Cambridge, Massachusetts-based Biogen Inc. (BIIB) operates as a leading biotech firm, pioneering innovative science to deliver new medicines to transform patients’ lives and to create value for shareholders and communities. Valued at $26.6 billion by market cap, it has a deep understanding of human biology and leverages different modalities to advance first-in-class treatments or therapies that deliver superior outcomes.

Companies worth $10 billion or more are generally described as "large-cap stocks." Biogen fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the biotech industry.

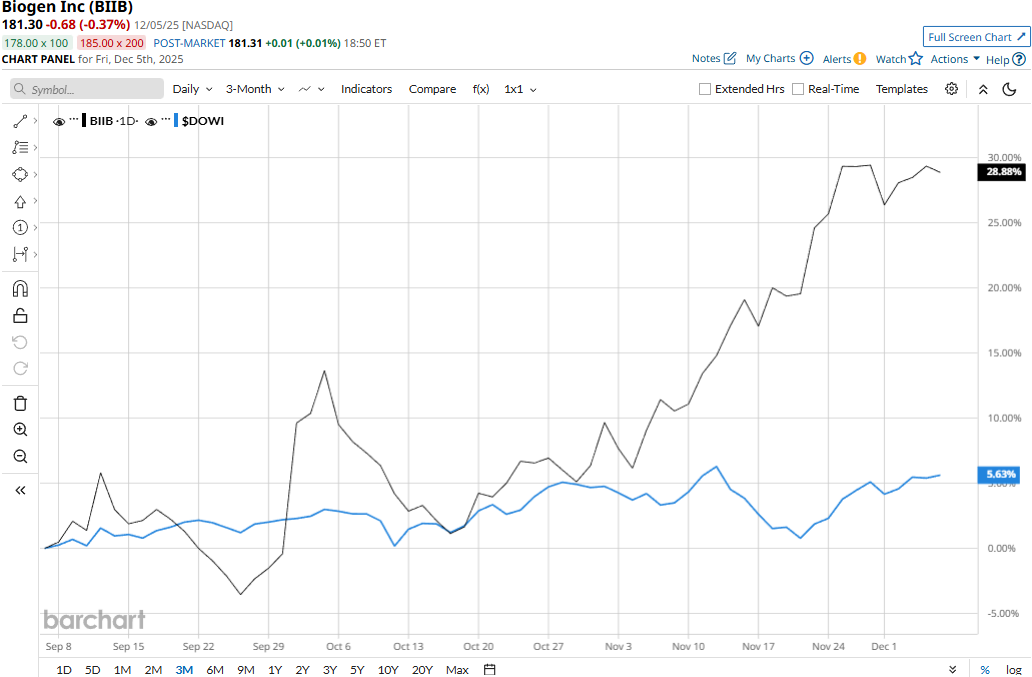

BIIB stock touched its 52-week high of $185.17 on Nov. 24 and is currently trading 2.1% below that peak. Meanwhile, the stock has soared 28.9% over the past three months, significantly outperforming the Dow Jones Industrial Average’s ($DOWI) 5.6% uptick during the same time frame.

Biogen has outperformed over the longer term as well. BIIB stock has gained 18.6% on a YTD basis and 13.8% over the past 52 weeks, compared to the Dow’s 12.7% gains in 2025 and 7.1% returns over the past year.

BIIB stock has traded mostly above its 50-day moving average since May and consistently above its 200-day moving average since early September, underscoring its bullish trend.

Biogen’s stock prices gained 1.2% in the trading session following the release of its better-than-expected Q3 results on Oct. 30. The company observed a solid 67% growth across its products launched for Alzheimer's disease, rare disease, and postpartum depression. Overall, its topline grew 2.8% year-over-year to $2.5 billion, beating the Street’s expectations by a notable 8.3%. Meanwhile, its adjusted EPS soared 17.9% year-over-year to $4.81, surpassing the consensus estimates by 23.7%.

Further, Biogen has notably outperformed its peer, Sarepta Therapeutics, Inc.’s (SRPT) 81.7% plunge in 2025 and an 82.4% decline over the past 52 weeks.

Among the 33 analysts covering the BIIB stock, the consensus rating is a “Moderate Buy.” As of writing, BIIB is trading slightly above its mean price target of $178.26.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart