2 Reasons to Like WDFC (and 1 Not So Much)

By:

StockStory

August 26, 2025 at 00:02 AM EDT

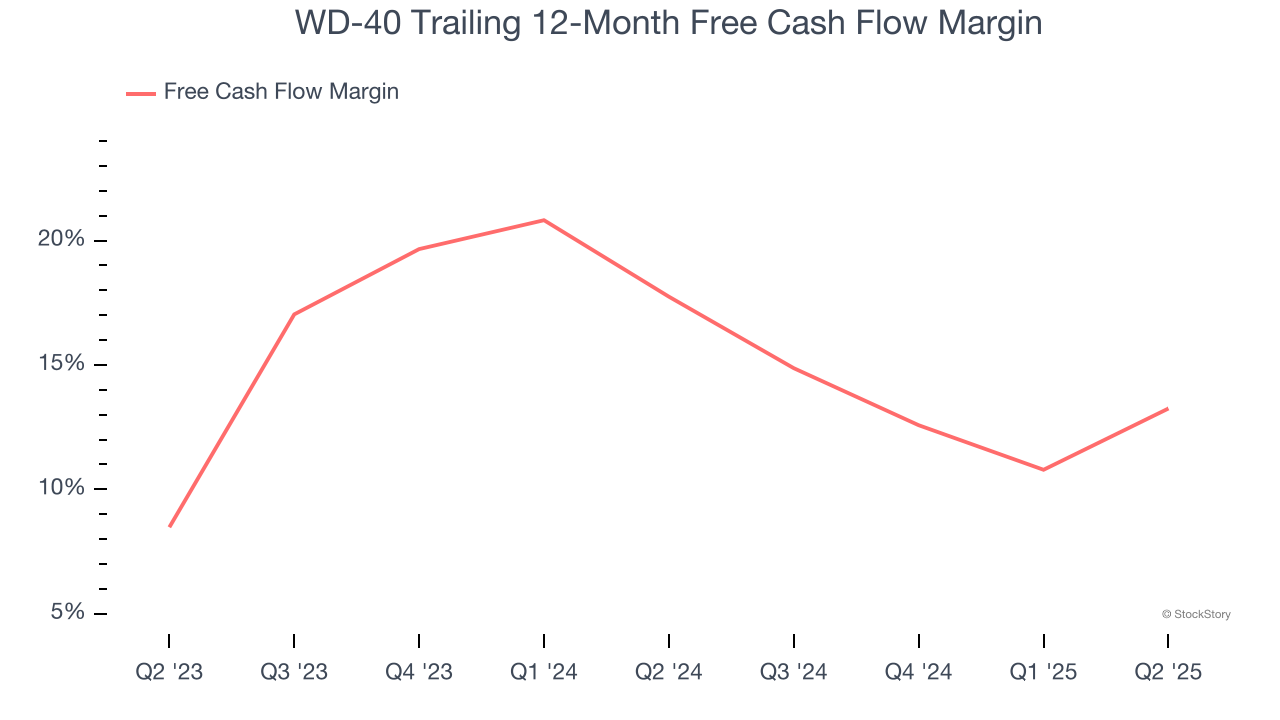

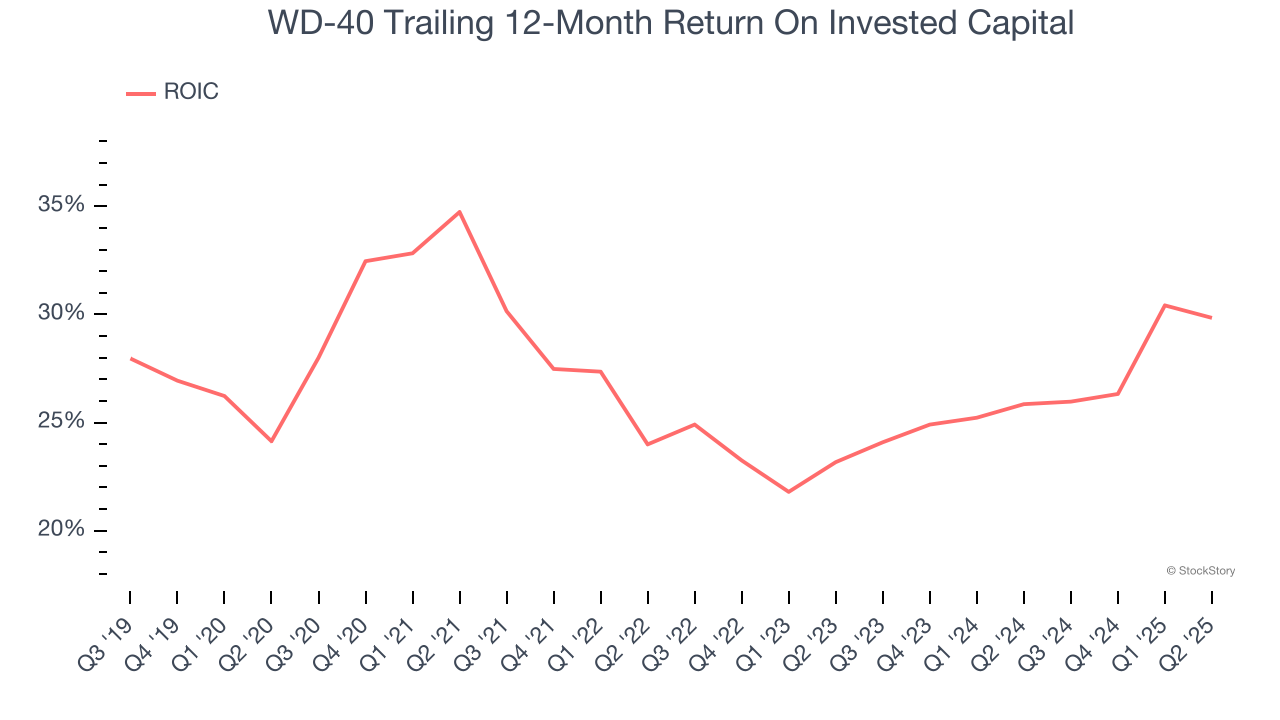

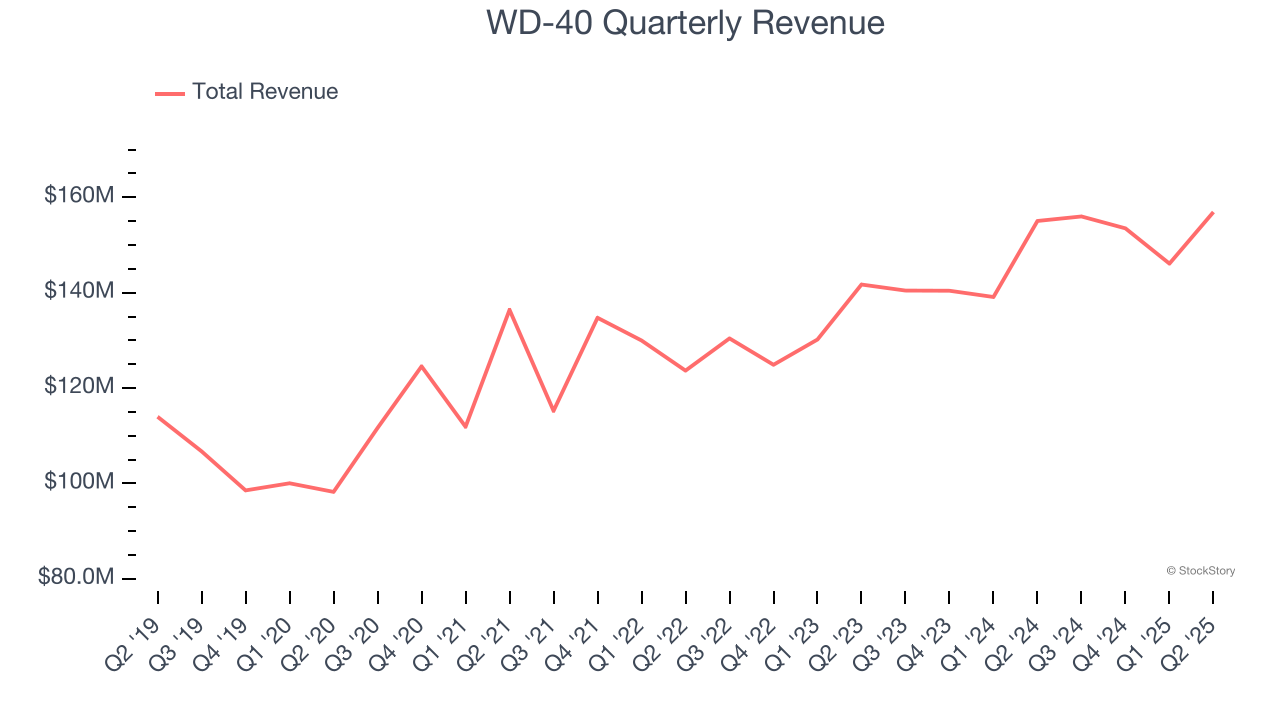

Over the last six months, WD-40’s shares have sunk to $219.12, producing a disappointing 8.1% loss - a stark contrast to the S&P 500’s 8.1% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation. Following the drawdown, is now a good time to buy WDFC? Find out in our full research report, it’s free. Why Does WD-40 Spark Debate?Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ: WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product. Two Things to Like:1. Excellent Free Cash Flow Margin Boosts Reinvestment PotentialFree cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king. WD-40 has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 15.4% over the last two years.  2. Stellar ROIC Showcases Lucrative Growth OpportunitiesGrowth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity). WD-40’s five-year average ROIC was 27.5%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.  One Reason to be Careful:Long-Term Revenue Growth DisappointsA company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, WD-40’s 6.7% annualized revenue growth over the last three years was mediocre. This wasn’t a great result compared to the rest of the consumer staples sector, but there are still things to like about WD-40.  Final JudgmentWD-40’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 36.9× forward P/E (or $219.12 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free. Stocks We Like Even More Than WD-40Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines. Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Five Below and Dollar Tree Earnings Signal a Shopper Shift ↗

Today 7:15 EST

Via MarketBeat

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|