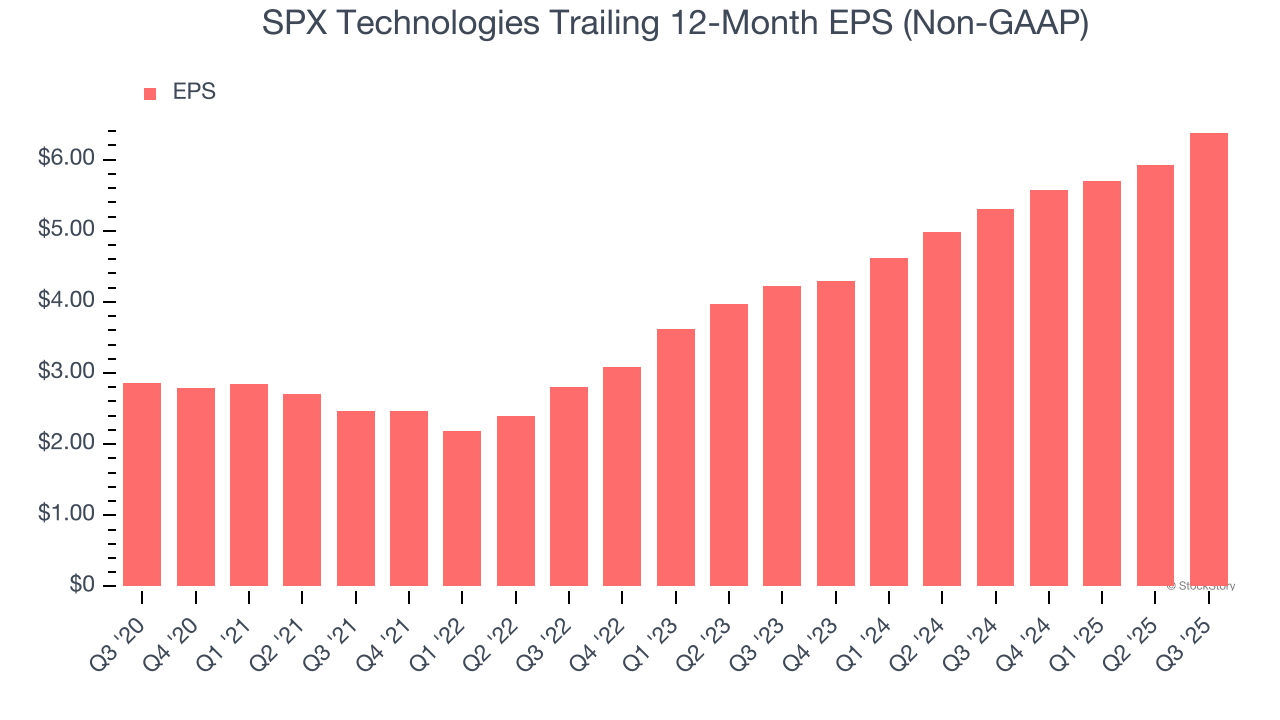

Company OverviewWith roots dating back to 1912 as the Piston Ring Company, SPX Technologies (NYSE: SPXC) supplies specialized infrastructure equipment for HVAC systems and detection and measurement applications across industrial, commercial, and utility markets. Revenue GrowthA company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, SPX Technologies’s 10.1% annualized revenue growth over the last five years was solid. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.  We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SPX Technologies’s annualized revenue growth of 12.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. This quarter, SPX Technologies reported robust year-on-year revenue growth of 22.6%, and its $592.8 million of revenue topped Wall Street estimates by 2.2%. Looking ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is admirable and suggests the market sees success for its products and services. Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories. Operating MarginSPX Technologies has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point. Looking at the trend in its profitability, SPX Technologies’s operating margin rose by 8.5 percentage points over the last five years, as its sales growth gave it immense operating leverage.  This quarter, SPX Technologies generated an operating margin profit margin of 16.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable. Earnings Per ShareWe track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable. SPX Technologies’s EPS grew at a spectacular 17.4% compounded annual growth rate over the last five years, higher than its 10.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.  We can take a deeper look into SPX Technologies’s earnings to better understand the drivers of its performance. As we mentioned earlier, SPX Technologies’s operating margin was flat this quarter but expanded by 8.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals. Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business. For SPX Technologies, its two-year annual EPS growth of 23% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base. In Q3, SPX Technologies reported adjusted EPS of $1.84, up from $1.39 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects SPX Technologies’s full-year EPS of $6.38 to grow 11.8%. Key Takeaways from SPX Technologies’s Q3 ResultsWe enjoyed seeing SPX Technologies beat analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.5% to $201.63 immediately after reporting. Indeed, SPX Technologies had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members. More NewsView More

Via MarketBeat

Tickers

KRKNF

Via MarketBeat

Will Crypto Miners Pivot to AI? Latest on 3 Key Players ↗

Today 10:36 EST

Via MarketBeat

Tickers

CRM

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|