With a market cap of $29.2 billion, First Solar, Inc. (FSLR) is a leading global provider of photovoltaic (PV) solar energy solutions. The company specializes in manufacturing cadmium telluride thin-film solar modules and offers project development, operations, and maintenance services to utilities, developers, and commercial customers worldwide.

Shares of the Tempe, Arizona-based company have exceeded the broader market over the past 52 weeks. FSLR stock has soared 34.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.4%. Moreover, shares of First Solar have climbed 50.1% on a YTD basis, compared to SPX's 14.3% increase.

Looking closer, the largest U.S. solar company stock has outpaced the Technology Select Sector SPDR Fund's (XLK) 20.7% return over the past 52 weeks.

Despite reporting weaker-than-expected Q3 2025 EPS of $4.24 and revenue of $1.59 billion on Oct. 30, First Solar shares surged 14.3% the next day as its net income rose about 33% to $455.9 million. The company also announced plans for a new 3.7 GW U.S. manufacturing facility that will boost domestic production and align with federal energy and AI priorities.

For the fiscal year ending in December 2025, analysts expect FSLR's EPS to grow 21.6% year-over-year to $14.62. The company's earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

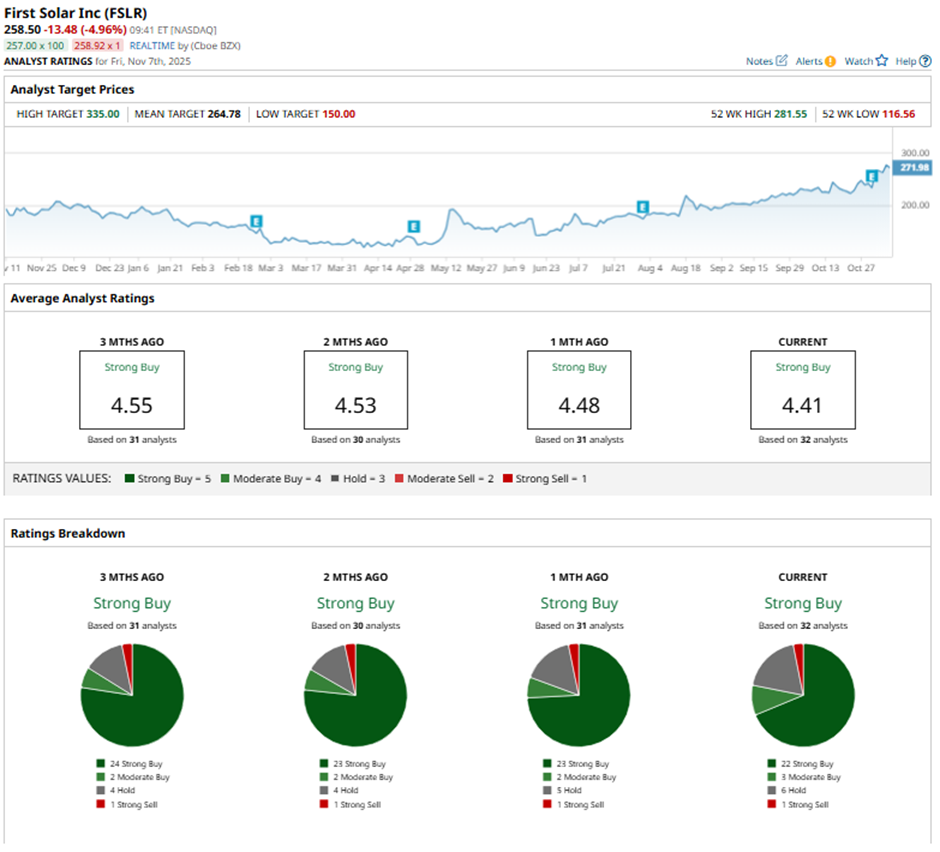

Among the 32 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 22 “Strong Buys,” three “Moderate Buy” ratings, six “Holds,” and one “Strong Sell.”

This configuration is less bullish than three months ago, with 24 “Strong Buy” ratings on the stock.

On Nov. 3, UBS analyst Jon Windham raised First Solar’s price target to $330 and maintained a “Buy” rating.

The mean price target of $264.78 represents a premium of 2.4% to FSLR's current price. The Street-high price target of $335 suggests a 29.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart