PlayStudios (NASDAQ:MYPS) Misses Q1 Revenue Estimates, Stock Drops

By:

StockStory

May 05, 2025 at 16:56 PM EDT

Digital casino game platform PlayStudios (NASDAQ: MYPS) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 19.4% year on year to $62.71 million. On the other hand, the company’s full-year revenue guidance of $260 million at the midpoint came in 1% above analysts’ estimates. Its GAAP loss of $0.02 per share was in line with analysts’ consensus estimates. Is now the time to buy PlayStudios? Find out by accessing our full research report, it’s free. PlayStudios (MYPS) Q1 CY2025 Highlights:

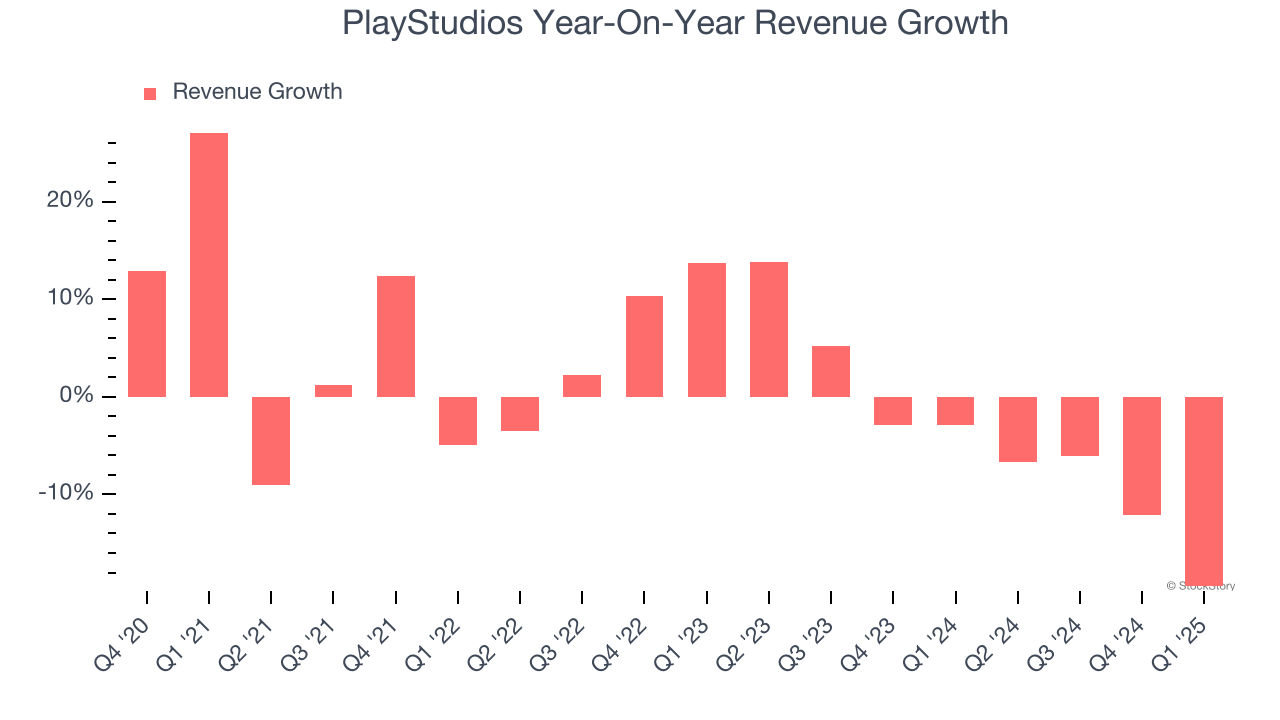

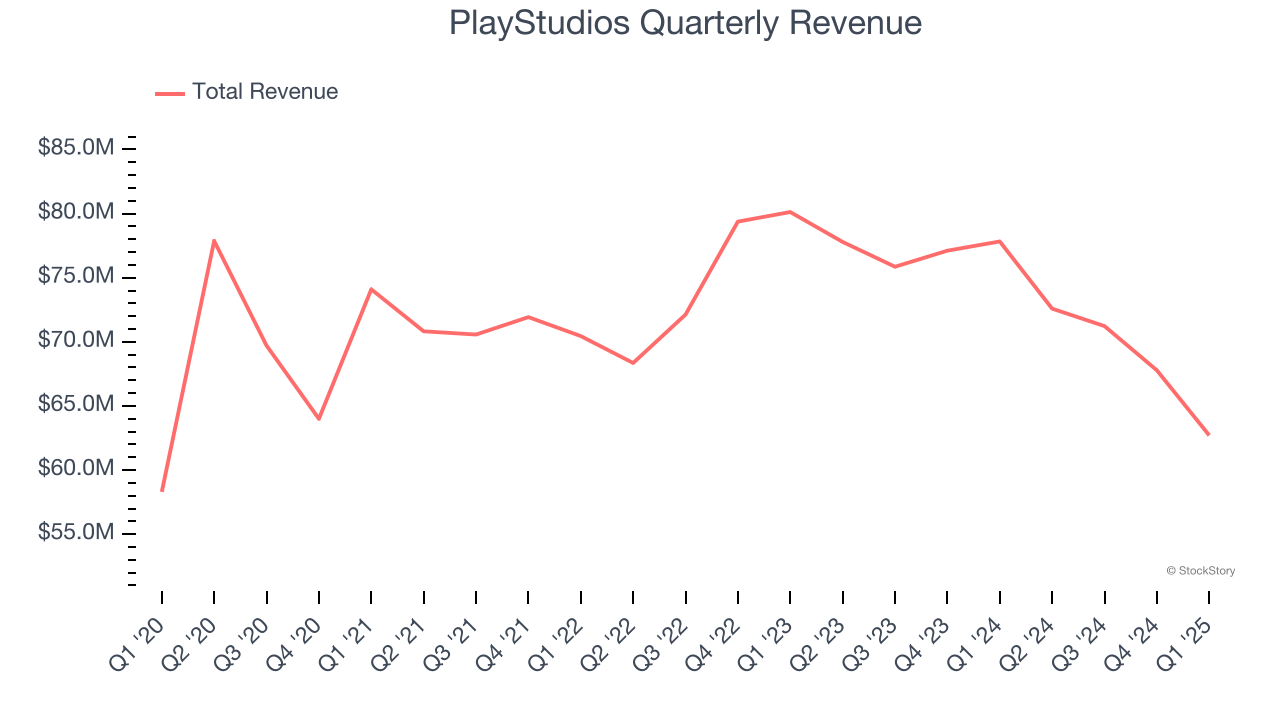

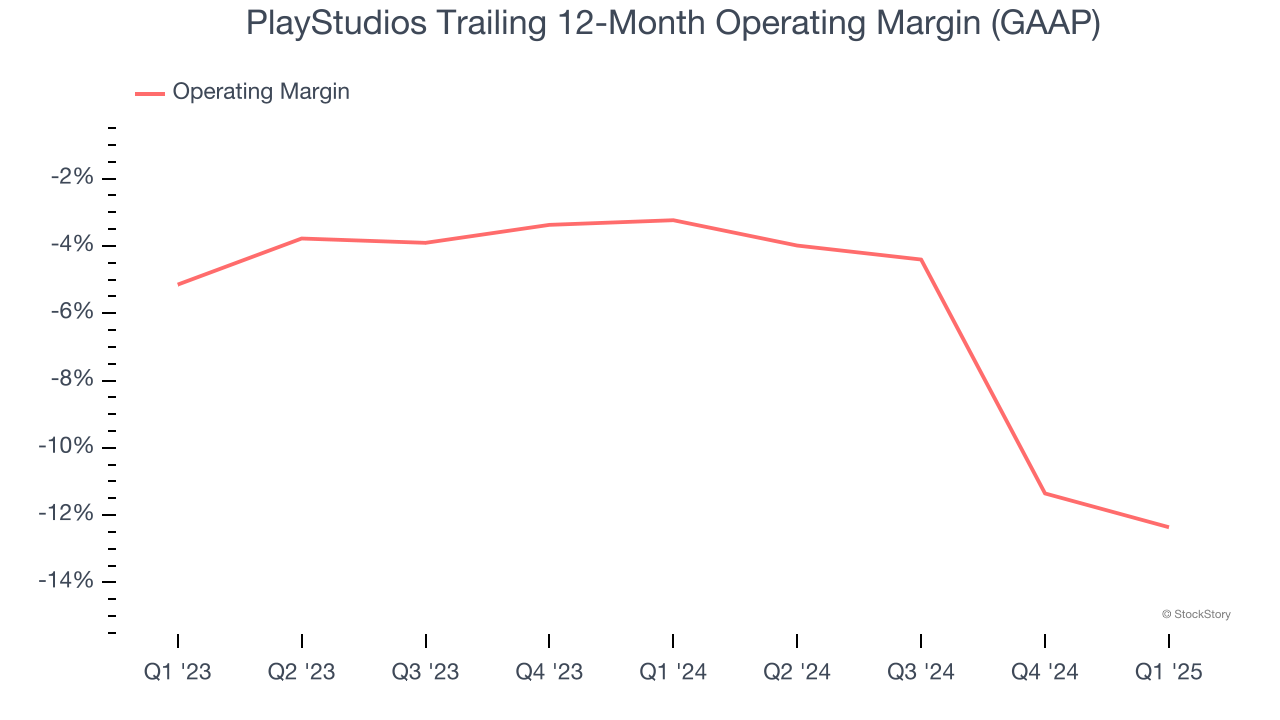

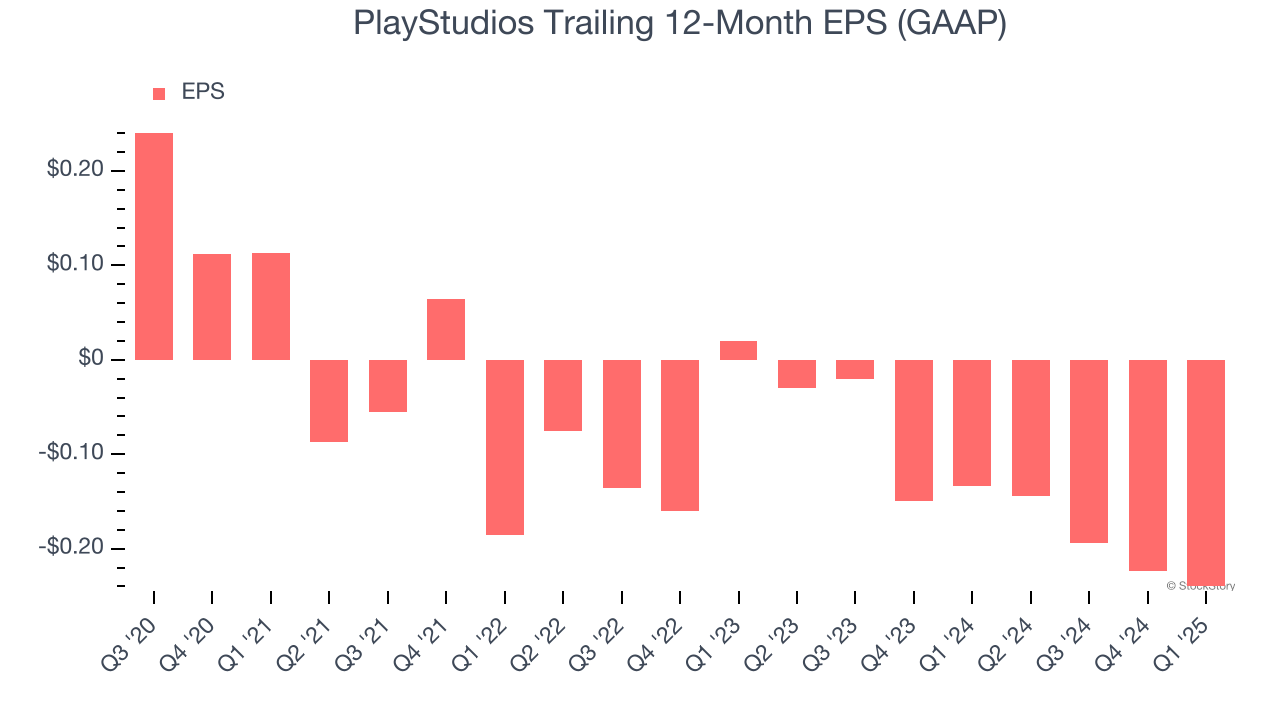

Company OverviewFounded by a team of former gaming industry executives, PlayStudios (NASDAQ: MYPS) offers free-to-play digital casino games. Sales GrowthA company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, PlayStudios grew its sales at a weak 2.6% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.  We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. PlayStudios’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually. This quarter, PlayStudios missed Wall Street’s estimates and reported a rather uninspiring 19.4% year-on-year revenue decline, generating $62.71 million of revenue. Looking ahead, sell-side analysts expect revenue to decline by 2.5% over the next 12 months. While this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties. Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link. Operating MarginPlayStudios’s operating margin has shrunk over the last 12 months and averaged negative 7.5% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.  PlayStudios’s operating margin was negative 4.4% this quarter. The company's consistent lack of profits raise a flag. Earnings Per ShareWe track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable. Sadly for PlayStudios, its EPS declined by 39.3% annually over the last five years while its revenue grew by 2.6%. This tells us the company became less profitable on a per-share basis as it expanded.  In Q1, PlayStudios reported EPS at negative $0.02, down from negative $0 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast PlayStudios’s full-year EPS of negative $0.24 will reach break even. Key Takeaways from PlayStudios’s Q1 ResultsWe enjoyed seeing PlayStudios beat analysts’ EBITDA expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its revenue and EPS fell short. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The market seemed to be hoping for more, and the stock traded down 4.3% to $1.32 immediately after reporting. Is PlayStudios an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free. More NewsView More

Rubrik’s Massive Rebound: Why the Next Leg Higher Could Be Fast ↗

December 07, 2025

Five Below and Dollar Tree Earnings Signal a Shopper Shift ↗

December 07, 2025

Via MarketBeat

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|