Targeting Ore Reserves, PFS and ML application by the end of 2026

HIGHLIGHTS

-

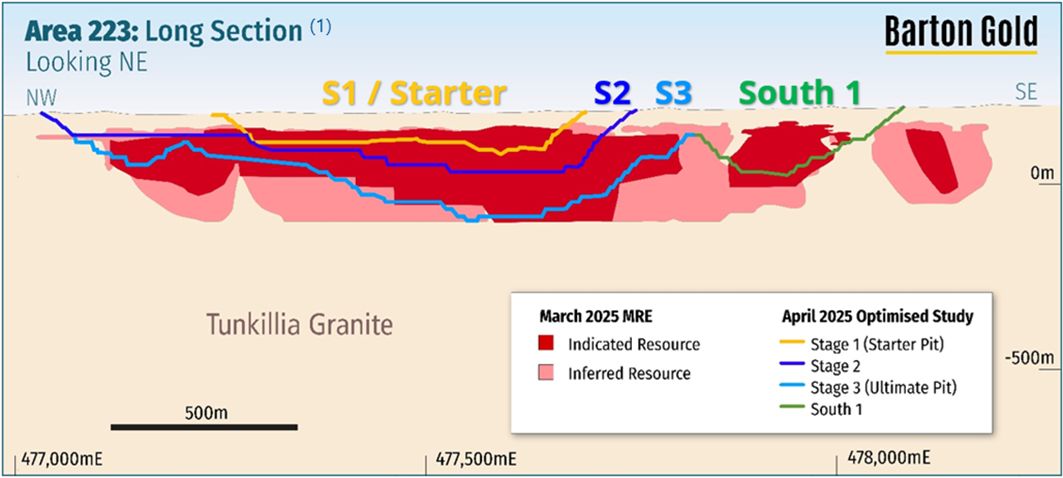

May 2025 Optimised Scoping Study (OSS) outlined a compelling Tunkillia development project:1

Annual production: ~120,000oz gold and ~250,000oz silver

Total LoM operating cash: ~A$2.7 billion (unlevered, pre-tax)

Net Present Value (NPV7.5%): ~A$1.4 billion (unlevered, pre-tax)

Internal Rate of Return (IRR): ~73.2% (unlevered, pre-tax); and

Payback period: ~0.8 years (unlevered, pre-tax)

Barton expediting Tunkillia toward Mining Lease (ML) application, with AUD gold and silver prices now over $1,500/oz and $50/oz higher (respectively) than used for OSS revenue estimates1

~900m water drilling has started, targeting potential new water sources near OSS open pits

~28,000m second phase reverse circulation (RC) Resource upgrade drilling to begin March 2026, with ~3,000m Resource, geotechnical & metallurgical diamond drilling (DD) to start in parallel

Targeting JORC (2012) Ore Reserves, pre-feasibility study (PFS) & ML application by end of 2026

ADELAIDE, AU / ACCESS Newswire / February 2, 2026 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) (Barton or Company) is pleased to announce the start of water bore drilling at its South Australian Tunkillia Gold Project (Tunkillia). Underdale Drillers has been engaged to complete a program totalling ~900m drilling for preliminary water testing. Success in locating additional sources of nearby water has the potential to both de-risk and improve project economics.

Barton is also pleased to confirm that Tunkillia's planned second phase JORC (2012) Mineral Resource upgrade drilling will start as planned during March 2026, with ~28,000m RC drilling targeting the conversion of the balance of Tunkillia's OSS modelled open pit mineralisation (beyond S1 / S2) to JORC (2012) 'Indicated' category.2

A ~3,000m diamond drilling (DD) program is planned to run in parallel with phase 2 RC drilling, targeting the infill and expansion of Tunkillia's geotechnical and metallurgical databases in support of further open pit design optimisation, detailed recovery and production modelling, and a PFS and ML application by the end of 2026.

Commenting on Tunkillia's 2026 development drilling programs, Barton MD Alexander Scanlon said:

"The Tunkillia OSS demonstrated the financial and capital leverage available to large-scale bulk processing operations, with the major advantage of a higher-grade 'Starter Pit' that can pay back development costs 2x over in the first year.

"With recent Resource upgrade drilling results further de-risking this profile, we are advancing our other development drilling programs in support of planned JORC Ore Reserves, a PFS, and a Mining Lease application by the end of 2026.

"Following the submission of our Mining Lease application, we will expedite Tunkillia's project finance discussions in parallel with our targeted reinstatement of 'Stage 1' operations at our neighbouring Challenger Gold Project. Our objective is to bring Tunkillia online as soon as possible to realise our gold production target of 150,000oz annually."

Program background

Tunkillia's May 2025 OSS outlined a compelling development profile, with its S1 and S2 pits modelled to produce 365,000oz gold, 923,000oz silver and $1.3bn operating free cash during the first ~27 months alone at an average cash cost of only A$1,429/oz Au.1 These pit could therefore pay back development 3x over in this time. 2026 development drilling programs follow recent 'phase 1' RC upgrade drilling (key detailed results below).2

Hole ID |

Interval |

Including: |

TKB0257 |

23m @ 2.25 g/t Au from 62 metres |

2m @ 5.45 g/t Au from 69 metres, and 1m @ 7.50 g/t Au from 75 metres, and 1m @ 8.90 g/t Au from 81 metres |

TKB0268 |

22m @ 2.43 g/t Au from 100 metres |

1m @ 17.6 g/t Au from 107 metres |

TKB0269 |

28m @ 2.60 g/t Au from 129 metres |

2m @ 20.9 g/t Au from 144 metres |

TKB0282 |

27m @ 2.68 g/t Au from 60 metres, and 44m @ 3.68 g/t Au from 103 metres |

2m @ 38.7 g/t Au from 73 metres 3m @ 23.5 g/t Au from 123 metres, and 1m @ 18.9 g/t Au from 131 metres, and 2m @ 13.2 g/t Au from 136 metres |

TKB0285 |

47m @ 2.67 g/t Au from 97 metres |

16m @ 5.03 g/t Au from 126 metres |

TKB0292 |

41m @ 2.21 g/t Au from 47 metres |

7m @ 9.61 g/t Au from 47 metres |

TKB0301 |

10m @ 7.37 g/t Au from 65 metres |

1m @ 28.8 g/t Au from 67 metres |

TKB0306 |

10m @ 5.03 g/t Au from 152 metres, and 13m @ 3.75 g/t Au from 165 metres |

1m @ 43.2 g/t Au from 154 metres 1m @ 37.1 g/t Au from 165 metres |

TKB0375 |

10m @ 5.21 g/t Au from 45 metres |

3m @ 9.70 g/t Au from 49 metres |

TKB0376 |

17m @ 2.23 g/t Au from 53 metres |

3m @ 8.97 g/t Au from 58 metres |

TKB0390 |

20m @ 2.72 g/t Au from 44 metres |

3m @ 9.33 g/t Au from 50 metres |

TKB0422 |

24m @ 4.49 g/t Au from 127 metres, and 22m @ 3.17 g/t Au from 156 metres |

1m @ 15.4 g/t Au from 137 metres, and 5m @ 11.5 g/t Au from 143 metres 8m @ 6.89 g/t Au from 157 metres |

TKB0434 |

22m @ 2.58 g/t Au from 68 metres |

1m @ 6.3 g/t Au from 73 metres, and 3m @ 9.2 g/t Au from 75 metres |

Table 1 - Key significant assays from Tunkillia Phase 1 Mineral Resource upgrade RC drilling4

Further details of Tunkillia's planned phase 2 RC upgrade drilling and DD drilling will be published in due course.

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon |

Jade Cook |

1 Refer to ASX announcement dated 5 May 2025

2 Refer to ASX announcements dated 2 / 16 December 2025 and 21 January 2026

3 Refer to ASX announcements dated 2 / 16 December 2025 and 21 January 2026

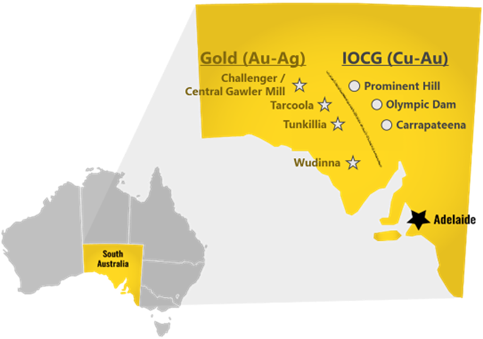

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and 100% ownership of the region's only gold mill in the renowned Gawler Craton of South Australia.*

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity |

Competent Person |

Membership |

Status |

Tarcoola Mineral Resource (Stockpiles) |

Dr Andrew Fowler (Consultant) |

AusIMM |

Member |

Tarcoola Mineral Resource (Perseverance Mine) |

Mr Ian Taylor (Consultant) |

AusIMM |

Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) |

Mr Colin Skidmore (Consultant) |

AIG |

Member |

Tarcoola Exploration Results (after 15 Nov 2021) |

Mr Marc Twining (Employee) |

AusIMM |

Member |

Tunkillia Exploration Results (until 15 Nov 2021) |

Mr Colin Skidmore (Consultant) |

AIG |

Member |

Tunkillia Exploration Results (after 15 Nov 2021) |

Mr Marc Twining (Employee) |

AusIMM |

Member |

Tunkillia Mineral Resource |

Mr Ian Taylor (Consultant) |

AusIMM |

Fellow |

Challenger Mineral Resource (above 215mRL) |

Mr Ian Taylor (Consultant) |

AusIMM |

Fellow |

Challenger Mineral Resource (below 90mRL) |

Mr Dale Sims |

AusIMM / AIG |

Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) |

Ms Justine Tracey |

AusIMM |

Member |

Wudinna Mineral Resource (all other Deposits) |

Mrs Christine Standing |

AusIMM / AIG |

Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. In accordance with ASX Listing Rule 5.19.2, the Company further confirms that the material assumptions underpinning any production targets and the forecast financial information derived therefrom continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire