Palo Alto Networks (NASDAQ:PANW) Surprises With Q1 Sales

By:

StockStory

May 20, 2025 at 16:09 PM EDT

Cybersecurity provider Palo Alto Networks (NASDAQ: PANW) announced better-than-expected revenue in Q1 CY2025, with sales up 15.3% year on year to $2.29 billion. The company expects next quarter’s revenue to be around $2.5 billion, close to analysts’ estimates. Its non-GAAP profit of $0.80 per share was 3.6% above analysts’ consensus estimates. Is now the time to buy Palo Alto Networks? Find out by accessing our full research report, it’s free. Palo Alto Networks (PANW) Q1 CY2025 Highlights:

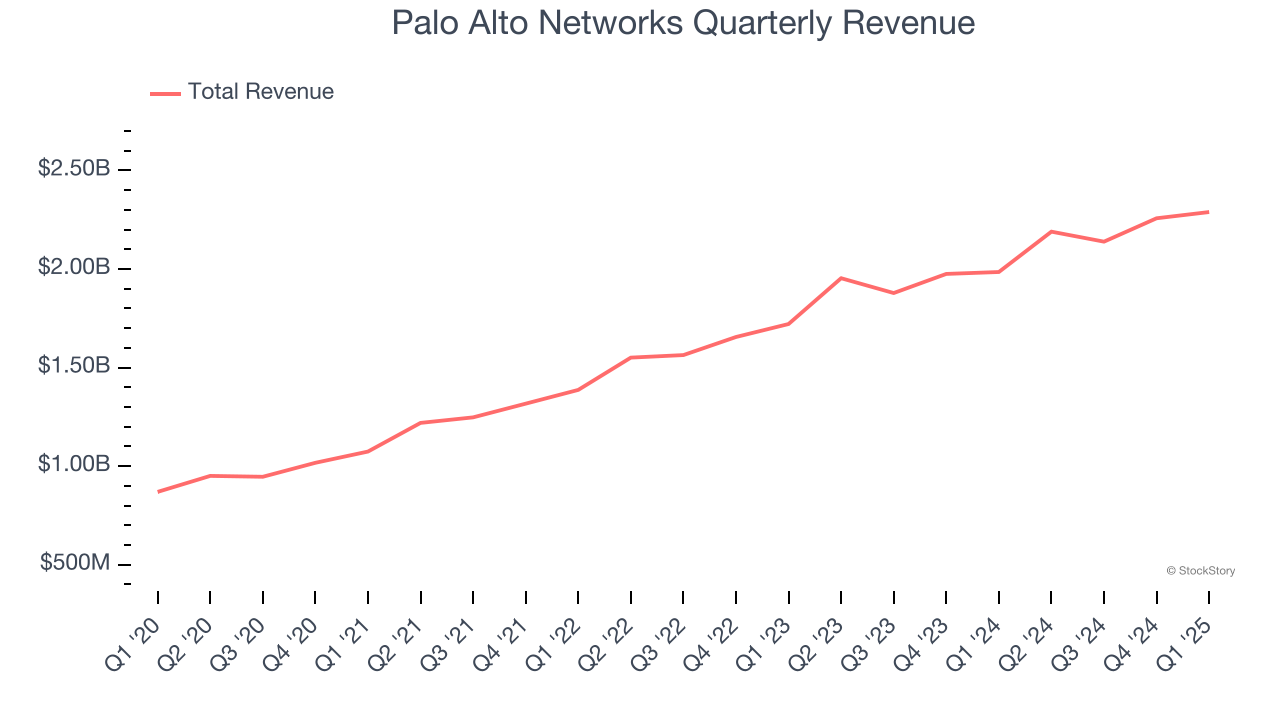

"In Q3, we continued to make progress on our platformization strategy and achieved an important milestone in crossing $5 billion in Next-Gen Security ARR," said Nikesh Arora, chairman and CEO of Palo Alto Networks. Company OverviewFounded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ: PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats. Sales GrowthReviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Palo Alto Networks grew its sales at a 19.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.  This quarter, Palo Alto Networks reported year-on-year revenue growth of 15.3%, and its $2.29 billion of revenue exceeded Wall Street’s estimates by 0.5%. Company management is currently guiding for a 14.2% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect revenue to grow 14.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is healthy and indicates the market is forecasting success for its products and services. Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next. Customer Acquisition EfficiencyThe customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments. Palo Alto Networks is extremely efficient at acquiring new customers, and its CAC payback period checked in at 19.6 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments. Key Takeaways from Palo Alto Networks’s Q1 ResultsIt was good to see Palo Alto Networks raise its full-year EPS guidance. We were also glad its revenue, adjusted operating income, and EPS exceeded Wall Street’s estimates. Overall, this print had some key positives, but the market seemed to be hoping for more, and the stock traded down 3.3% to $188.25 immediately following the results. Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free. More NewsView More

DoorDash’s Recent Stock Dip Equals 60% Upside ↗

Today 12:15 EST

Via MarketBeat

Tickers

DASH

Wall Street Loves Williams-Sonoma Right Now—Here’s Why the Stock Could Soar in 2026 ↗

Today 10:22 EST

Via MarketBeat

Tickers

WSM

Meta Wins FTC Fight, Keeps Instagram Growth Machine Intact ↗

Today 10:17 EST

Via MarketBeat

Tickers

META

Via MarketBeat

Tickers

SBUX

MP Materials Stock Soared After Earnings—Here’s the Real Reason ↗

November 22, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|