Fiserv (FI) stock suffered its worst trading day ever on Wednesday, plunging 44% after the fintech giant slashed earnings guidance and overhauled its leadership team. The selloff forced Goldman Sachs to downgrade the stock and reduce its price target by 55% to $81. Valued at a market capitalization of $35.4 billion, FI stock is currently priced at $66 and is down 73% from its all-time high.

The payment technology company projected adjusted earnings for 2025 between $8.50 per share and $8.60 per share, below its previous midpoint guidance of $10.23 per share. It also estimated revenue to grow between 3.5% and 4% for the year, below an earlier forecast of 10%. In Q3 of 2025, Fiserv reported revenue of $4.92 billion and earnings per share of $2.04, below consensus estimates of $5.36 billion and $2.64, respectively.

CEO Mike Lyons attributed the shortfall partly to Argentina's deteriorating economy, which had contributed 10 percentage points to last year's 16% organic growth. The company had assumed other businesses would accelerate to compensate for this slowdown, which didn't materialize. Moreover, analysts were concerned about the potential reversal of aggressive pricing actions and the one-time revenue impacts that had not been previously disclosed.

Morgan Stanley analyst James Faucette emphasized that the company's 40-year streak of double-digit earnings growth has come to an end. MS downgraded Fiserv stock to “Equal-Weight” and cut the stock price target to $81 from $179. According to BTIG, the fair value of the fintech stock could range between $50 and $75 based on future earnings multiples.

Fiserv also announced leadership changes, including the naming of two co-presidents and a new finance chief, alongside three new board members, including an independent chairman, who will take their seats in early 2026.

What Impacted Fiserv Stock in Q3 of 2025?

Fiserv's earnings call revealed deeper structural issues beyond the headline numbers. For instance, CEO Mike Lyons acknowledged the company had been relying too heavily on short-term initiatives rather than building sustainable client relationships.

Management also explained that deferred investments and cost cuts designed to boost margins in the short term have hampered the ability to serve clients and execute product launches to acceptable standards. This self-inflicted damage suggests years of prioritizing quarterly results over long-term business health.

Fiserv’s digital payments revenue declined 5% year-over-year (YoY) in Q3 as the company took competitive actions, while growth of just 1% came despite healthy account growth. The banking business fell 7% due to lower license activity.

Management also expects margin compression to continue, with the first quarter of 2026 representing the trough at approximately 33% to 35% margins, compared to historical levels of around 40%.

Free cash flow expectations for 2025 dropped to approximately $4.25 billion, pressured by higher capital expenditures of $1.8 billion as the company scrambles to address structural headwinds.

Is FI Stock a “Buy the Dip” Opportunity?

Analysts tracking FI stock forecast revenue to increase from $19.1 billion in 2024 to $25.77 billion in 2029. In this period, adjusted earnings are projected to expand from $8.80 per share to $14.95 per share.

Wall Street estimates the company’s free cash flow to narrow from $5.23 billion in 2024 to $4.37 billion in 2025. However, FCF is then forecast to improve to $7.10 billion, indicating a margin of 27.5%. FI stock is priced at 9.33 times forward FCF, which is below its five-year average of 17.2 times. If it trades at 9x FCF, the fintech stock could gain 80% within the next four years.

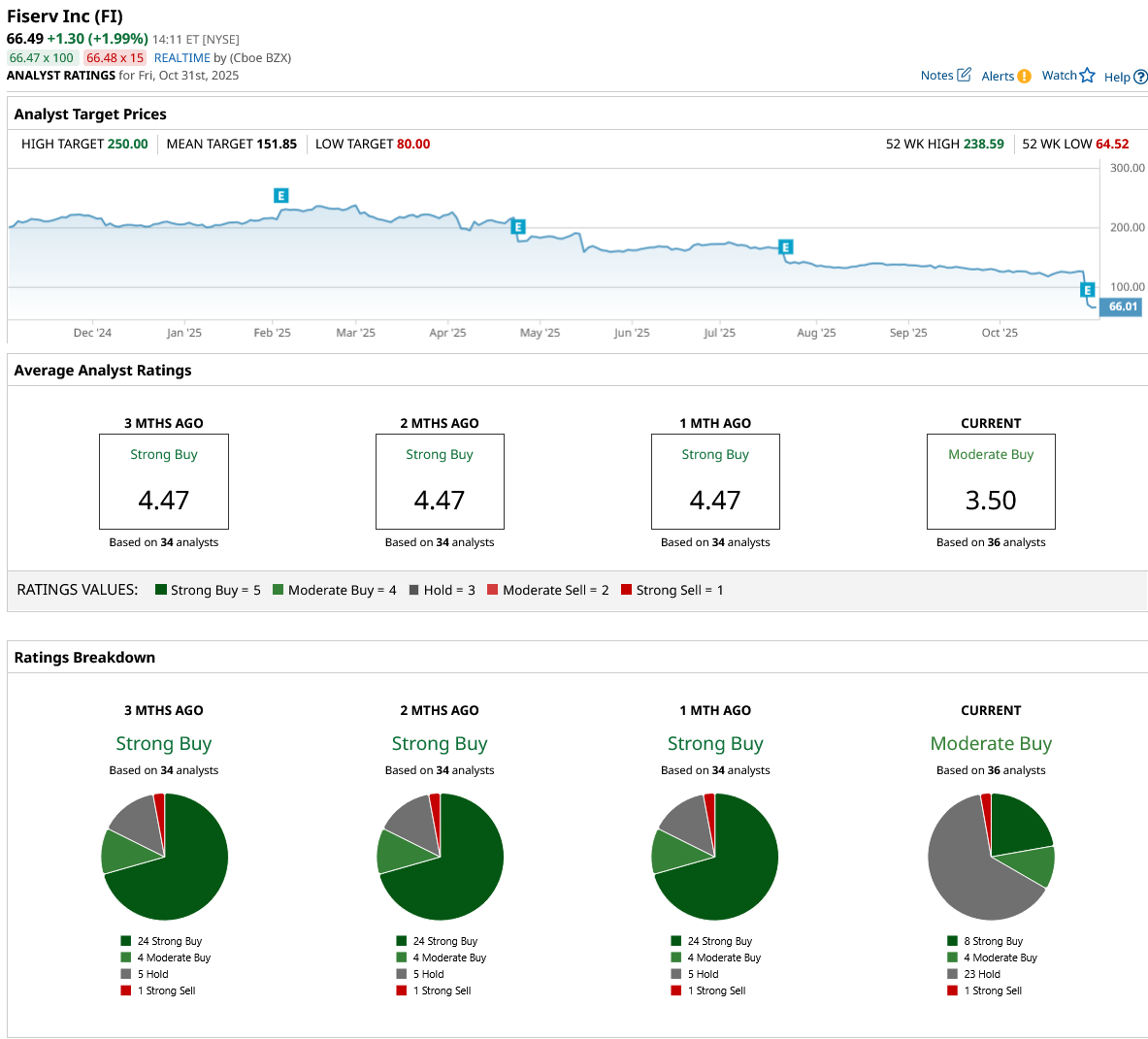

Out of the 36 analysts covering FI stock, 19 recommend “Strong Buy,” four recommend “Moderate Buy,” 12 recommend “Hold,” and one recommends “Strong Sell.” The average FI stock price target is $151.85, above the current price of $66. However, several of these price target estimates are bound to move lower over the next two weeks as analysts revise the company’s growth projections.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?

- Netflix Just Announced a 10-for-1 Stock Split. Should You Buy NFLX Stock Here?

- Qualcomm Is Becoming an AI Company. That Means Earnings on November 5 Could Supercharge QCOM Stock.