Zeta Global (NYSE:ZETA) Exceeds Q3 Expectations, Stock Soars

By:

StockStory

November 04, 2025 at 18:15 PM EST

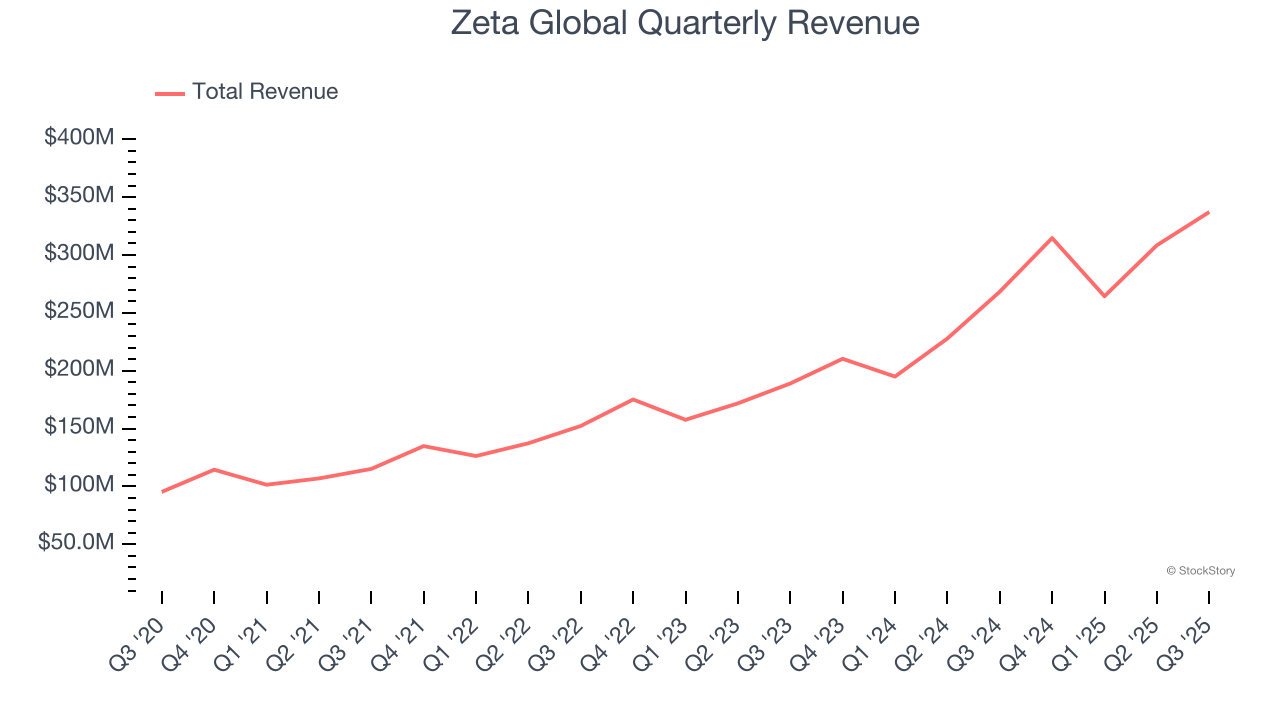

Marketing technology company Zeta Global (NYSE: ZETA) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 25.7% year on year to $337.2 million. The company expects next quarter’s revenue to be around $364.5 million, close to analysts’ estimates. Is now the time to buy Zeta Global? Find out by accessing our full research report, it’s free for active Edge members. Zeta Global (ZETA) Q3 CY2025 Highlights:

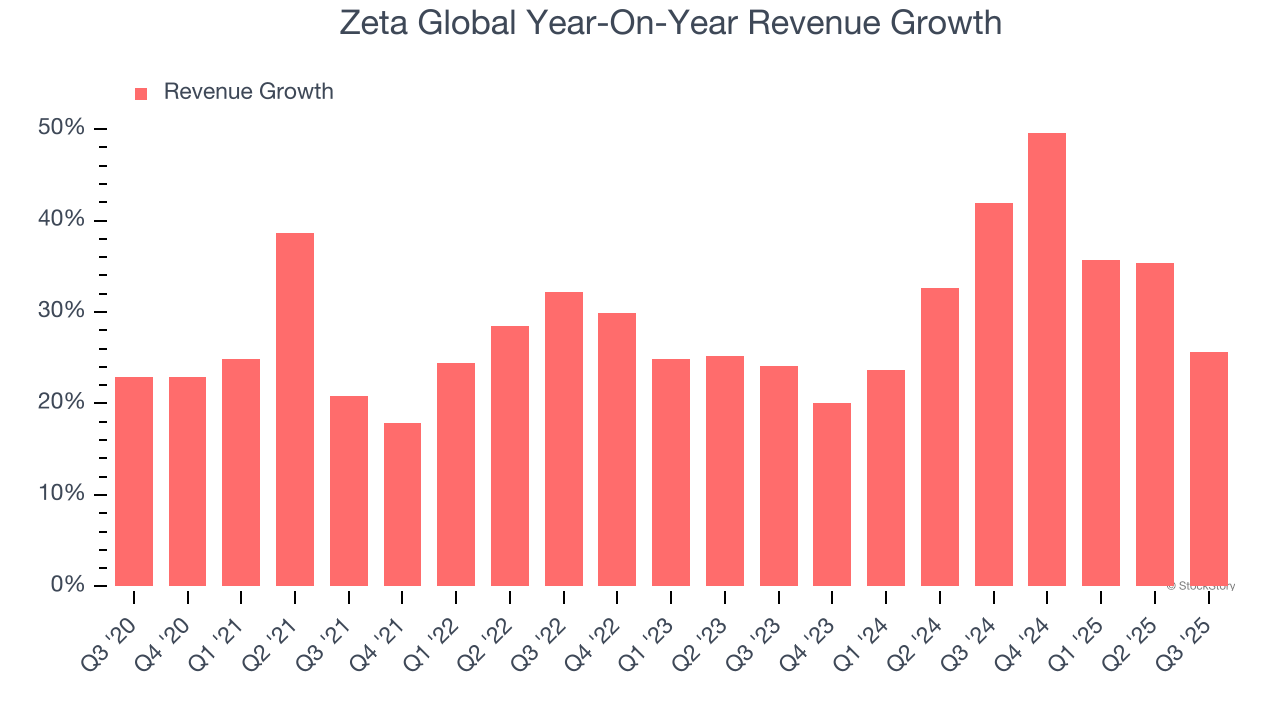

Company OverviewPowered by an AI engine that processes over one trillion consumer signals monthly, Zeta Global (NYSE: ZETA) operates a data-driven cloud platform that helps companies target, connect, and engage with consumers through personalized marketing across channels like email, social media, and video. Revenue GrowthReviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Zeta Global’s sales grew at an impressive 28.7% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.  Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Zeta Global’s annualized revenue growth of 32.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. This quarter, Zeta Global reported robust year-on-year revenue growth of 25.7%, and its $337.2 million of revenue topped Wall Street estimates by 2.7%. Company management is currently guiding for a 15.8% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect revenue to grow 16.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and implies the market is baking in some success for its newer products and services. Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report. Customer Acquisition EfficiencyThe customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability. Zeta Global is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Zeta Global more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments. Key Takeaways from Zeta Global’s Q3 ResultsWe were impressed by how significantly Zeta Global blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 9% to $18.21 immediately following the results. Indeed, Zeta Global had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members. More NewsView More

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

December 05, 2025

Via MarketBeat

Tickers

RKLB

Meta’s AI Moment? New SAM 3 Model Has Wall Street Turning Bullish ↗

December 05, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|