Applied Materials (AMAT): Buy, Sell, or Hold Post Q1 Earnings?

By:

StockStory

August 05, 2025 at 00:01 AM EDT

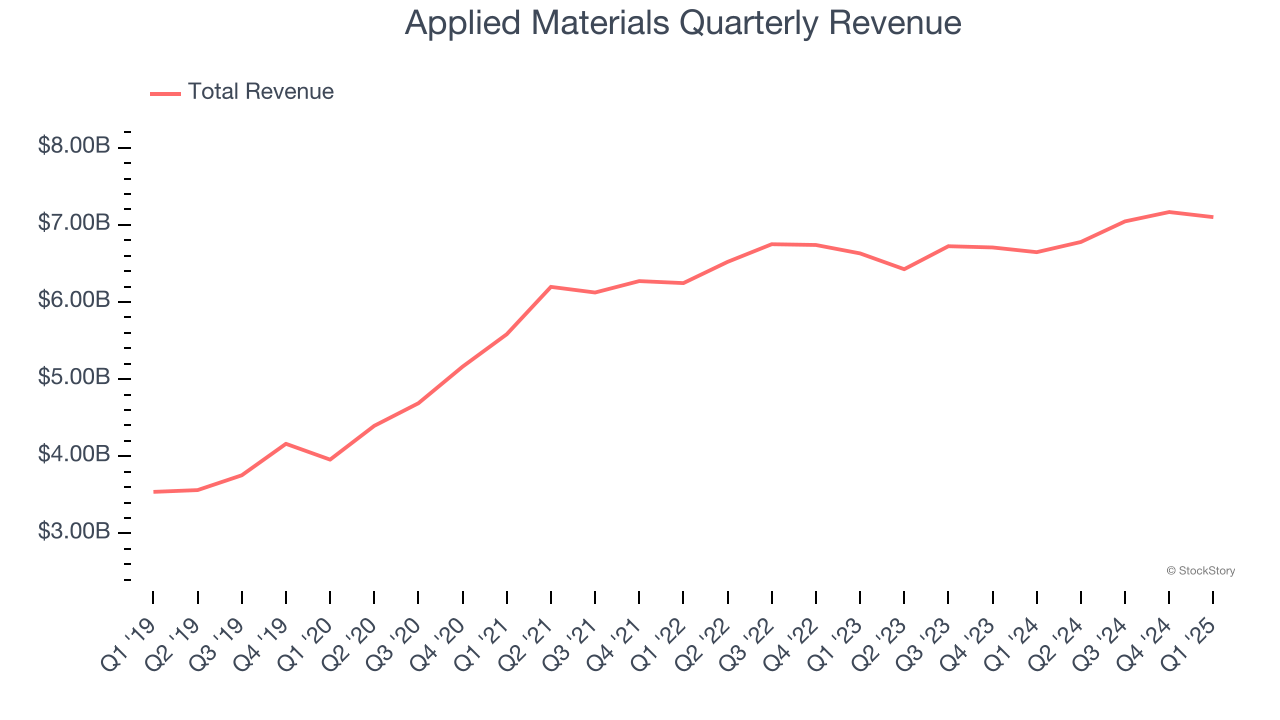

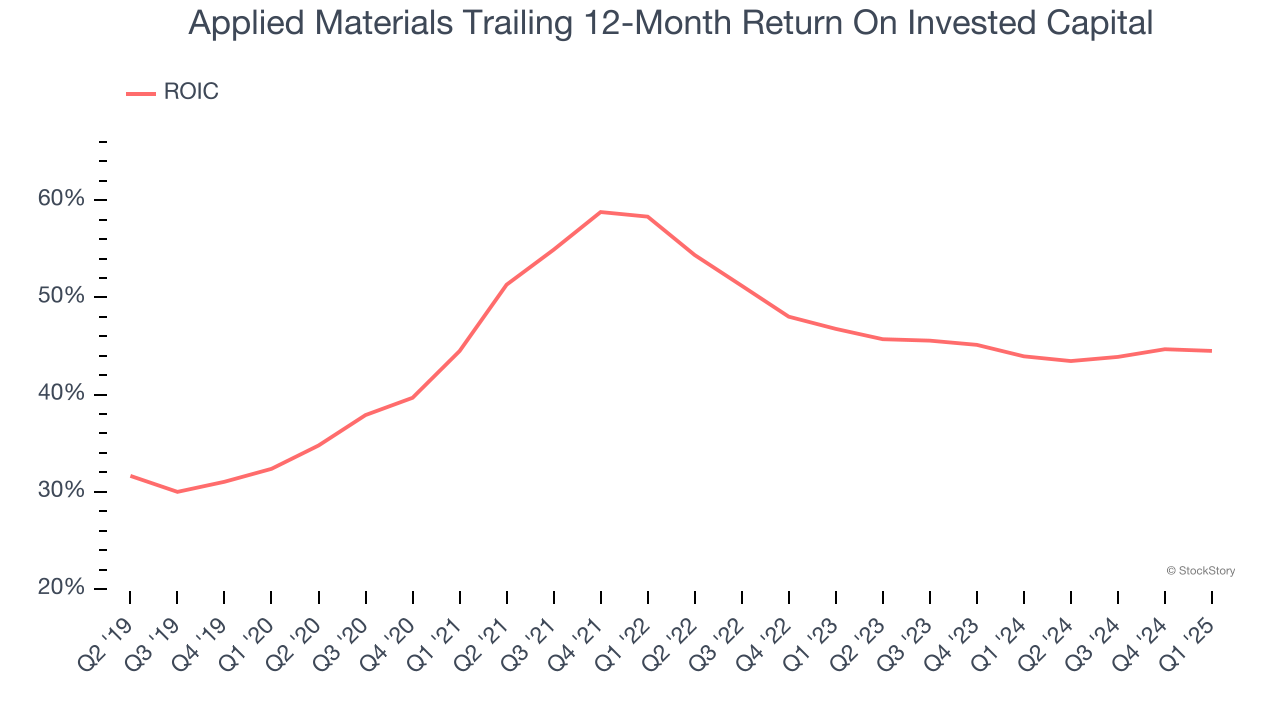

Applied Materials has been treading water for the past six months, recording a small return of 1.2% while holding steady at $182.90. Is now the time to buy AMAT? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free. Why Does Applied Materials Spark Debate?Founded in 1967 as the first company to develop tools for other businesses in the semiconductor industry, Applied Materials (NASDAQ: AMAT) is the largest provider of semiconductor wafer fabrication equipment. Two Things to Like:1. Skyrocketing Revenue Shows Strong MomentumA company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Applied Materials’s 12.7% annualized revenue growth over the last five years was impressive. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions. 2. Stellar ROIC Showcases Lucrative Growth OpportunitiesGrowth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity). Applied Materials’s five-year average ROIC was 47.6%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.  One Reason to be Careful:Projected Revenue Growth Is SlimForecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite. Over the next 12 months, sell-side analysts expect Applied Materials’s revenue to rise by 5%. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average. At least the company is tracking well in other measures of financial health. Final JudgmentApplied Materials’s merits more than compensate for its flaws, but at $182.90 per share (or 19.4× forward P/E), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free. High-Quality Stocks for All Market ConditionsWhen Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses. Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Via MarketBeat

Via MarketBeat

Tickers

KRKNF

Via MarketBeat

Will Crypto Miners Pivot to AI? Latest on 3 Key Players ↗

Today 10:36 EST

Via MarketBeat

Tickers

CRM

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|