WEBTOON (NASDAQ:WBTN) Reports Sales Below Analyst Estimates In Q1 Earnings, Stock Drops

By:

StockStory

May 13, 2025 at 16:17 PM EDT

Digital storytelling platform WEBTOON (NASDAQ: WBTN) fell short of the market’s revenue expectations in Q1 CY2025, with sales flat year on year at $325.7 million. On the other hand, the company expects next quarter’s revenue to be around $340 million, close to analysts’ estimates. Its GAAP loss of $0.17 per share was 7% below analysts’ consensus estimates. Is now the time to buy WEBTOON? Find out by accessing our full research report, it’s free. WEBTOON (WBTN) Q1 CY2025 Highlights:

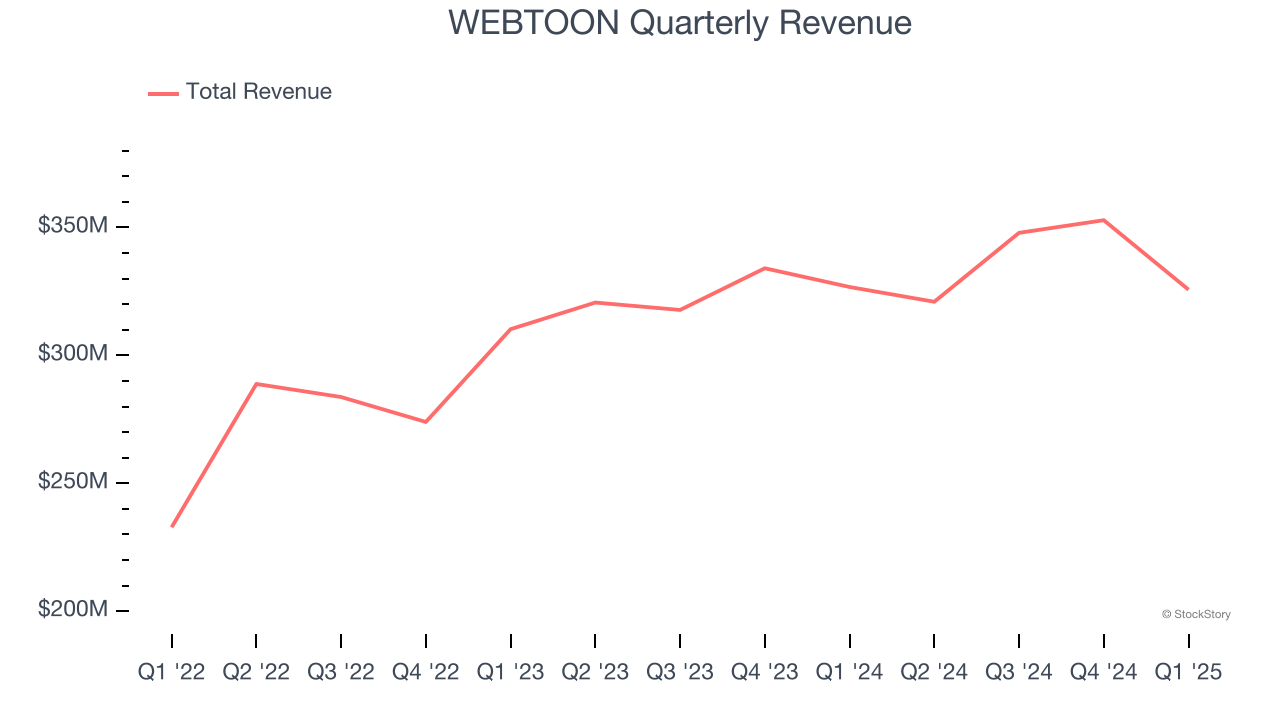

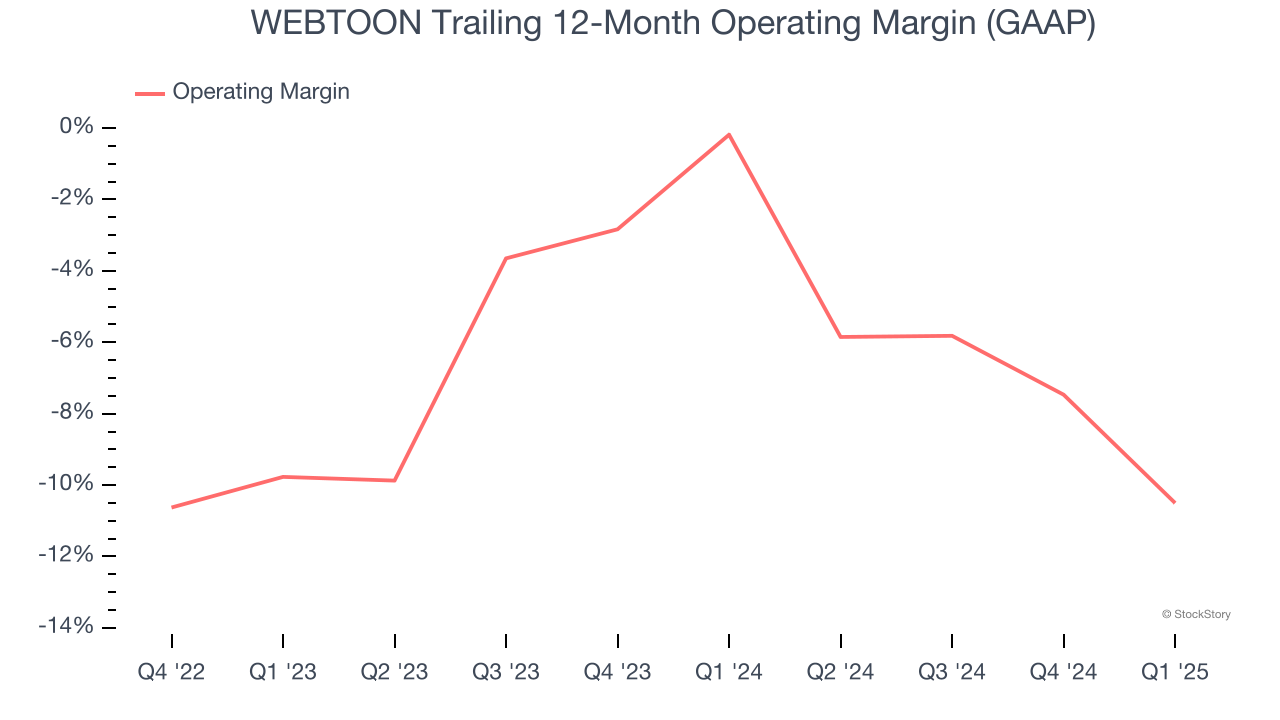

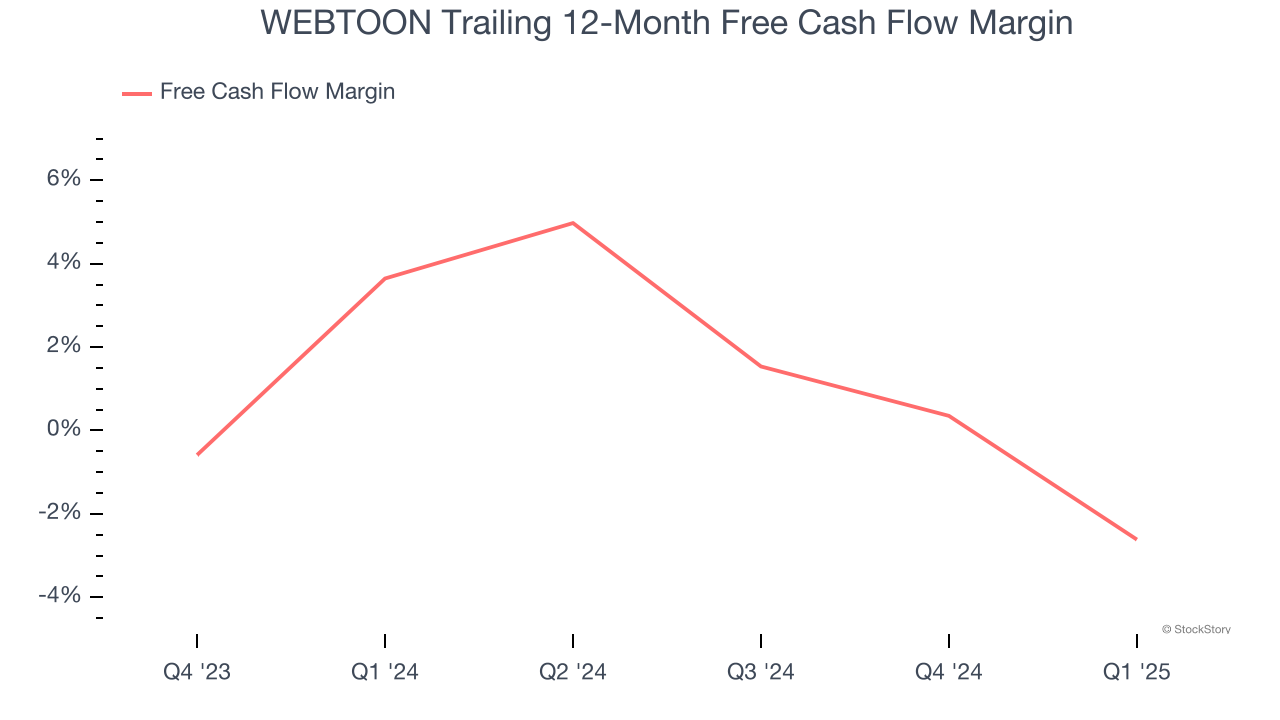

Junkoo Kim, Founder and CEO, said, “We are pleased to report both revenue and Adjusted EBITDA above the midpoint of our guidance. Total revenue was up 5.3% on a constant currency basis, with all three revenue streams – Paid Content, Advertising, and IP Adaptations – contributing to growth.” Company OverviewPioneering a vertical-scrolling format optimized for mobile devices, WEBTOON Entertainment (NASDAQ: WBTN) operates a global platform where creators publish serialized web-comics and web-novels that users can read in bite-sized episodes. Sales GrowthExamining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. With $1.35 billion in revenue over the past 12 months, WEBTOON is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand. As you can see below, WEBTOON’s 7.9% annualized revenue growth over the last two years was solid. This is an encouraging starting point for our analysis because it shows WEBTOON’s demand was higher than many business services companies.  This quarter, WEBTOON missed Wall Street’s estimates and reported a rather uninspiring 0.3% year-on-year revenue decline, generating $325.7 million of revenue. Company management is currently guiding for a 5.9% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will spur better top-line performance. Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link. Operating MarginWEBTOON’s operating margin has been trending down over the last 12 months and averaged negative 6.9% over the last three years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.  This quarter, WEBTOON generated a negative 8.2% operating margin. Cash Is KingFree cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king. WEBTOON broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.  WEBTOON burned through $19.19 million of cash in Q1, equivalent to a negative 5.9% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from WEBTOON’s Q1 ResultsWe struggled to find many positives in these results as its revenue and EPS missed. Next quarter's EBITDA guidance also fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.6% to $9.22 immediately after reporting. WEBTOON underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free. More NewsView More

Market Momentum: 3 Stocks Poised for Major Breakouts ↗

December 10, 2025

Via MarketBeat

3 Reasons Casey’s General Stores Will Continue Trending Higher ↗

December 10, 2025

Via MarketBeat

Tickers

CASY

Golden Cross Alert: 3 Stocks With Major Upside Potential ↗

December 10, 2025

The Top 3 Investment Themes That Will Dominate 2026 ↗

December 10, 2025

Vertical’s Valo Launch: A Commercial Leap Disguised as a Dip ↗

December 10, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|