Viatris (NASDAQ:VTRS) Reports Sales Below Analyst Estimates In Q1 Earnings, But Stock Soars 8%

By:

StockStory

May 08, 2025 at 09:54 AM EDT

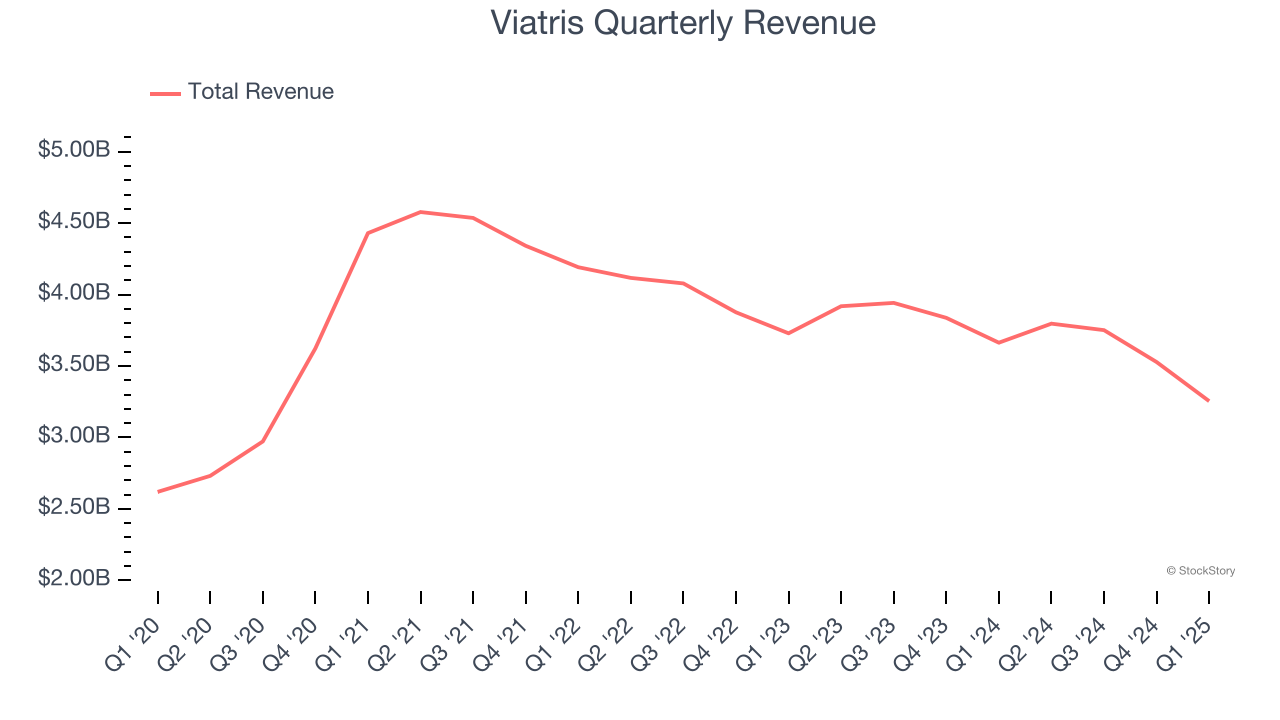

Medication company Viatris (NASDAQ: VTRS) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 11.2% year on year to $3.25 billion. The company’s full-year revenue guidance of $13.75 billion at the midpoint came in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.50 per share was in line with analysts’ consensus estimates. Is now the time to buy Viatris? Find out by accessing our full research report, it’s free. Viatris (VTRS) Q1 CY2025 Highlights:

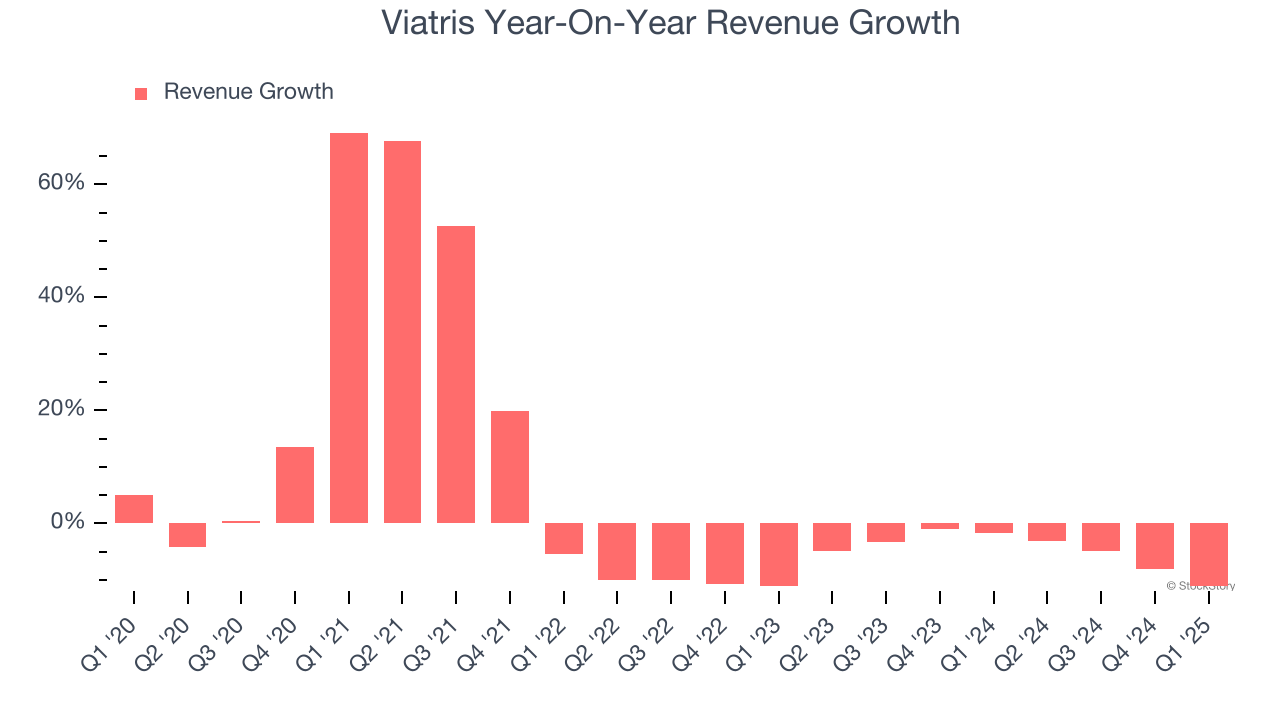

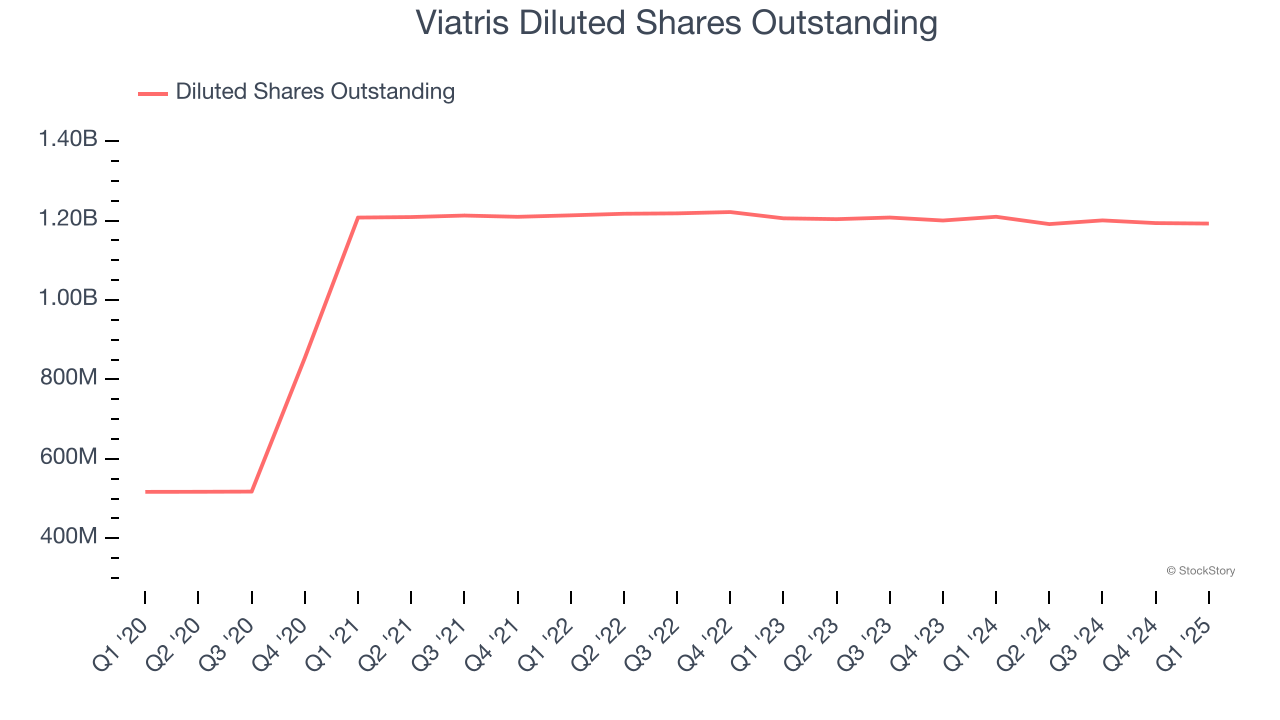

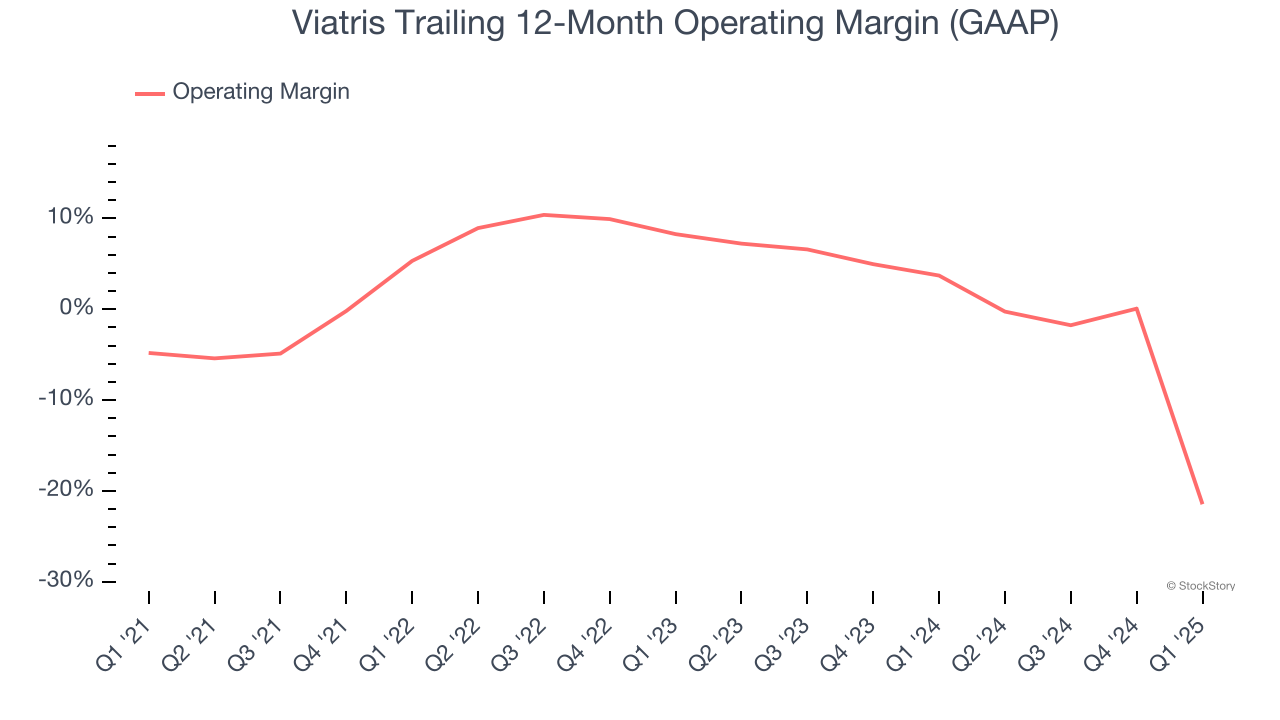

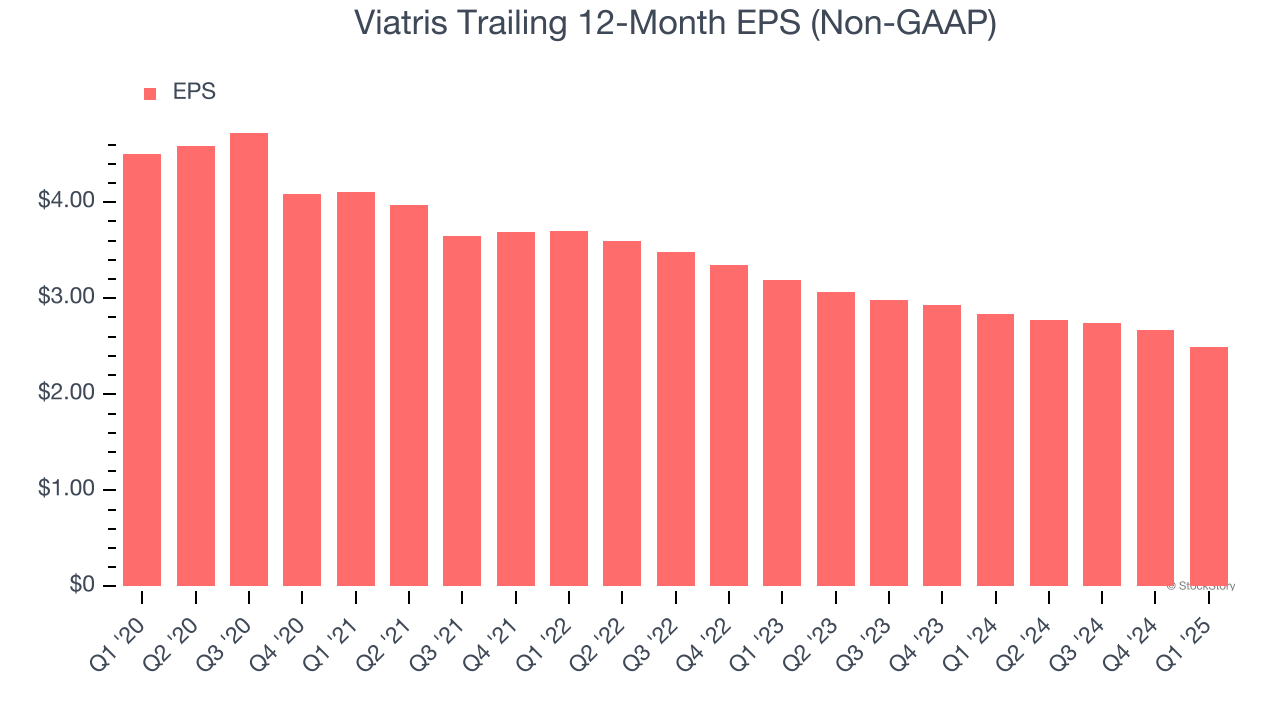

Company OverviewCreated through the 2020 merger of Mylan and Pfizer's Upjohn division, Viatris (NASDAQ: VTRS) is a healthcare company that develops, manufactures, and distributes branded and generic medicines across more than 165 countries worldwide. Sales GrowthA company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Viatris grew its sales at a mediocre 4.3% compounded annual growth rate. This was below our standard for the healthcare sector and is a tough starting point for our analysis.  We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Viatris’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.8% annually. This quarter, Viatris missed Wall Street’s estimates and reported a rather uninspiring 11.2% year-on-year revenue decline, generating $3.25 billion of revenue. Looking ahead, sell-side analysts expect revenue to decline by 3.4% over the next 12 months, similar to its two-year rate. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand. Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories. Operating MarginViatris’s high expenses have contributed to an average operating margin of negative 1.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle. Looking at the trend in its profitability, Viatris’s operating margin decreased by 16.7 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 29.7 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.  This quarter, Viatris generated a negative 88.6% operating margin. The company's consistent lack of profits raise a flag. Earnings Per ShareWe track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable. Sadly for Viatris, its EPS declined by 11.2% annually over the last five years while its revenue grew by 4.3%. This tells us the company became less profitable on a per-share basis as it expanded.  Diving into the nuances of Viatris’s earnings can give us a better understanding of its performance. As we mentioned earlier, Viatris’s operating margin declined by 16.7 percentage points over the last five years. Its share count also grew by 131%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders. In Q1, Viatris reported EPS at $0.50, down from $0.67 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.6%. Over the next 12 months, Wall Street expects Viatris’s full-year EPS of $2.49 to shrink by 7.9%. Key Takeaways from Viatris’s Q1 ResultsIt was good to see Viatris raise its full-year EPS guidance. On the other hand, its revenue and full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better, but the stock traded up 8.4% to $9.32 immediately following the results due to the profit outlook. So do we think Viatris is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free. More NewsView More

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

Today 8:57 EST

Via MarketBeat

Tickers

ULTA

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

Today 7:00 EST

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

December 05, 2025

Via MarketBeat

Tickers

RKLB

Meta’s AI Moment? New SAM 3 Model Has Wall Street Turning Bullish ↗

December 05, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|