Earnings To Watch: BellRing Brands (BRBR) Reports Q3 Results Tomorrow

By:

StockStory

November 16, 2025 at 22:01 PM EST

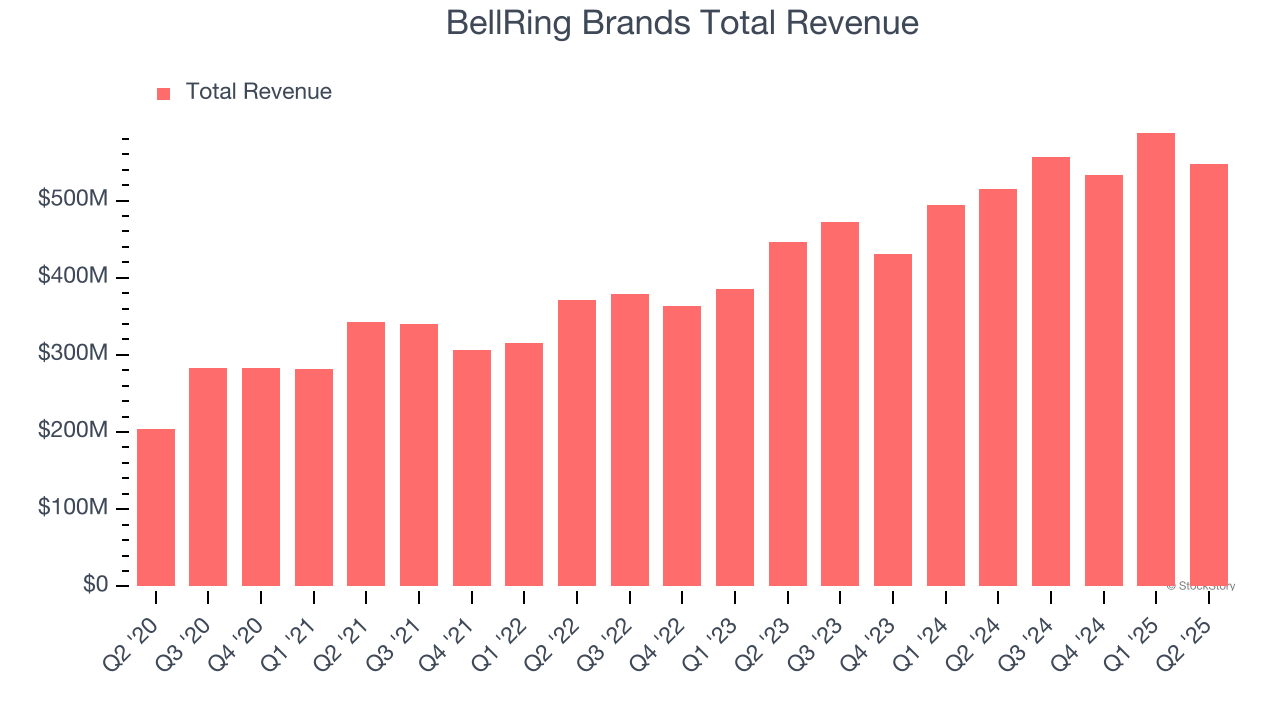

Nutrition products company Bellring Brands (NYSE: BRBR) will be announcing earnings results this Tuesday before market hours. Here’s what to expect. BellRing Brands beat analysts’ revenue expectations by 3% last quarter, reporting revenues of $547.5 million, up 6.2% year on year. It was a strong quarter for the company, with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ organic revenue estimates. Is BellRing Brands a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members. This quarter, analysts are expecting BellRing Brands’s revenue to grow 14% year on year to $633.6 million, slowing from the 17.6% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.55 per share.  Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. BellRing Brands has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 3% on average. Looking at BellRing Brands’s peers in the shelf-stable food segment, some have already reported their Q3 results, giving us a hint as to what we can expect. SunOpta delivered year-on-year revenue growth of 16.6%, beating analysts’ expectations by 5.2%, and Hershey reported revenues up 6.5%, topping estimates by 2.2%. SunOpta traded down 28.3% following the results while Hershey was also down 3.2%. Read our full analysis of SunOpta’s results here and Hershey’s results here. The euphoria surrounding Trump’s November win lit a fire under major indices, but potential tariffs have caused the market to do a 180 in 2025. While some of the shelf-stable food stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 5.1% on average over the last month. BellRing Brands is down 16.6% during the same time and is heading into earnings with an average analyst price target of $49 (compared to the current share price of $26.98). When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Why Taiwan Semiconductor's 6.5% Dip Could Be a Smart Buy ↗

Today 18:39 EST

Via MarketBeat

RTX Surges to Record Highs as Defense Orders Explode ↗

Today 17:42 EST

Via MarketBeat

Tickers

RTX

Smart Money Is Buying Auto Suppliers, Not Car Brands ↗

Today 16:49 EST

Higher Beef Prices Are Here: Best Steakhouse Stocks for 2026 ↗

Today 15:07 EST

Via MarketBeat

AI Runs on Power—And Constellation Energy Controls the Switch ↗

Today 14:16 EST

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|