2 Reasons to Like TCBK and 1 to Stay Skeptical

By:

StockStory

November 05, 2025 at 23:04 PM EST

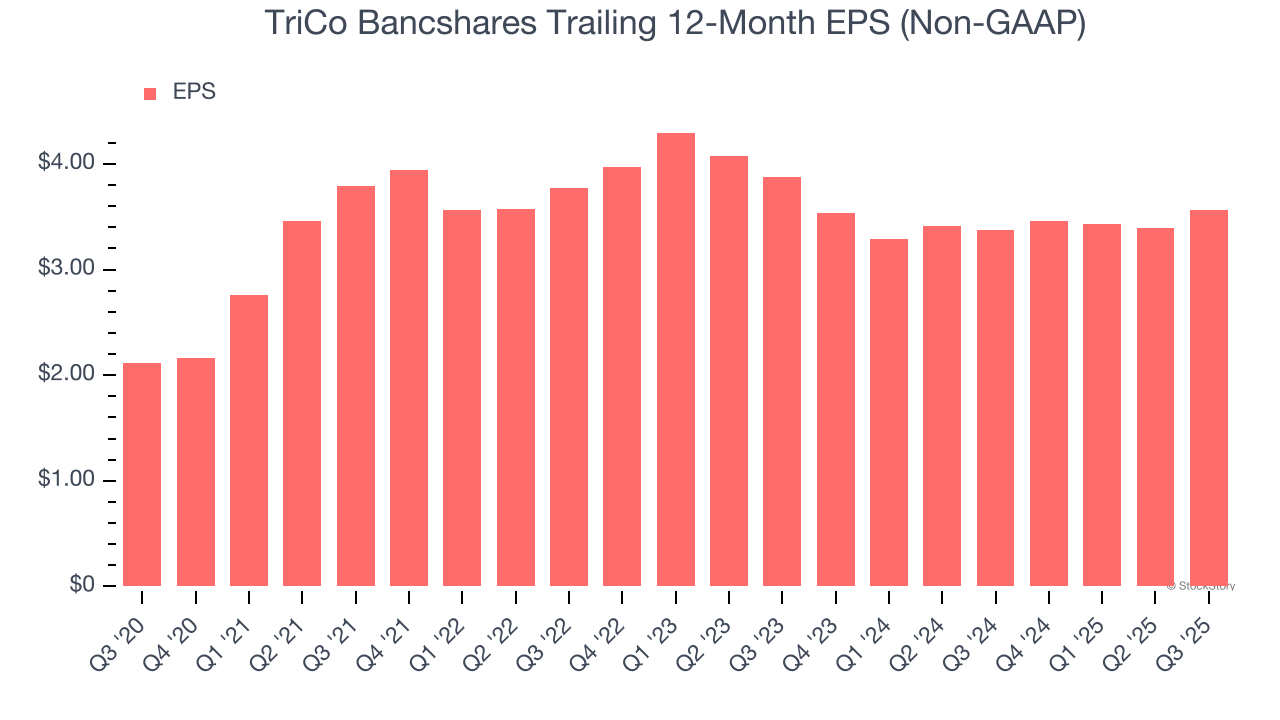

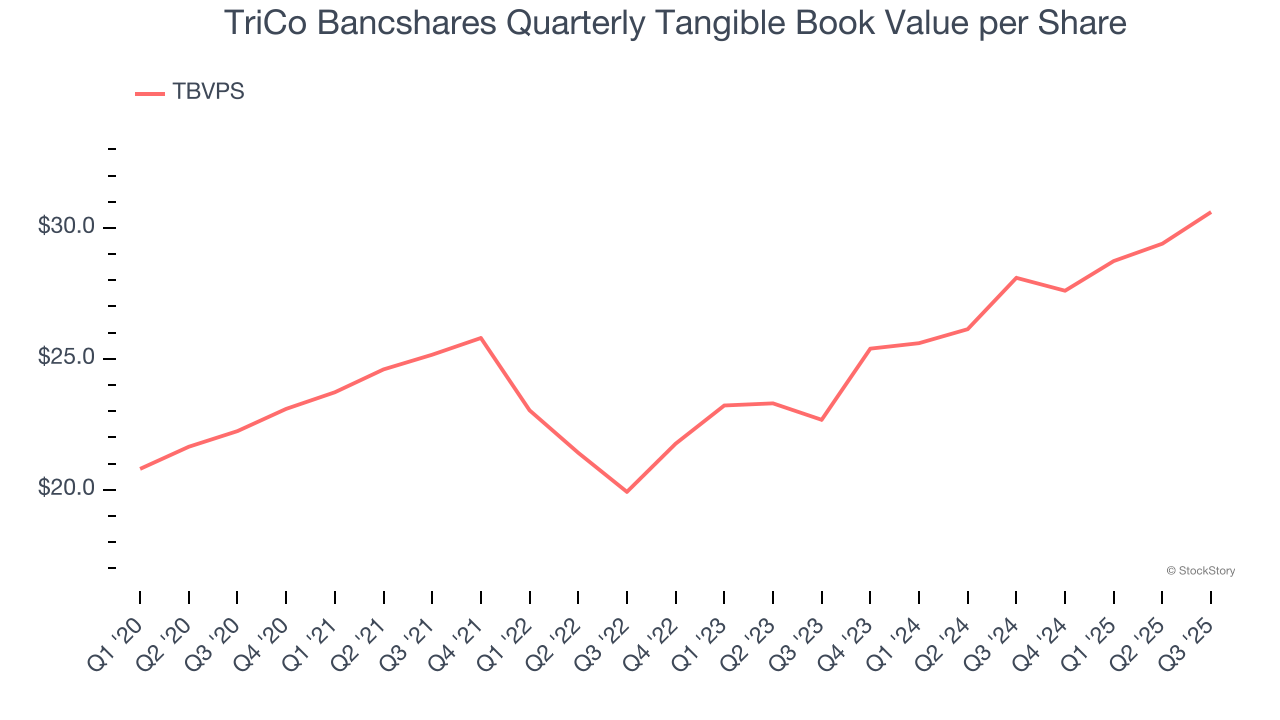

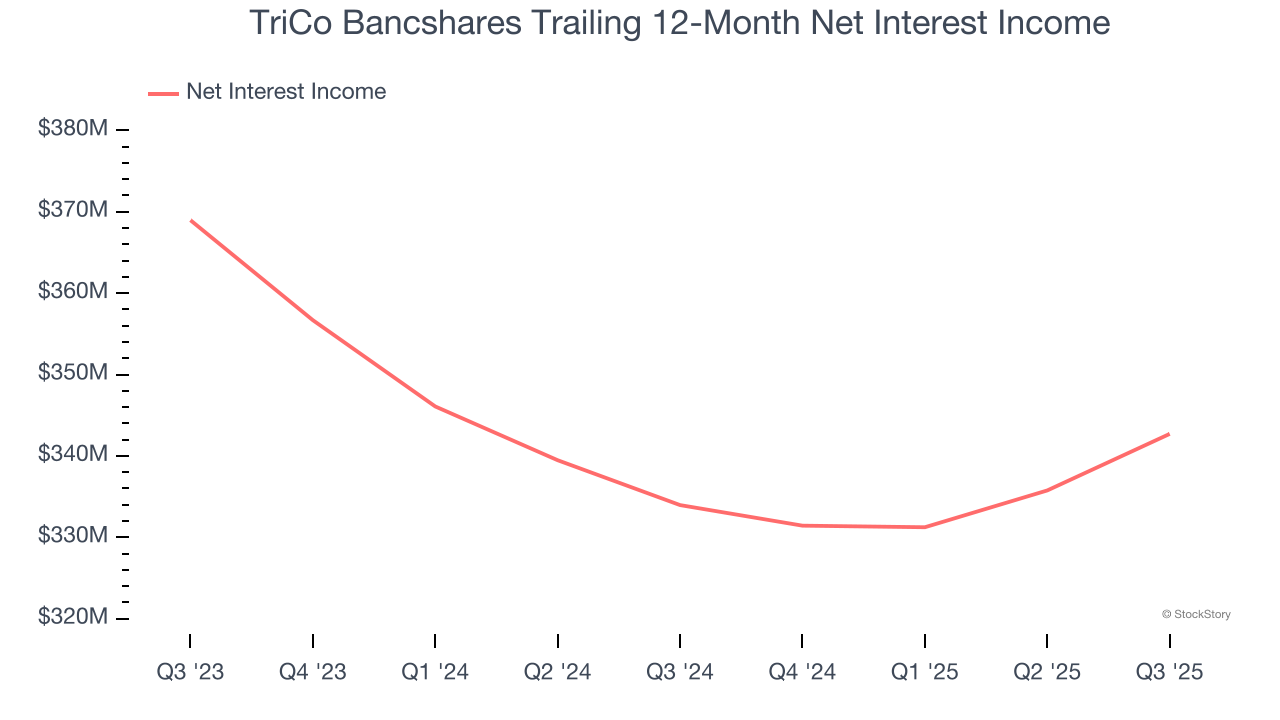

TriCo Bancshares trades at $45.47 per share and has stayed right on track with the overall market, gaining 16.3% over the last six months. At the same time, the S&P 500 has returned 21.3%. Is now a good time to buy TCBK? Find out in our full research report, it’s free for active Edge members. Why Does TCBK Stock Spark Debate?Founded in 1975 and headquartered in Chico, California, TriCo Bancshares (NASDAQ: TCBK) operates Tri Counties Bank, providing personal, small business, and commercial banking services through branches across California. Two Things to Like:1. Outstanding Long-Term EPS GrowthWe track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable. TriCo Bancshares’s EPS grew at an astounding 11% compounded annual growth rate over the last five years, higher than its 5.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.  2. Growing TBVPS Reflects Strong Asset BaseIn the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times. TriCo Bancshares’s TBVPS increased by 6.6% annually over the last five years, and growth has recently accelerated as TBVPS grew at an excellent 16.2% annual clip over the past two years (from $22.67 to $30.61 per share).  One Reason to be Careful:Net Interest Income Points to Soft DemandMarkets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams. TriCo Bancshares’s net interest income has grown at a 6.2% annualized rate over the last five years, slightly worse than the broader banking industry and in line with its total revenue.  Final JudgmentTriCo Bancshares’s positive characteristics outweigh the negatives, but at $45.47 per share (or 1.1× forward P/B), is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members. Stocks We Like Even More Than TriCo BancsharesFresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce. Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Five Below and Dollar Tree Earnings Signal a Shopper Shift ↗

Today 7:15 EST

Via MarketBeat

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|