3 Reasons to Avoid OZK and 1 Stock to Buy Instead

By:

StockStory

November 24, 2025 at 23:00 PM EST

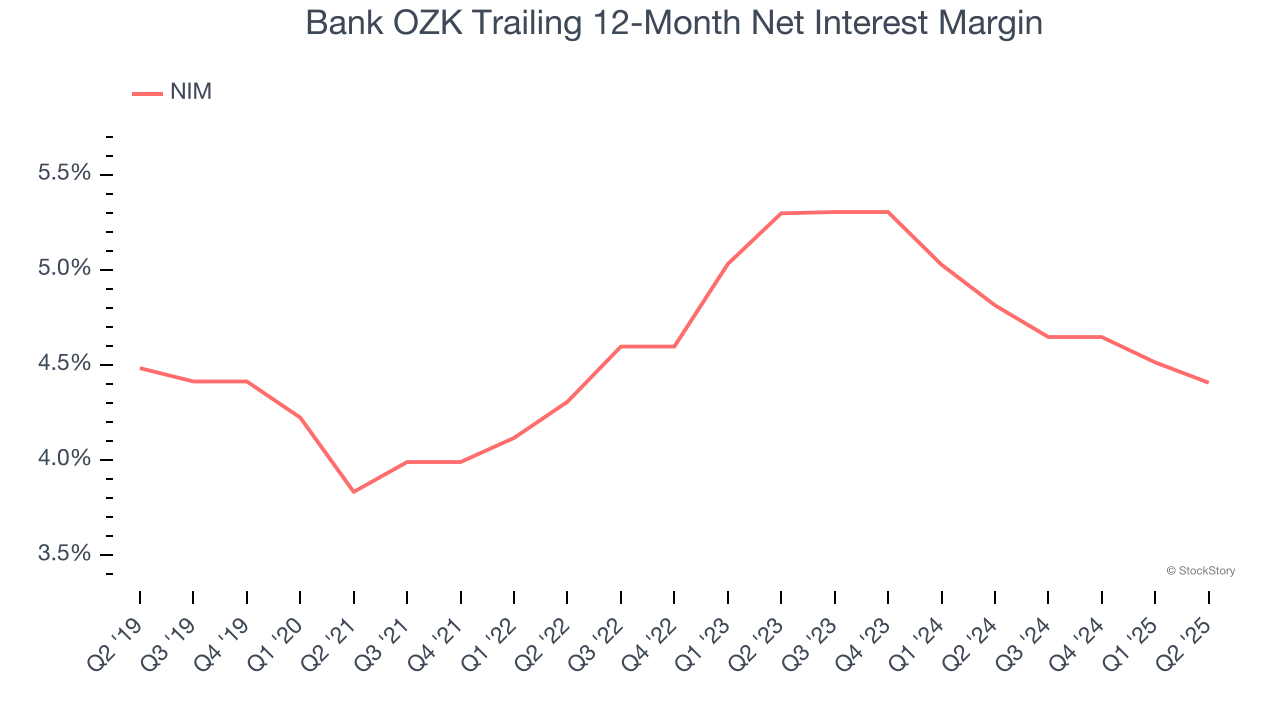

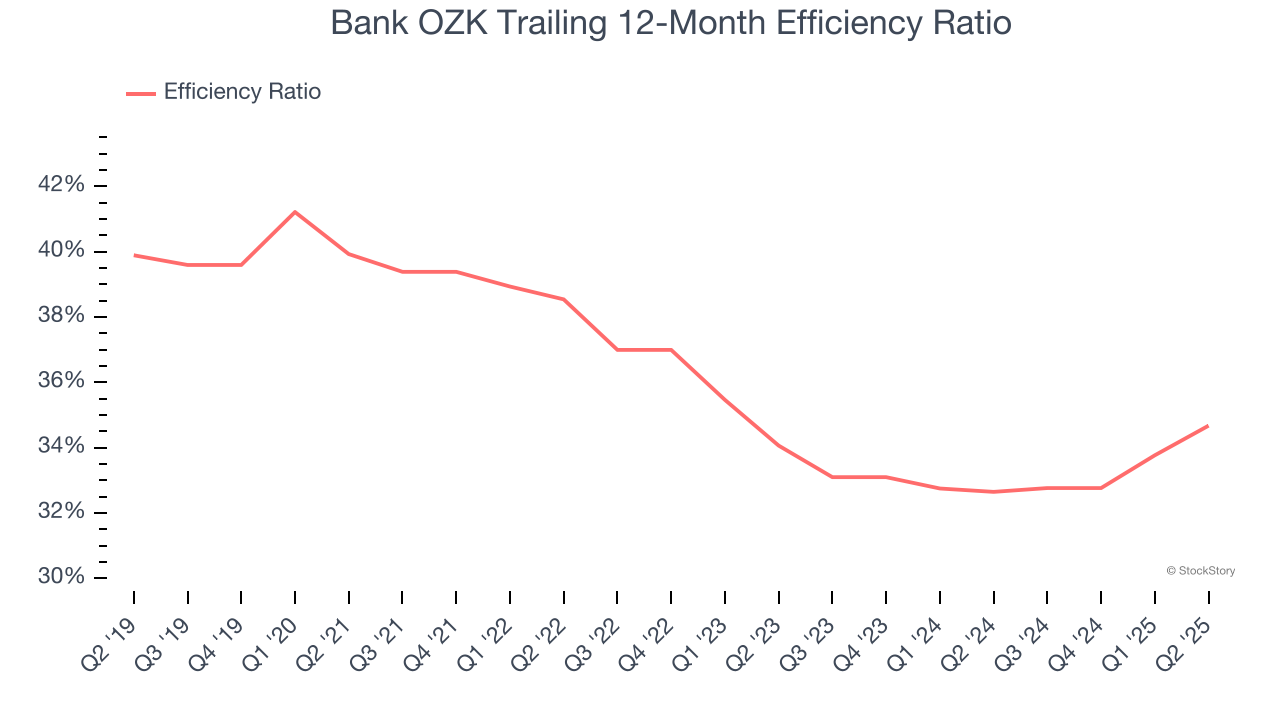

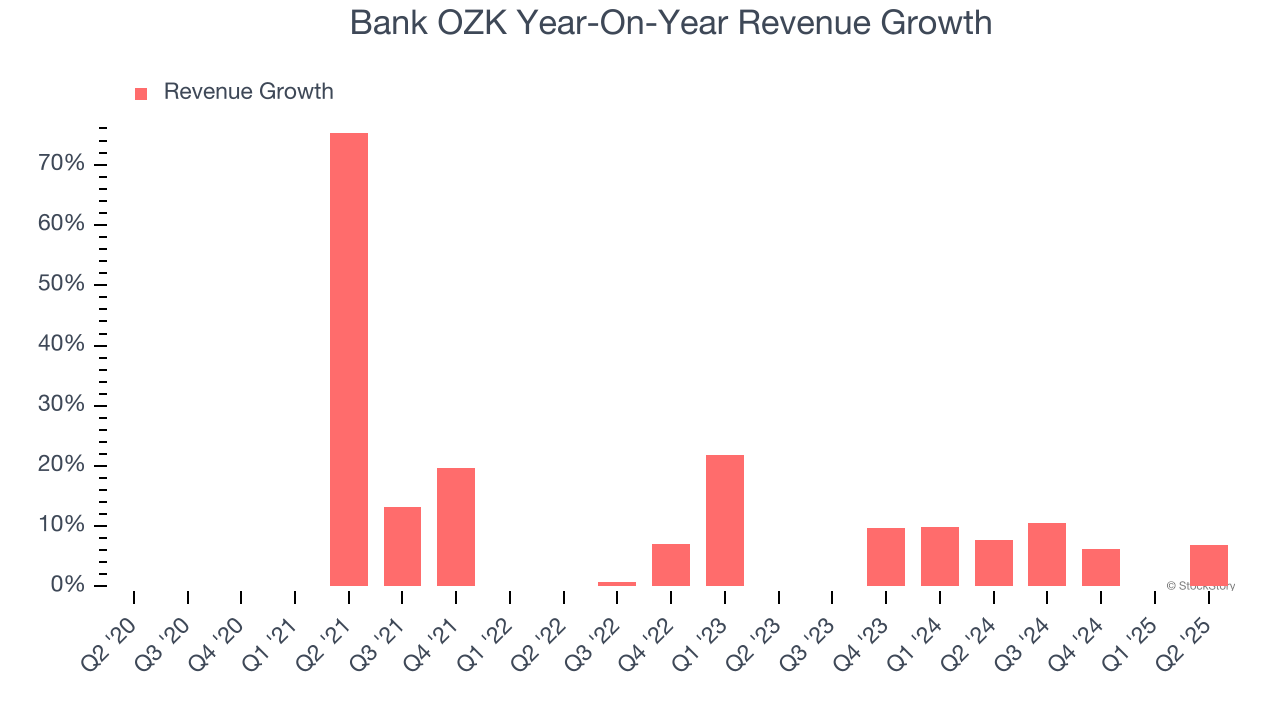

Bank OZK has been treading water for the past six months, recording a small loss of 1.3% while holding steady at $44.88. The stock also fell short of the S&P 500’s 11.5% gain during that period. Is there a buying opportunity in Bank OZK, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members. Why Is Bank OZK Not Exciting?We're cautious about Bank OZK. Here are three reasons we avoid OZK and a stock we'd rather own. 1. Lackluster Revenue GrowthLong-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Bank OZK’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 9.1% over the last two years was well below its five-year trend. 2. Net Interest Margin DroppingThe net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities. Over the past two years, Bank OZK’s net interest margin averaged 4.6%. However, its margin contracted by 89 basis points (100 basis points = 1 percentage point) over that period. This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean Bank OZK either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.  3. Efficiency Ratio Expected to FalterTopline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams. Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue. For the next 12 months, Wall Street expects Bank OZK to become less profitable as it anticipates an efficiency ratio of 37.6% compared to 34.7% over the past year.  Final JudgmentBank OZK isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 0.8× forward P/B (or $44.88 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses. High-Quality Stocks for All Market ConditionsThe market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025). Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

Today 17:19 EST

Via MarketBeat

Tickers

RKLB

Via MarketBeat

Via MarketBeat

Tickers

KRKNF

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.