IPG Photonics (NASDAQ:IPGP) Q3: Strong Sales But Inventory Levels Increase

By:

StockStory

November 04, 2025 at 08:13 AM EST

Fiber laser manufacturer IPG Photonics (NASDAQ: IPGP) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 7.6% year on year to $250.8 million. Guidance for next quarter’s revenue was better than expected at $245 million at the midpoint, 1.1% above analysts’ estimates. Its non-GAAP profit of $0.35 per share was 78.8% above analysts’ consensus estimates. Is now the time to buy IPG Photonics? Find out by accessing our full research report, it’s free for active Edge members. IPG Photonics (IPGP) Q3 CY2025 Highlights:

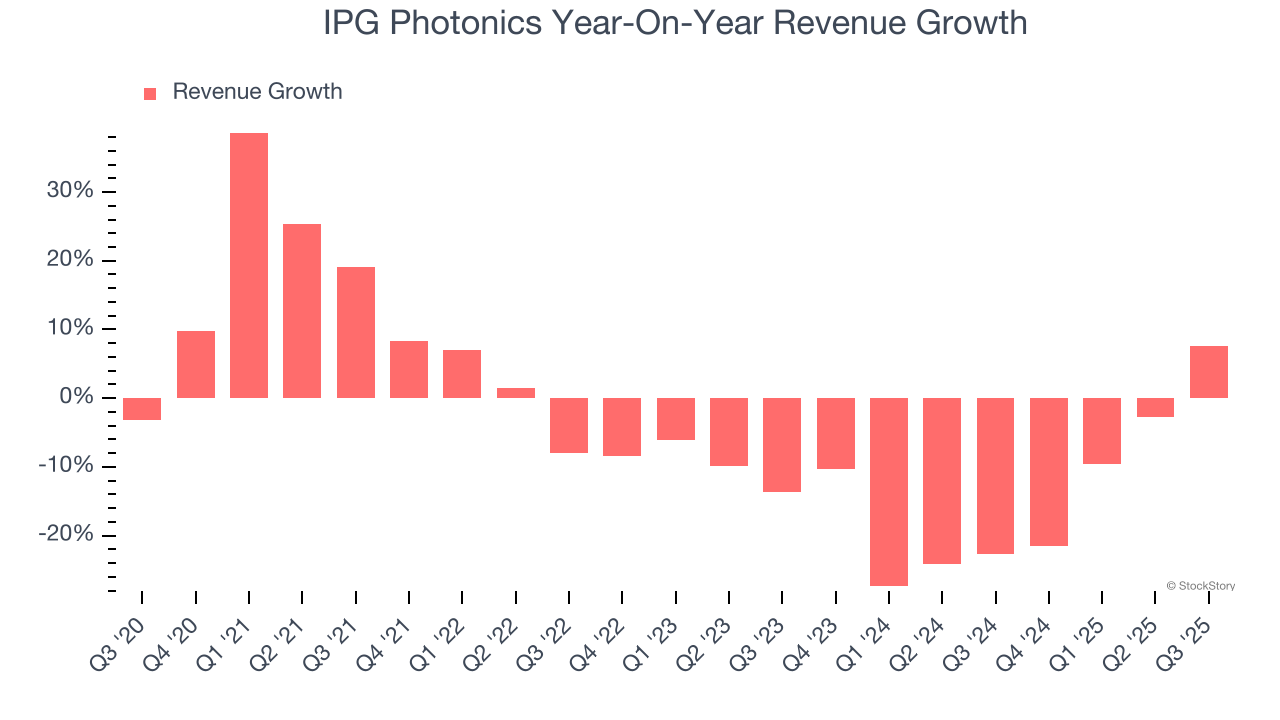

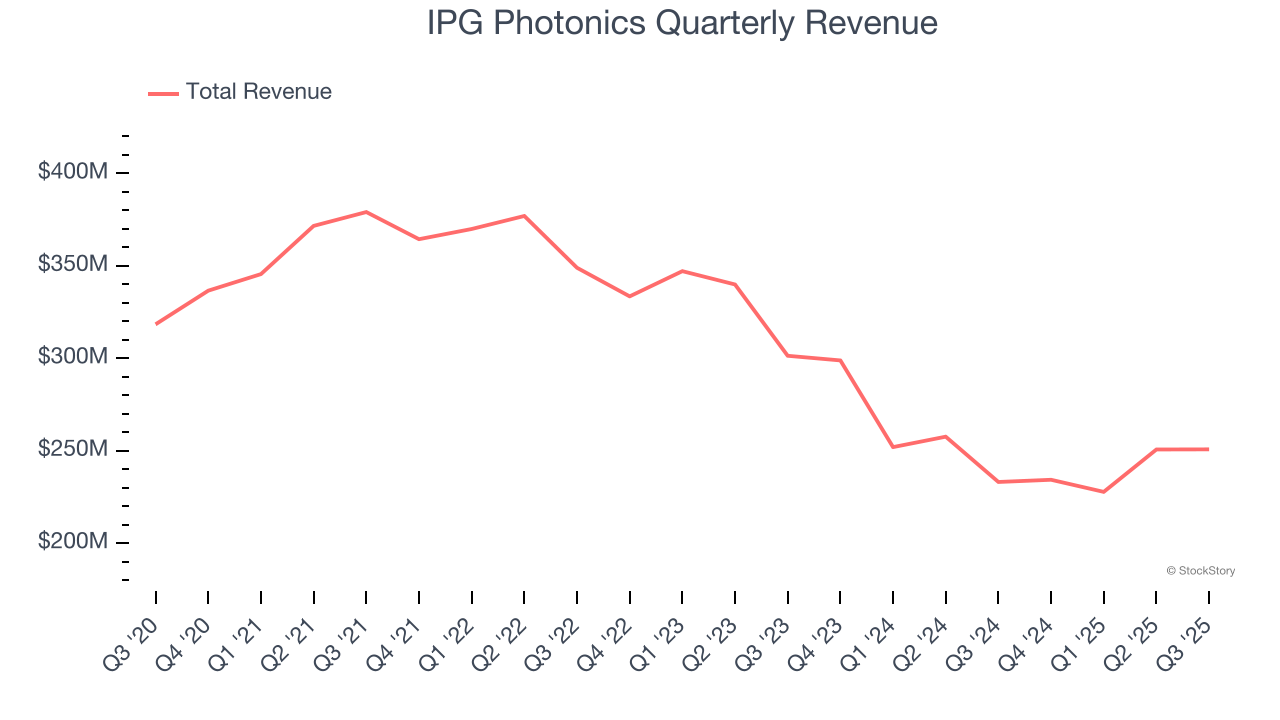

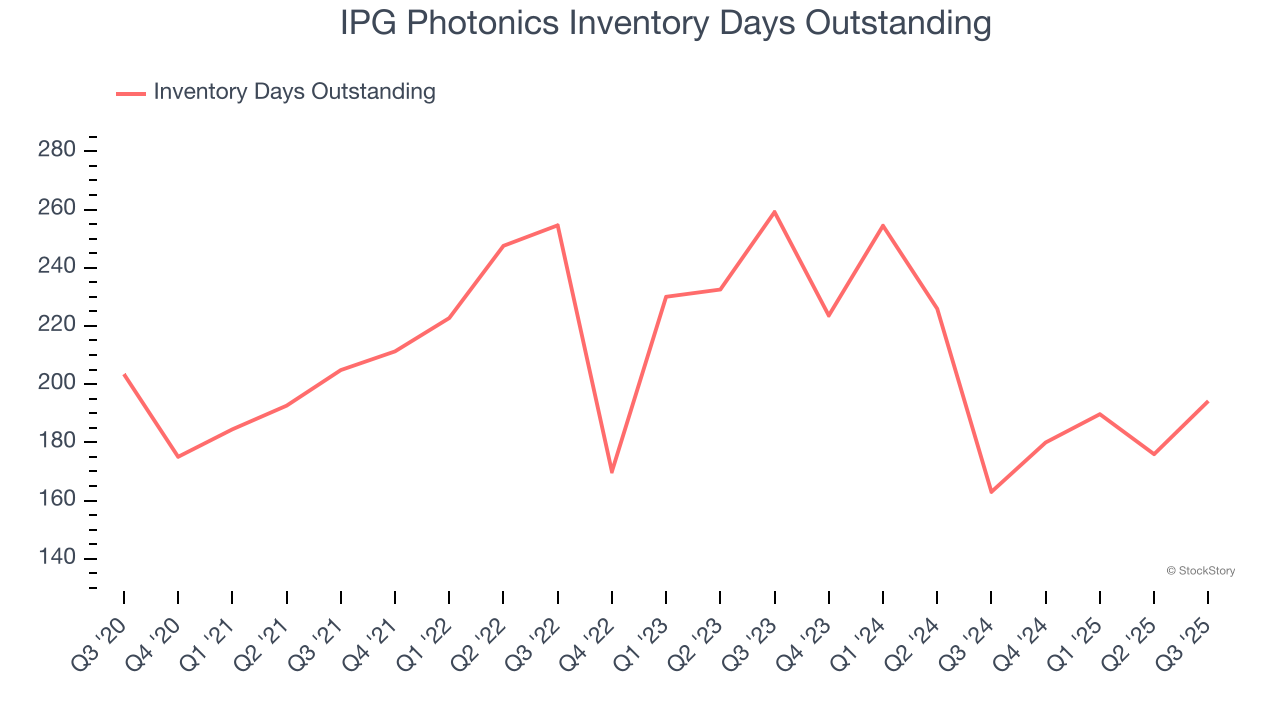

“We delivered third-quarter results at the top end of our expectations with double-digit revenue growth, excluding divestitures, driven by business wins and progress in key strategic initiatives as well as stable industrial demand and growth in battery production,” said Dr. Mark Gitin, Chief Executive Officer of IPG Photonics. Company OverviewBoth a designer and manufacturer of its products, IPG Photonics (NASDAQ: IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials. Revenue GrowthA company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. IPG Photonics struggled to consistently generate demand over the last five years as its sales dropped at a 3.8% annual rate. This was below our standards and suggests it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.  Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. IPG Photonics’s recent performance shows its demand remained suppressed as its revenue has declined by 14.6% annually over the last two years. This quarter, IPG Photonics reported year-on-year revenue growth of 7.6%, and its $250.8 million of revenue exceeded Wall Street’s estimates by 5%. Adding to the positive news, IPG Photonics’s growth inflected positively this quarter, news that will likely give some shareholders hope. Company management is currently guiding for a 4.6% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average. While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories. Product Demand & Outstanding InventoryDays Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production. This quarter, IPG Photonics’s DIO came in at 194, which is 15 days below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.  Key Takeaways from IPG Photonics’s Q3 ResultsIt was good to see IPG Photonics beat analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. On the other hand, its inventory levels materially increased. Zooming out, we think this quarter featured some important positives. The stock remained flat at $85.27 immediately after reporting. So do we think IPG Photonics is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members. More NewsView More

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

Today 17:19 EST

Via MarketBeat

Tickers

RKLB

Via MarketBeat

Via MarketBeat

Tickers

KRKNF

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|