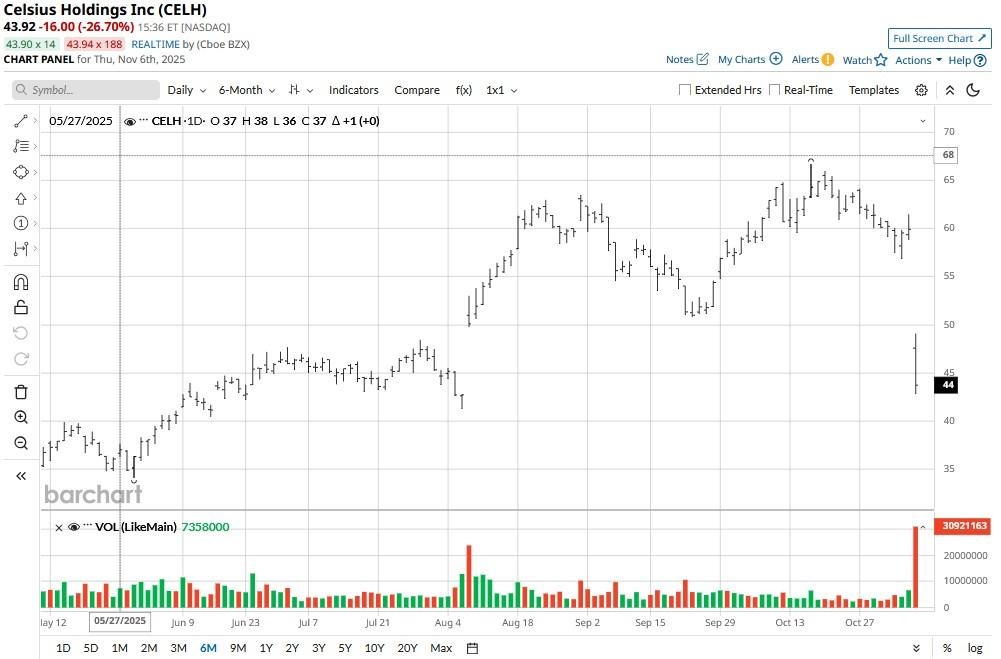

Celsius (CELH) shares crashed on Nov. 6 after the energy drink specialist reported market-beating financials for its third quarter.

Investors responded primarily to a $247 million one-time charge from its transition into PepsiCo’s (PEP) distribution infrastructure.

Beneath strong headline numbers, there were major red flags in the company’s financial release that warrant caution in buying Celsius stock on the post-earnings dip, even though it’s now down over 30% versus its October high.

Why Celsius Stock Isn’t Worth Buying on the Dip

Investors are recommended against buying CELH shares on the pullback as the company’s flagship CELSIUS brand decelerated and lost market share in its fiscal Q3.

In the recently concluded quarter, retail sales went up 13%, indicating weak growth by historical standards.

Meanwhile, the brand lost 50 basis points of U.S. market share as well due to competitive pressure and possible saturation.

In fact, the Florida-based company attributed much of its third-quarter strength to recently acquired brands like Alani Nu (up 114% year-on-year), raising concerns about sustainability of its organic growth.

Put together, these underlying weaknesses suggest Celsius shares could tumble further in 2026.

CELH Shares Are Expensive to Own Heading into 2026

Investors should also note that Celsius Holdings’ shift to PepsiCo’s distribution system comes with new financial complications.

For example, the Nasdaq-listed firm borrowed more money to make the transition, which has led to an increase in long-term debt.

Moreover, the company’s inventory – how much it has, where it’s stored, how fast it can move – is changing and unpredictable right now.

These adjustments may distort Celsius’ financials in the near term, making it much more difficult to analyze its actual operating performance.

Amid such risks, CELH stock sure looks super expensive at a forward price-earnings (P/E) ratio of more than 53x at the time of writing – especially given the best-of-breed AI stocks like Nvidia (NVDA) is trading under 50x currently.

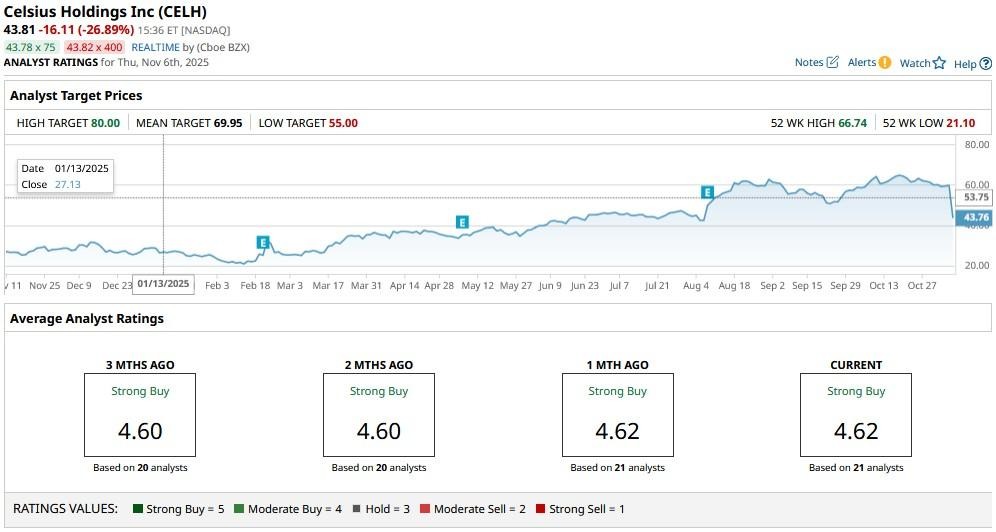

How Wall Street Recommends Playing Celsius Holdings

Despite the aforementioned concerns, Wall Street remains bullish on Celsius stock for 2026.

According to Barchart, the consensus rating on CELH shares remain at “Strong Buy” with the mean target of about $70 indicating potential of roughly 60% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here