Dynatrace (NYSE:DT) Surprises With Q2 Sales, Stock Soars

By:

StockStory

August 06, 2025 at 06:59 AM EDT

Application performance monitoring software provider Dynatrace (NYSE: DT) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 19.6% year on year to $477.3 million. Guidance for next quarter’s revenue was better than expected at $486.5 million at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $0.42 per share was 11.6% above analysts’ consensus estimates. Is now the time to buy Dynatrace? Find out by accessing our full research report, it’s free. Dynatrace (DT) Q2 CY2025 Highlights:

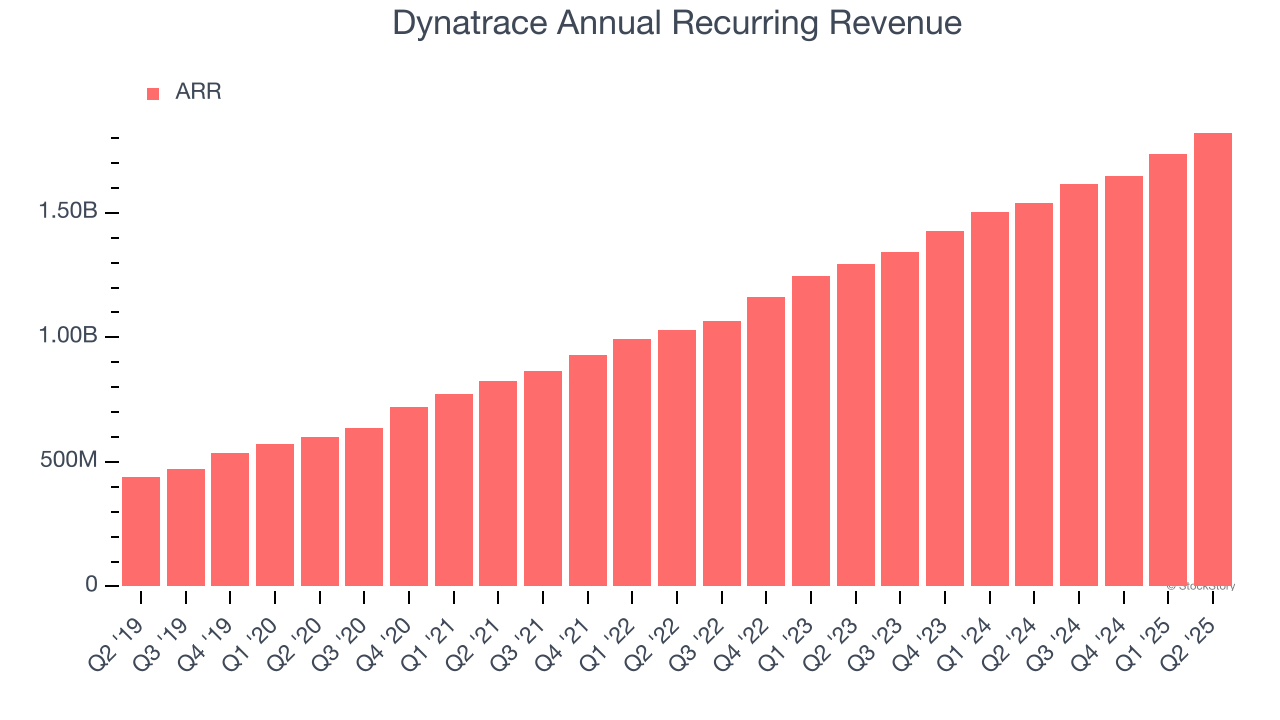

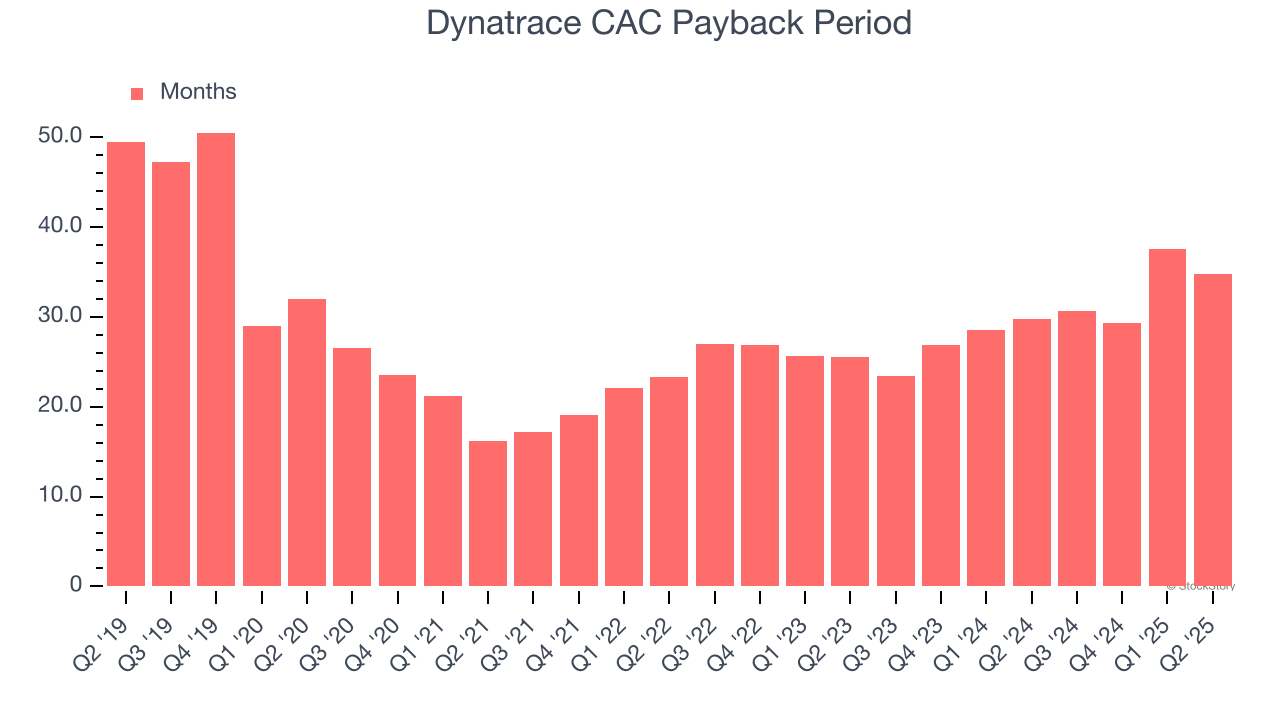

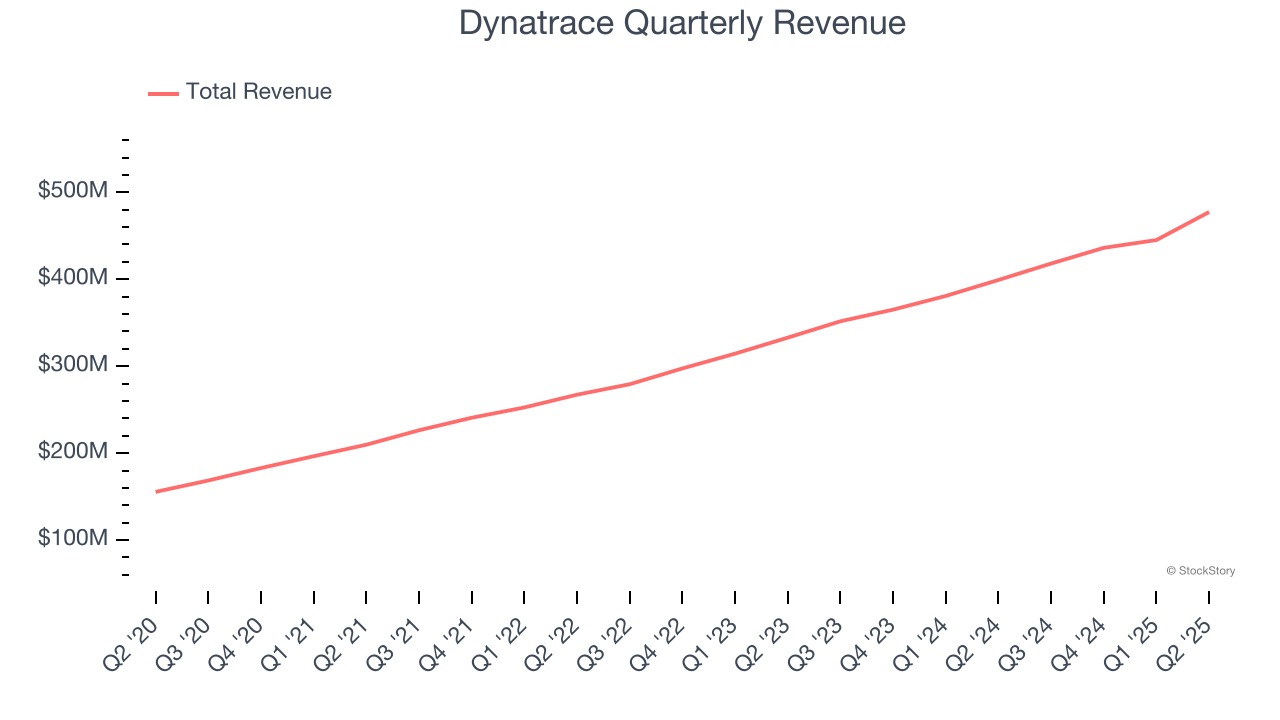

"We delivered a strong start to the fiscal year, exceeding guidance across all our metrics, driven by a large number of seven-figure expansion deals and accelerating log management deployment," said Rick McConnell, Chief Executive Officer of Dynatrace. Company OverviewFounded in Austria in 2005, Dynatrace (NYSE: DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on. Revenue GrowthA company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Dynatrace’s 21.6% annualized revenue growth over the last three years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.  This quarter, Dynatrace reported year-on-year revenue growth of 19.6%, and its $477.3 million of revenue exceeded Wall Street’s estimates by 2.1%. Company management is currently guiding for a 16.4% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and implies the market is baking in success for its products and services. Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories. Annual Recurring RevenueWhile reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable. Dynatrace’s ARR punched in at $1.82 billion in Q2, and over the last four quarters, its growth was solid as it averaged 17.4% year-on-year increases. This performance aligned with its total sales growth, reflecting the company’s ability to maintain strong customer relationships and secure longer-term commitments. Its growth also contributes positively to Dynatrace’s predictability and valuation, as investors typically prefer businesses with recurring revenue. Customer Acquisition EfficiencyThe customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability. Dynatrace is quite efficient at acquiring new customers, and its CAC payback period checked in at 34.8 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments. Key Takeaways from Dynatrace’s Q2 ResultsWe were impressed by how significantly Dynatrace blew past analysts’ billings expectations this quarter. We were also happy its annual recurring revenue outperformed Wall Street’s estimates. Full-year guidance was also lifted, usually a good sign of improving business momentum. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5% to $53.10 immediately after reporting. Dynatrace put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free. More NewsView More

3 Stocks Poised to Benefit From Google’s AI Breakthough ↗

December 03, 2025

Beyond NVIDIA: 5 Semiconductor Stocks Set to Dominate 2026 ↗

December 03, 2025

3 Stocks You’ll Wish You Bought Before 2026 ↗

December 03, 2025

Via MarketBeat

Wall Street Punished CrowdStrike for Beating Earnings? Seriously? ↗

December 03, 2025

Via MarketBeat

Tickers

CRWD

Okta: Excuses to Sell Vs. Reasons to Buy ↗

December 03, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|