Unpacking Q4 Earnings: DocuSign (NASDAQ:DOCU) In The Context Of Other Productivity Software Stocks

By:

StockStory

March 20, 2025 at 05:02 AM EDT

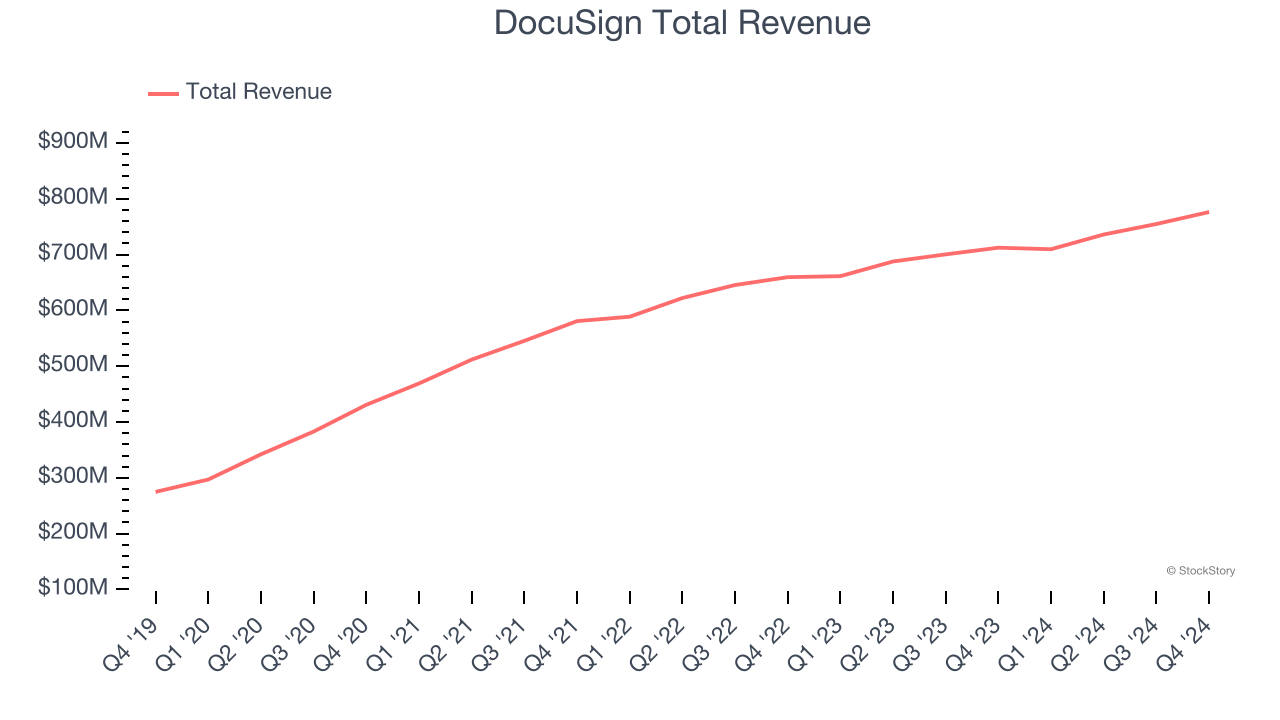

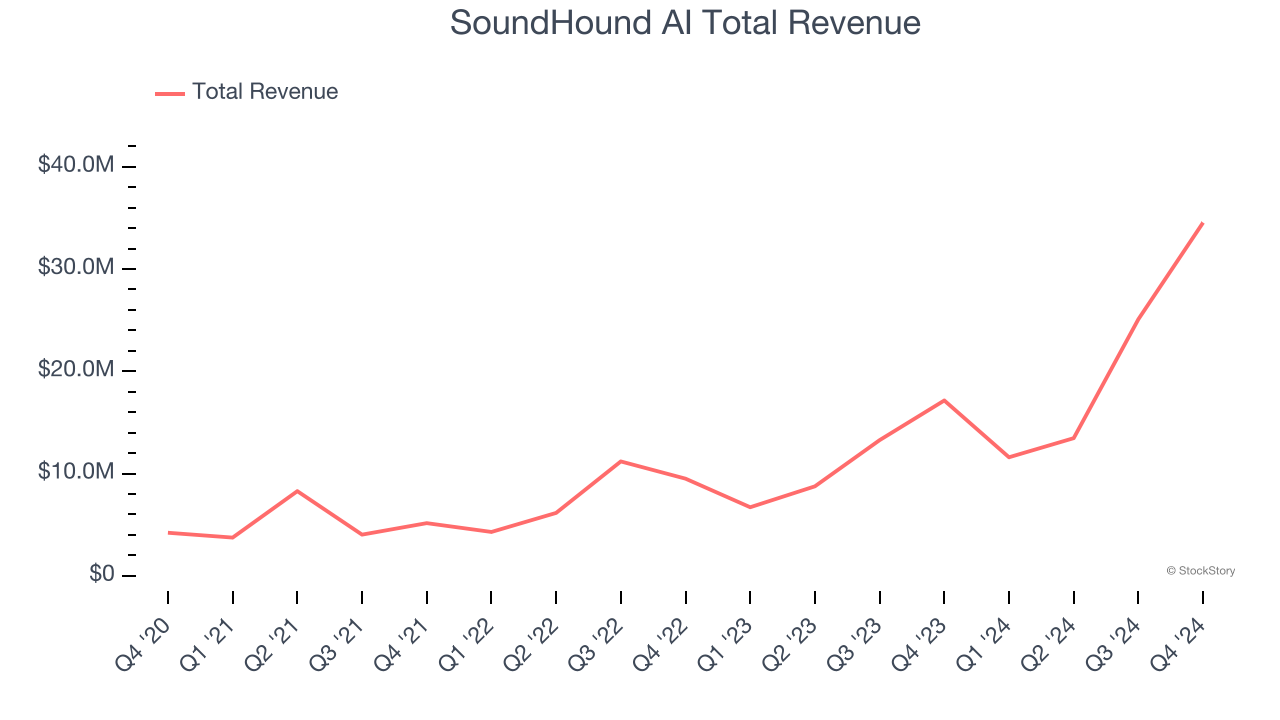

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the productivity software industry, including DocuSign (NASDAQ: DOCU) and its peers. Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks. The 17 productivity software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line. Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.7% since the latest earnings results. DocuSign (NASDAQ: DOCU)Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ: DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically. DocuSign reported revenues of $776.3 million, up 9% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ billings estimates. "Fiscal 2025 was a transformative year for Docusign. We launched Docusign IAM, our AI-powered agreement management platform, which is driving rapid traction with customers," said Allan Thygesen, CEO of Docusign.  The stock is up 14.9% since reporting and currently trades at $85.85. Is now the time to buy DocuSign? Access our full analysis of the earnings results here, it’s free. Best Q4: SoundHound AI (NASDAQ: SOUN)Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers. SoundHound AI reported revenues of $34.54 million, up 101% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.  SoundHound AI achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 8.9% since reporting. It currently trades at $10.03. Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free. Weakest Q4: UiPath (NYSE: PATH)Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE: PATH) makes software that helps companies automate repetitive computer tasks. UiPath reported revenues of $423.6 million, up 4.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ billings estimates and full-year guidance of slowing revenue growth. UiPath delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 8.2% since the results and currently trades at $10.90. Read our full analysis of UiPath’s results here. Asana (NYSE: ASAN)Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE: ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work. Asana reported revenues of $188.3 million, up 10% year on year. This number met analysts’ expectations. Overall, it was a strong quarter as it also produced EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates. The stock is down 12.7% since reporting and currently trades at $14.59. Read our full, actionable report on Asana here, it’s free. Jamf (NASDAQ: JAMF)Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ: JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones. Jamf reported revenues of $163 million, up 8.2% year on year. This result was in line with analysts’ expectations. More broadly, it was a slower quarter as it logged full-year guidance of slowing revenue growth and a miss of analysts’ billings estimates. The stock is down 7.1% since reporting and currently trades at $13.69. Read our full, actionable report on Jamf here, it’s free. Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate. Join Paid Stock Investor Research Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here. More NewsView More

3 Recently Downgraded Stocks to Avoid in 2026 ↗

Today 18:07 EST

Via MarketBeat

The Chip Boom Is Back: 3 Stocks Positioned for Huge Gains ↗

Today 17:39 EST

Beyond the Magnificent 7: Meet 3 of Tech’s Rising Stars ↗

Today 16:12 EST

The Quantum Fleet: Investing in the New Quantum Standard ↗

Today 15:14 EST

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|