Zumiez’s (NASDAQ:ZUMZ) Q3 CY2025 Sales Beat Estimates

By:

StockStory

December 04, 2025 at 16:18 PM EST

Clothing and footwear retailer Zumiez (NASDAQ: ZUMZ) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.5% year on year to $239.1 million. Guidance for next quarter’s revenue was optimistic at $293.5 million at the midpoint, 2.7% above analysts’ estimates. Its GAAP profit of $0.55 per share was significantly above analysts’ consensus estimates. Is now the time to buy Zumiez? Find out by accessing our full research report, it’s free for active Edge members. Zumiez (ZUMZ) Q3 CY2025 Highlights:

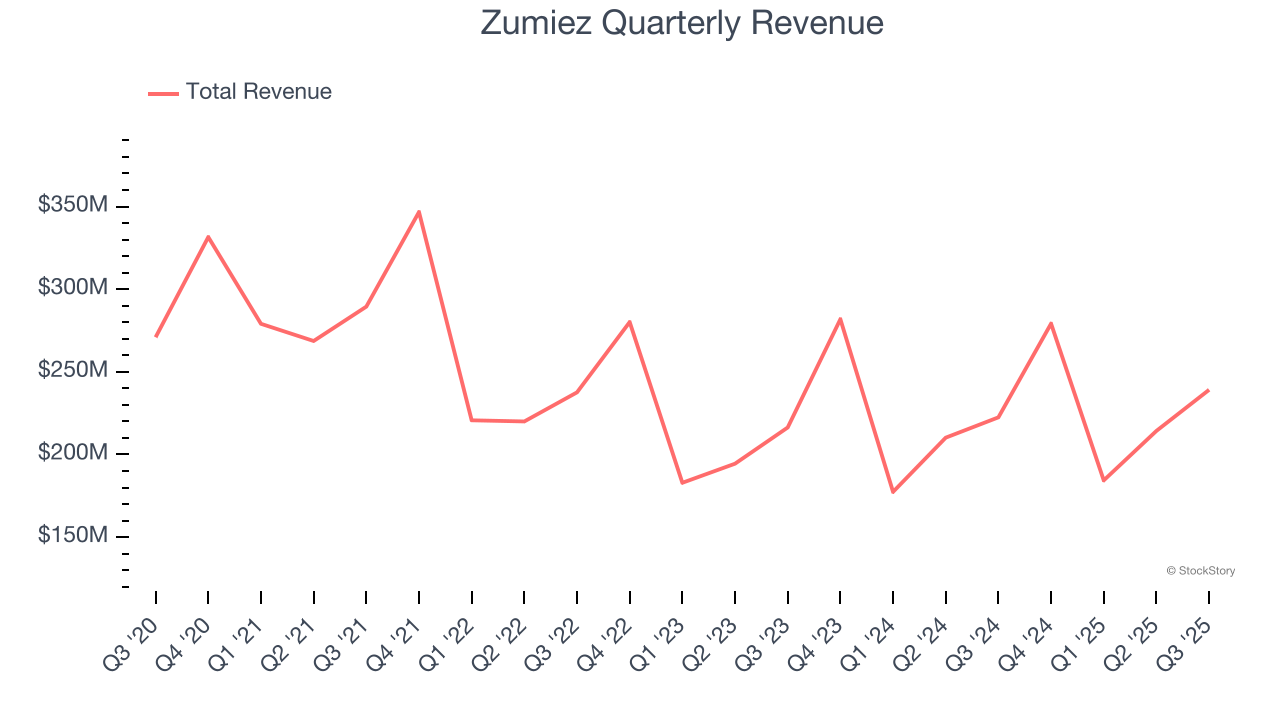

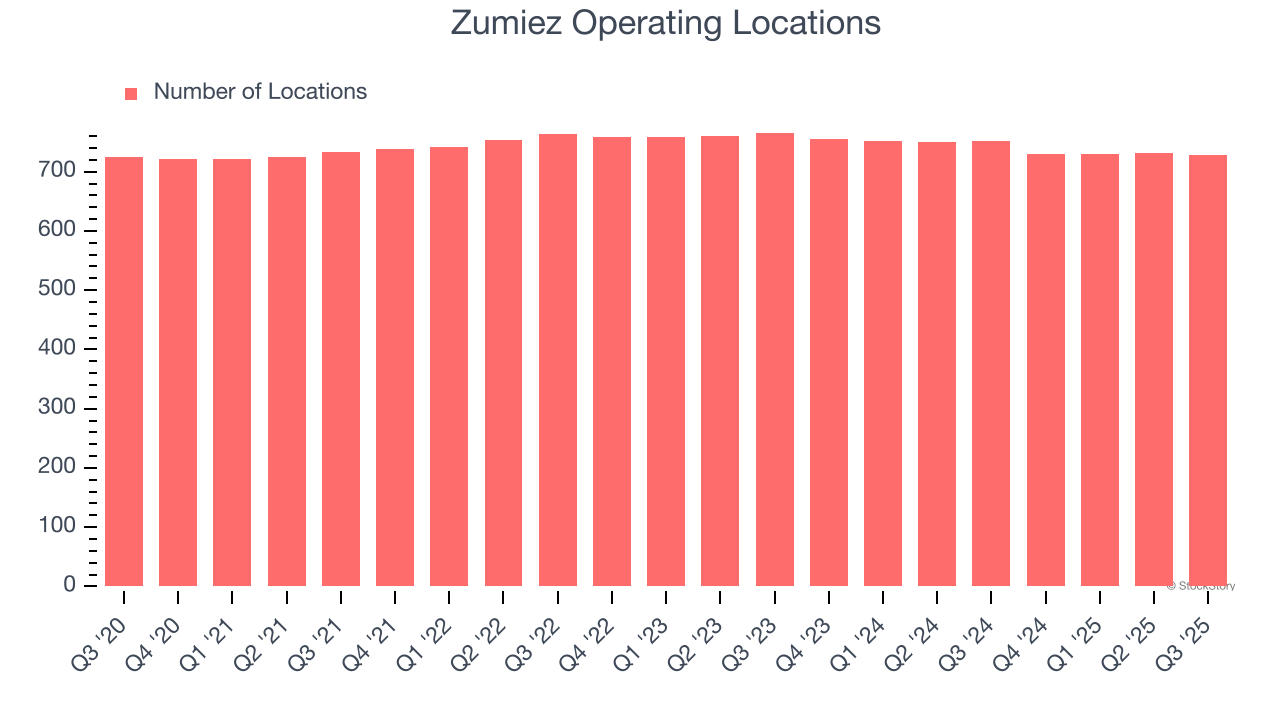

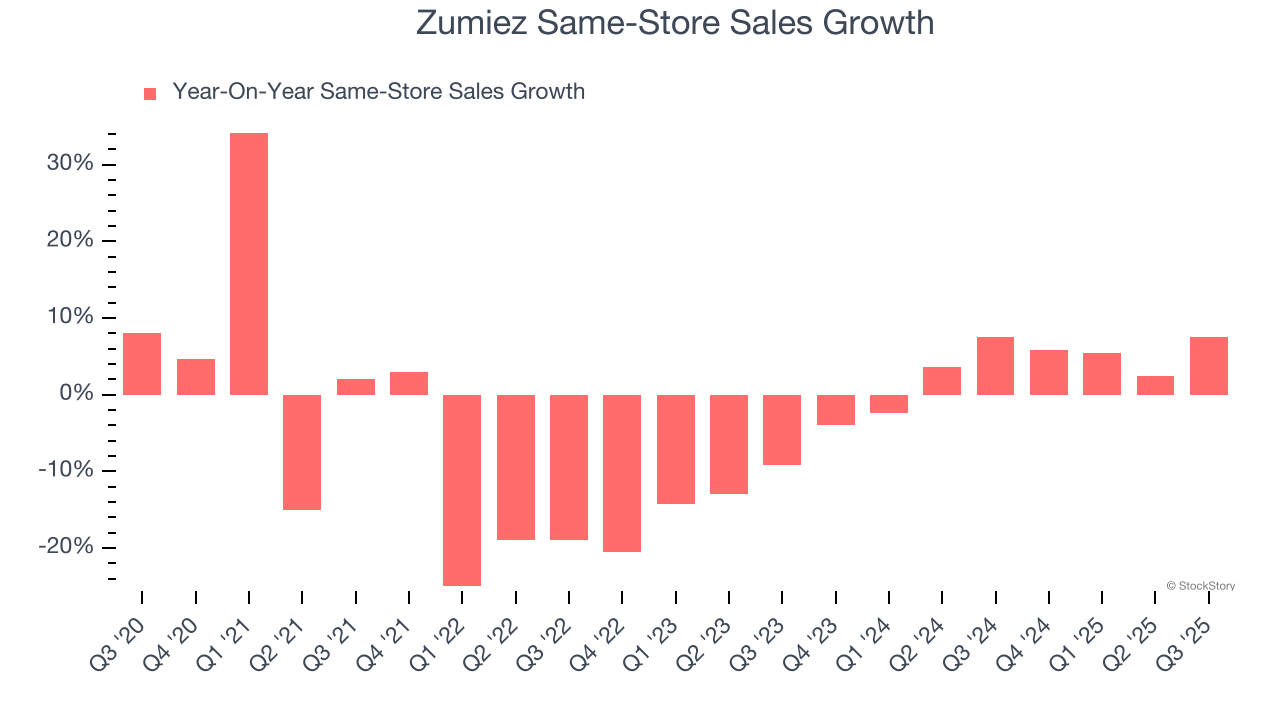

“We achieved our best third quarter in several years,” said Rick Brooks, Chief Executive Officer of Zumiez Inc. Company OverviewWith store associates called “Zumiez Stash Members”, Zumiez (NASDAQ: ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories. Revenue GrowthA company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. With $916.9 million in revenue over the past 12 months, Zumiez is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. As you can see below, Zumiez’s revenue declined by 3.6% per year over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores.  This quarter, Zumiez reported year-on-year revenue growth of 7.5%, and its $239.1 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 5.1% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months. Although this projection suggests its newer products will fuel better top-line performance, it is still below average for the sector. Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend. Store PerformanceNumber of StoresA retailer’s store count influences how much it can sell and how quickly revenue can grow. Zumiez operated 728 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2.1% annual declines. When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.  Same-Store SalesThe change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. Zumiez’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.3% per year. Given its declining store base over the same period, this performance stems from a mixture of higher e-commerce sales and increased foot traffic at existing locations (closing stores can sometimes boost same-store sales).  In the latest quarter, Zumiez’s same-store sales rose 7.6% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign. Key Takeaways from Zumiez’s Q3 ResultsIt was good to see Zumiez beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 4.3% to $28.46 immediately following the results. Zumiez put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members. More NewsView More

Five Below and Dollar Tree Earnings Signal a Shopper Shift ↗

Today 7:15 EST

Via MarketBeat

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|