2 Reasons to Watch PL and 1 to Stay Cautious

By:

StockStory

July 08, 2025 at 00:01 AM EDT

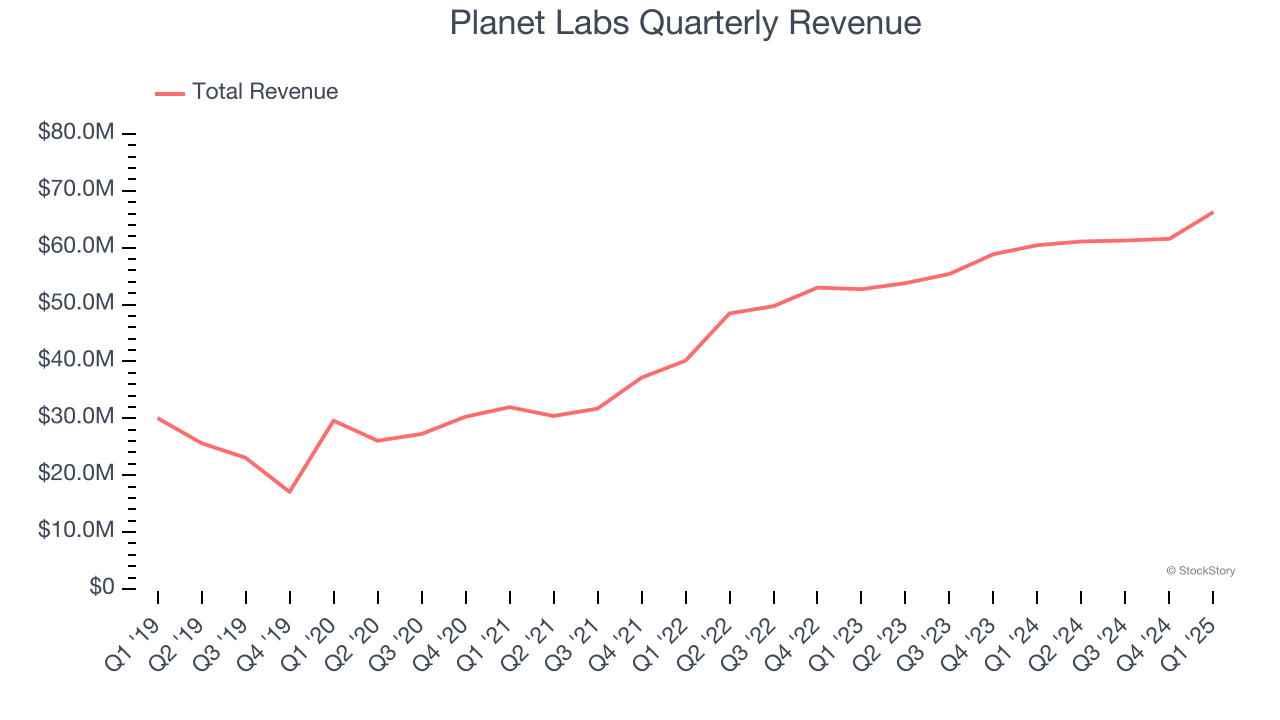

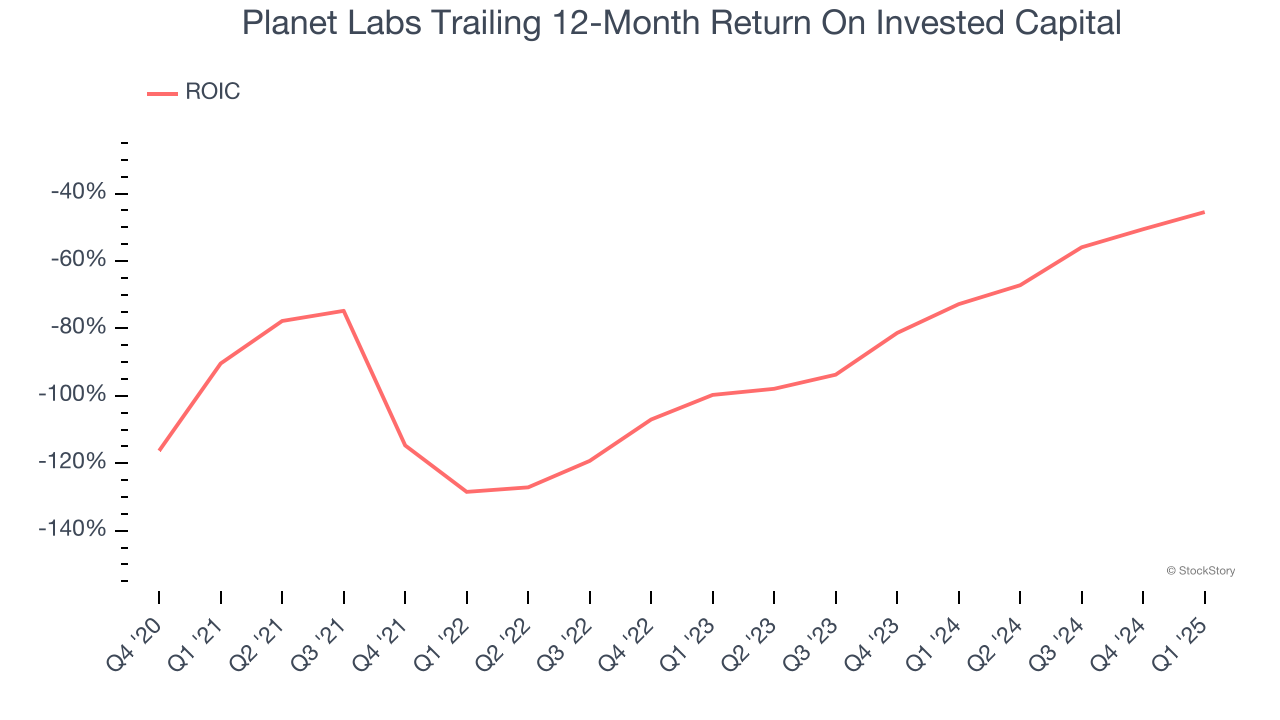

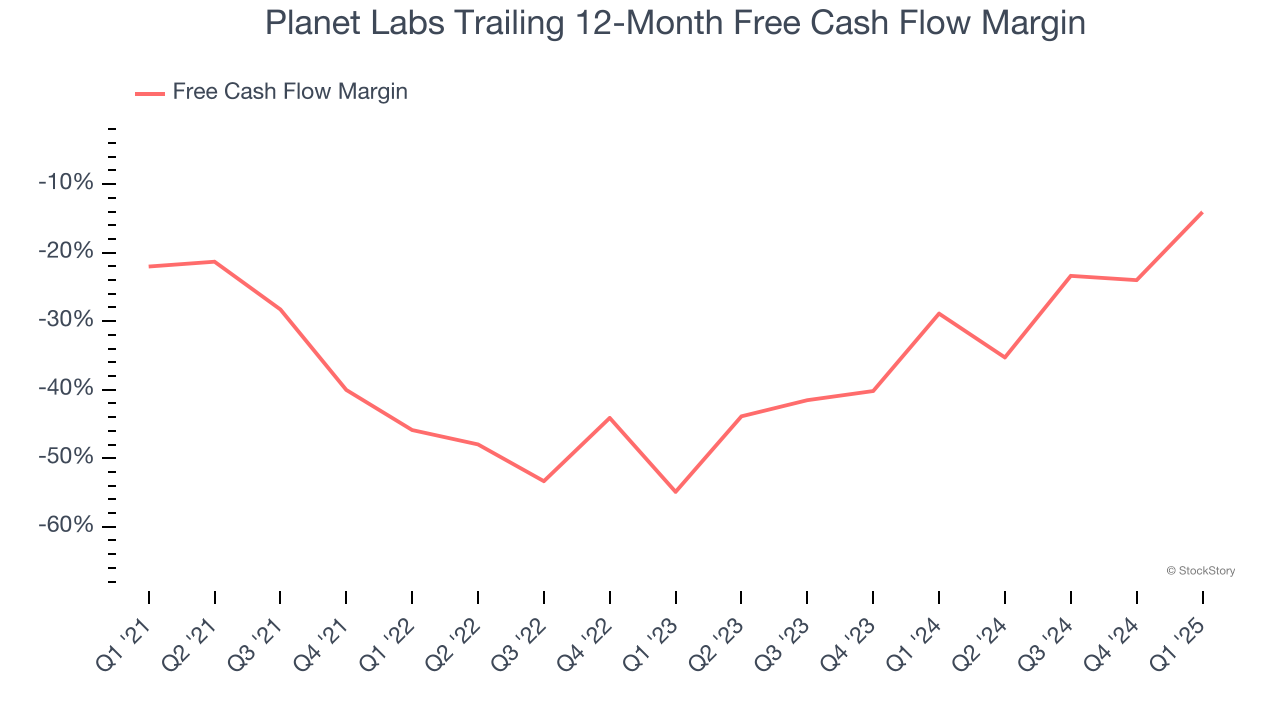

What a fantastic six months it’s been for Planet Labs. Shares of the company have skyrocketed 76%, hitting $6.83. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation. Is now still a good time to buy PL? Or are investors being too optimistic? Find out in our full research report, it’s free. Why Does Planet Labs Spark Debate?Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE: PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change. Two Positive Attributes:1. Skyrocketing Revenue Shows Strong MomentumA company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Planet Labs grew its sales at an incredible 21.3% compounded annual growth rate. Its growth beat the average business services company and shows its offerings resonate with customers. 2. New Investments Bear Fruit as ROIC JumpsROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity). We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Planet Labs’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.  One Reason to be Careful:Cash Burn Ignites ConcernsFree cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king. While Planet Labs posted positive free cash flow this quarter, the broader story hasn’t been so clean. Planet Labs’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 32.3%, meaning it lit $32.27 of cash on fire for every $100 in revenue.  Final JudgmentPlanet Labs has huge potential even though it has some open questions, and with the recent surge, the stock trades at $6.83 per share (or a forward price-to-sales ratio of 7.2×). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free. High-Quality Stocks for All Market ConditionsDonald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs. While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today. More NewsView More

Strong Quarter, Weak Reaction: Why GitLab Shares Dropped ↗

Today 16:27 EST

Via MarketBeat

3 Signs Tesla Is Starting December on the Front Foot ↗

Today 15:16 EST

Via MarketBeat

Tickers

TSLA

Via MarketBeat

Boeing's Bullish Breakout: Is This Rally Cleared for Takeoff? ↗

Today 14:29 EST

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|