Astec’s (NASDAQ:ASTE) Q1: Beats On Revenue, Stock Soars

By:

StockStory

April 29, 2025 at 07:35 AM EDT

Construction equipment company Astec (NASDAQ: ASTE) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 6.5% year on year to $329.4 million. Its non-GAAP profit of $0.88 per share was 91.3% above analysts’ consensus estimates. Is now the time to buy Astec? Find out by accessing our full research report, it’s free. Astec (ASTE) Q1 CY2025 Highlights:

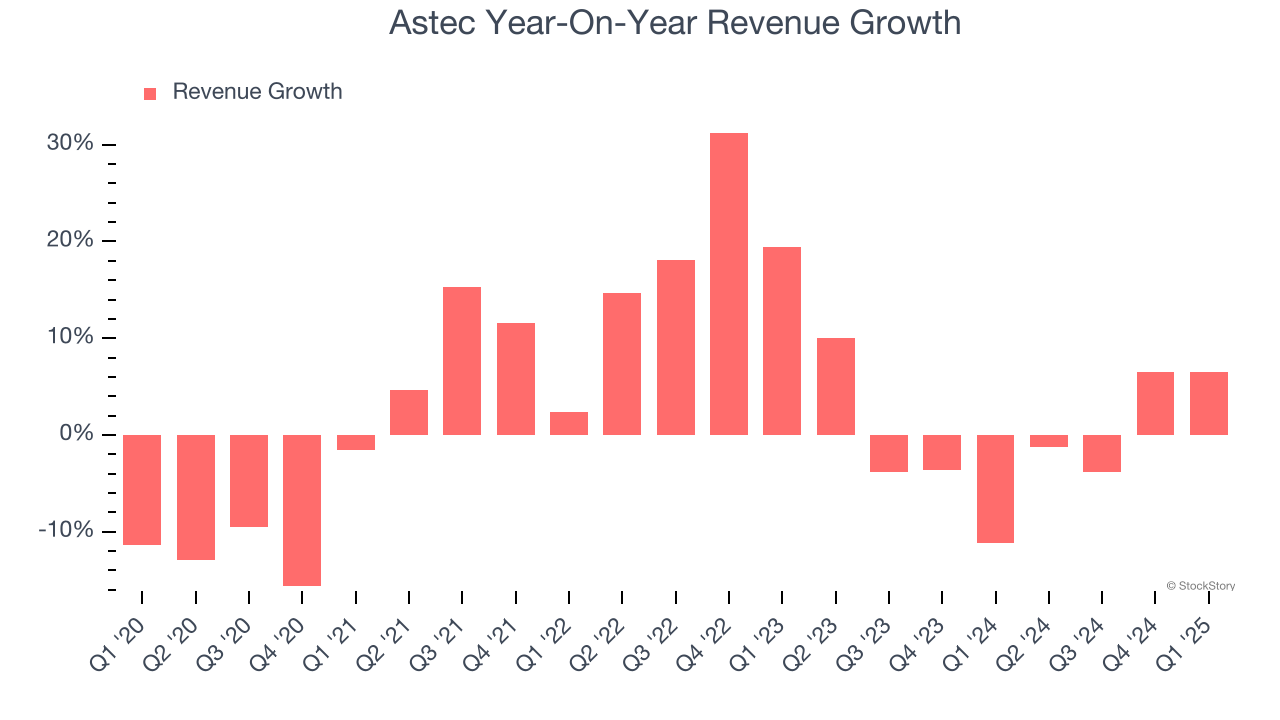

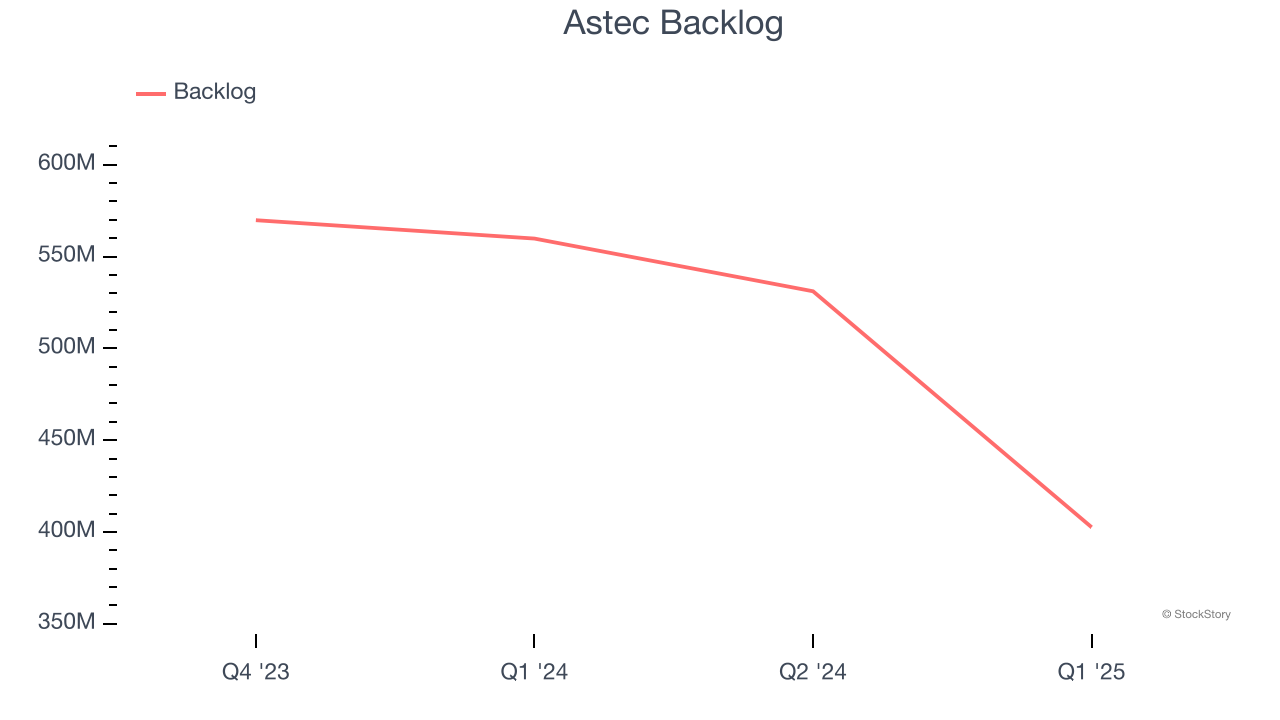

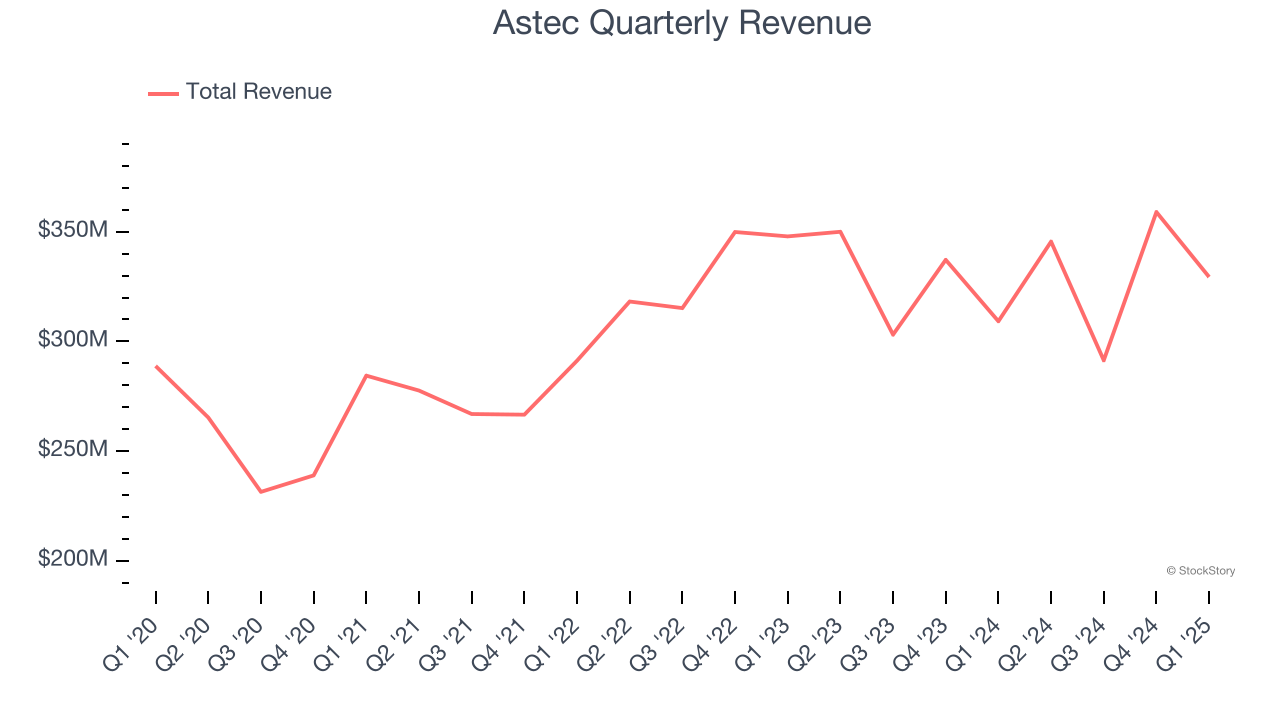

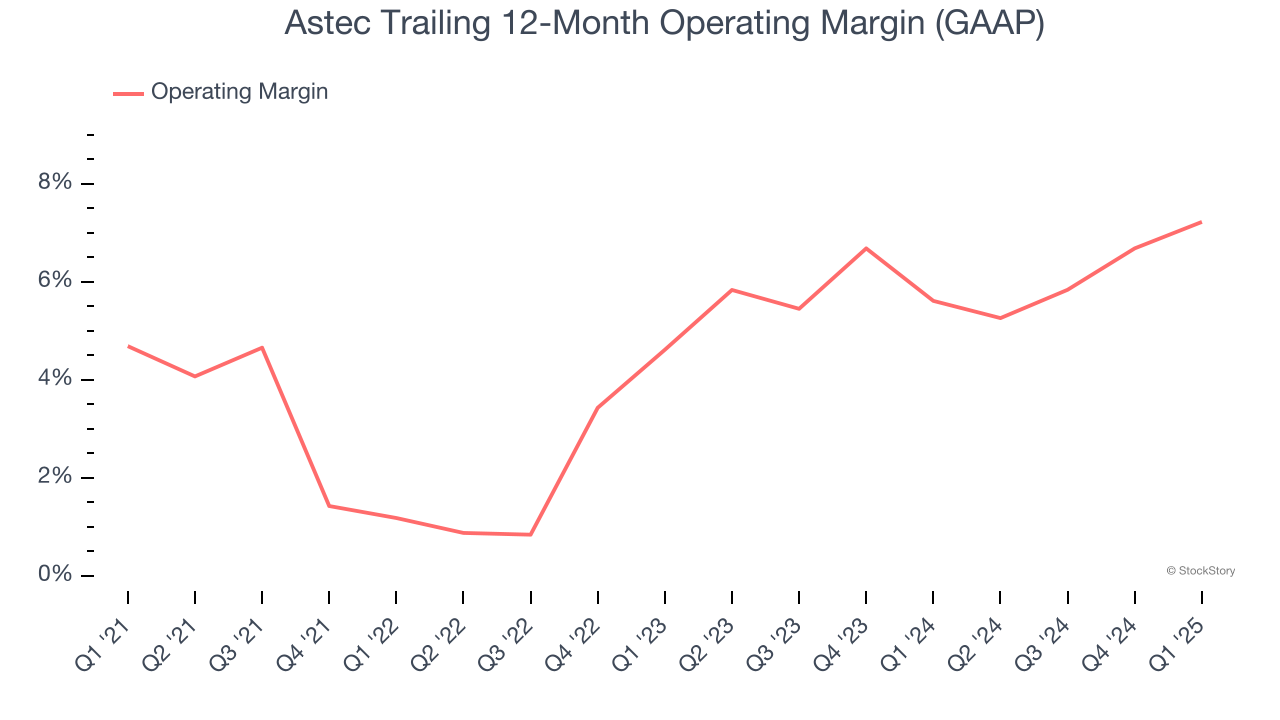

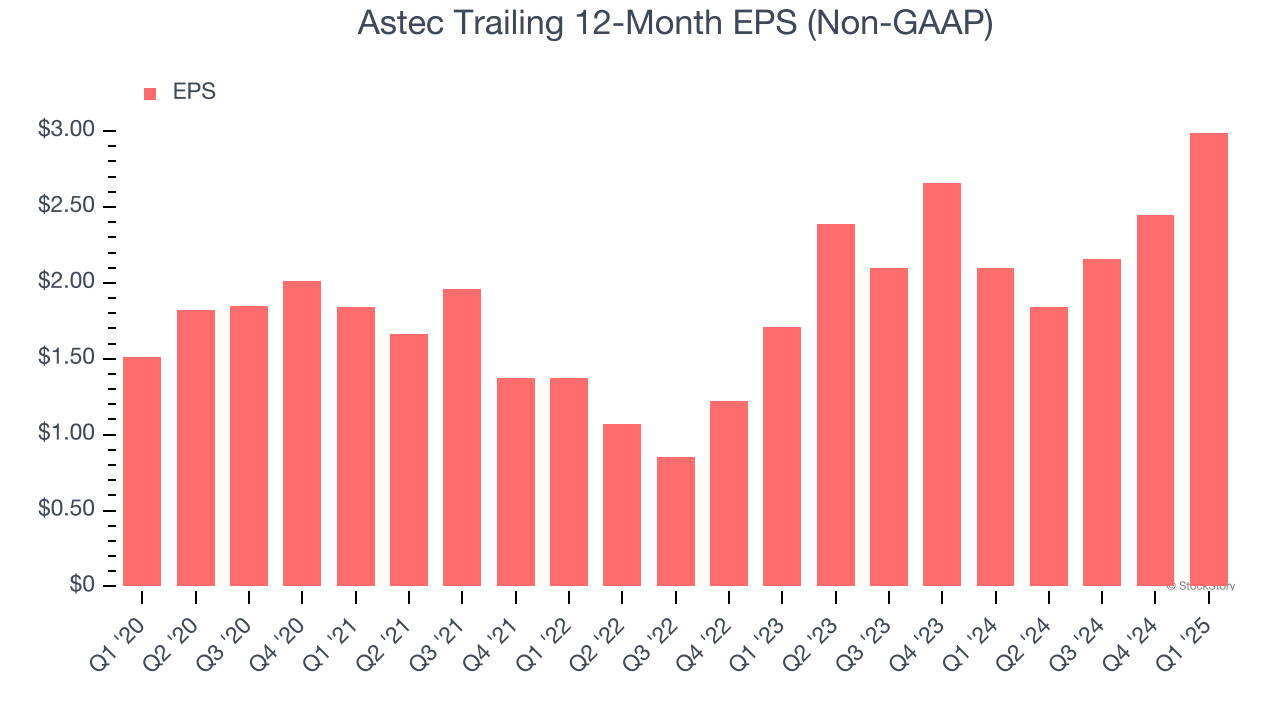

"We are pleased to report another strong quarter in line with our plans to deliver consistency, profitability and growth," said Jaco van der Merwe, Chief Executive Officer. Company OverviewInventing the first ever double-barrel hot-mix asphalt plant, Astec (NASDAQ: ASTE) provides machines and equipment for building roads, processing raw materials, and producing concrete. Sales GrowthReviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Astec grew its sales at a sluggish 3.2% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.  Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Astec’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Construction Machinery businesses have faced declining sales because of cyclical headwinds. While Astec’s growth wasn’t the best, it did do better than its peers. Astec also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Astec’s backlog reached $402.6 million in the latest quarter and averaged 28.1% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future. This quarter, Astec reported year-on-year revenue growth of 6.5%, and its $329.4 million of revenue exceeded Wall Street’s estimates by 2.8%. Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector. Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend. Operating MarginOperating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development. Astec was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point. On the plus side, Astec’s operating margin rose by 2.5 percentage points over the last five years, as its sales growth gave it operating leverage.  In Q1, Astec generated an operating profit margin of 6.2%, up 2.3 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency. Earnings Per ShareRevenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions. Astec’s EPS grew at a remarkable 14.6% compounded annual growth rate over the last five years, higher than its 3.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.  Diving into the nuances of Astec’s earnings can give us a better understanding of its performance. As we mentioned earlier, Astec’s operating margin expanded by 2.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals. Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business. For Astec, its two-year annual EPS growth of 32.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base. In Q1, Astec reported EPS at $0.88, up from $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Astec’s full-year EPS of $2.99 to shrink by 6%. Key Takeaways from Astec’s Q1 ResultsWe were impressed that Astec beat analysts’ revenue, EBITDA, and EPS expectations this quarter. The stock traded up 5.4% to $37.17 immediately after reporting. Astec put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free. More NewsView More

Post 35% Surge, Analysts Eye More Upside in Copper Giant Freeport ↗

December 17, 2025

Via MarketBeat

Why a SpaceX IPO Could Be a Major Catalyst for GOOGL Stock ↗

December 17, 2025

Can Upwork Maintain Its Comeback? Reasons to Be Bullish and Bearish ↗

December 17, 2025

Via MarketBeat

Is Tesla Overvalued? 2 Reasons It Might Be a Bargain ↗

December 17, 2025

Via MarketBeat

Tickers

TSLA

How These 2 Stocks Won 2025's AI Race—And What's In Store for 2026 ↗

December 17, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|