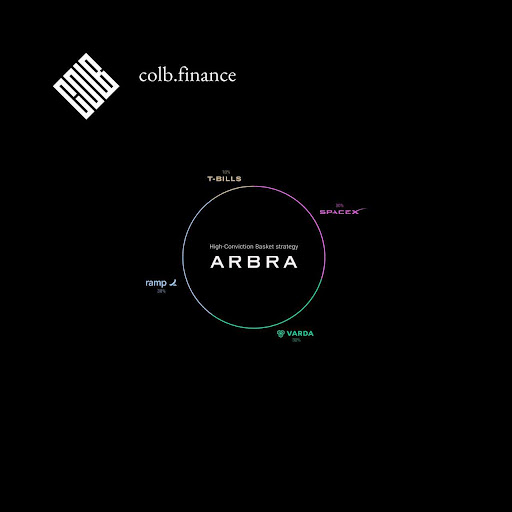

Arbra Unveils Tokenized Private Equity Basket with SpaceX, Ramp, and Varda on Colb

By:

Zexprwire

June 27, 2025 at 15:40 PM EDT

London, UK, 27th June 2025, Arbra Partners Group (“Arbra”), the global financial services company, has confirmed the introduction of its leading strategy, ‘High Conviction Basket’, via Colb Asset SA’s blockchain-agnostic web portal. The actively managed portfolio—which includes a cherry-picked collection of high-growth private technology companies like SpaceX, Ramp, Varda, and more—will be tokenized as an Actively Managed Certificate (AMC). This strategic partnership with Colb, a Swiss-based leader in real-world asset (RWA) tokenisation, is a significant step toward democratizing access to private market investment opportunities. Using blockchain technology, Arbra and Colb are allowing institutional-grade financial products to be securely and transparently accessed on-chain through Colb’s non-custodial web application. Philip Harris, Chief Executive of Arbra, commented: “We fully embrace the potential of digital innovation alongside our commitment to relationship-driven client service. This partnership with Colb enables investors to access our proven high-conviction strategies via tokenisation, unlocking new opportunities in the digital investment landscape.” Lucas Bitencourt, Founder of Arbra, added: “Arbra is not merely adapting to the future of finance—we are helping to shape it. Tokenisation is just one of the many ways in which we are helping our clients navigate and benefit from the shifting investment landscape.” Tokenising Private Markets for a Broader Audience. For Colb, the launch of this AMC represents a key milestone in the expansion of its tokenised investment offerings. Known for enabling traditional asset exposure through blockchain-based infrastructure, Colb is now opening up access to premium private market investments traditionally reserved for institutional clients. Yulgan Lira, CEO of Colb Asset SA, said: “At Colb, we are redefining access to financial markets through the power of blockchain. Partnering with Arbra allows us to bring trusted, high-quality investment strategies—previously limited to family offices and private banks—into the hands of a broader investor base, entirely on-chain.” About Arbra Partners — Arbra is an international financial services group. In a market that’s increasingly complex and impersonal, we believe transparency, trust, and a pragmatic approach will always deliver better results for our clients. We deliver advice and strategies that are painstakingly tailored to safeguard and grow our clients’ wealth. Established in 2022, the group has offices in London, Geneva, and Lisbon and now has over $1.5 billion in assets under management and 26 employees. For more information, visit arbra.global. Founded in 2020 in Geneva, Colb Asset SA is redefining global investing through the tokenisation of real-world assets. Colb’s suite of compliant, secure, and high-efficiency solutions connects institutional investors with traditional premium assets, fully accessible on-chain. Products include the Colb Managed Token (CMT), Colb Tracker Token (CTT), and Colb Fund Token (CFT), offering institutional-grade strategies through a decentralised lens. For more information, visit colb.finance. Media Contact: Company Name: Arbra Partners Website: www.arbra.global Contact Person: Philip Harris [Chief Executive Officer] More NewsView More

5 Stocks to Buy Before Santa Claus Comes to Town ↗

Today 9:35 EST

History Says These are 3 Stocks to Buy for December ↗

Today 7:13 EST

Via MarketBeat

Warner Bros. Sale Rumors Heat Up: What Investors Need to Know ↗

November 25, 2025

Via MarketBeat

From Science Project to Solvent: WeRide’s 761% Revenue Surge ↗

November 25, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|