Amazon, Inc. (AMZN) stock is deeply depressed after last week's tumble. It means both at-the-money (ATM) and out-of-the-money (OTM)put options now have high yields. That provides a great potential buy-in point for value investors, while also getting paid to wait.

AMZN closed at $198.79 on Friday, Feb. 13, 2026. This is down 10.7% from $222.69 on Feb. 5, just before its after-market Q4 earnings release.

But, its one-year low is between $167.32 and $170.66 from April 8, 2025, to April 21. If AMZN were to fall to that trough range, it could mean another 14% to 16% drop.

That possibility is pushing put options premiums very high. This provides a great opportunity for value investors.

Shorting ATM and ITM Puts in AMZN

ATM Puts. Investors who want to buy AMZN stock at Friday's low price may consider selling short at-the-money (ATM) put options that expire in one month.

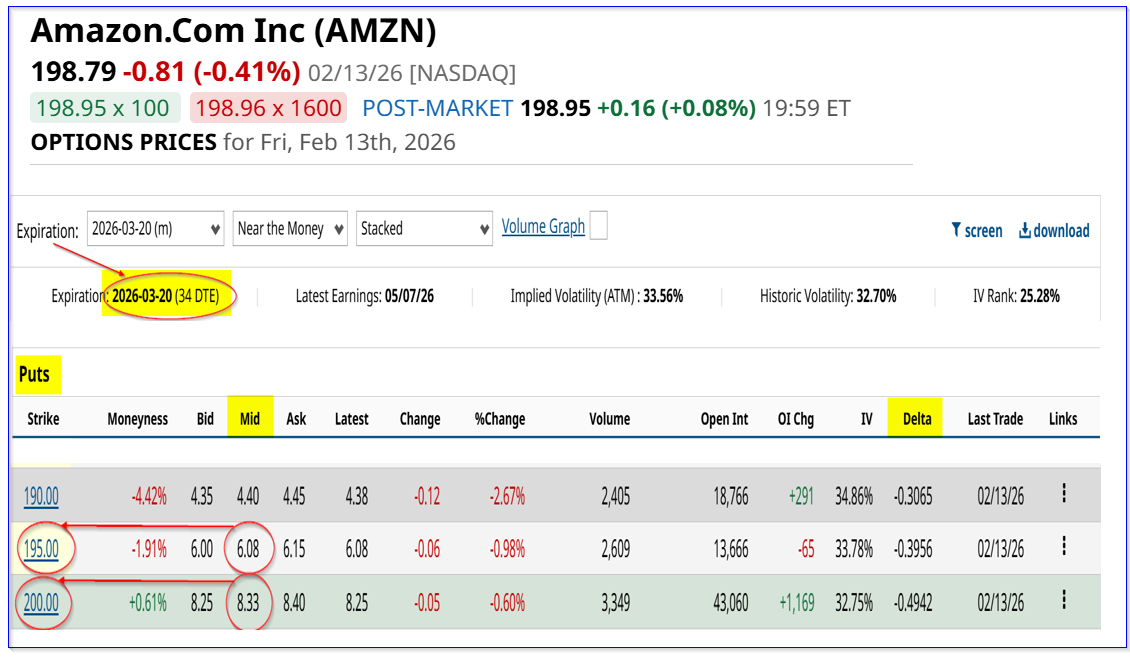

For example, look at the March 20, 2026, option expiration period, 34 days to expiry (DTE).

It shows that the $200.00 put option has a $8.33 midpoint premium. That provides an investor with an immediate yield of 4.165% over the next month (i.e., $8.33/$200.00).

However, a more conservative play is this: sell the $200 put and use the premium to buy the $195 put for the same period. That protects against any downside and still provides income.

For example, here is how that works:

$8.33 put income ($200 strike) - $6.08 put cost ($195 strike) = $2.25 net credit

$2.25 / $200.00 invested = 0.01125 = 1.125% yield over the next month

So, for example, if AMZN closes at $170 on March 20, here are the results:

$200 short put exercised = $170 - $200 = $30 unrealized loss

$195.00 put purchase = $195-$170 = $25 realized gain

Net premium credit: $8.33- $6.08 = $2.25 realized net income

Net Result: $25+2.25-$30 = -$2.75 net loss

That is less than 1.4% of the $200 net investment (i.e., -1.375%) and represents the worst that could happen if AMZN falls to $170 over the next month. Meanwhile, the investor still owns 100 shares of AMZN stock at a low buy-in cost of $200, and $197.75 ($200 - $2.25) on a breakeven basis.

Similarly, an investor could short the $195 put for $6.08, buy the $190 put for $4.40 (for a net income of $1.68 or 0.86% yield). If AMZN closes at $170 on March 20, the net loss is just $3.32, or just 1.70% of the $195.00 cost.

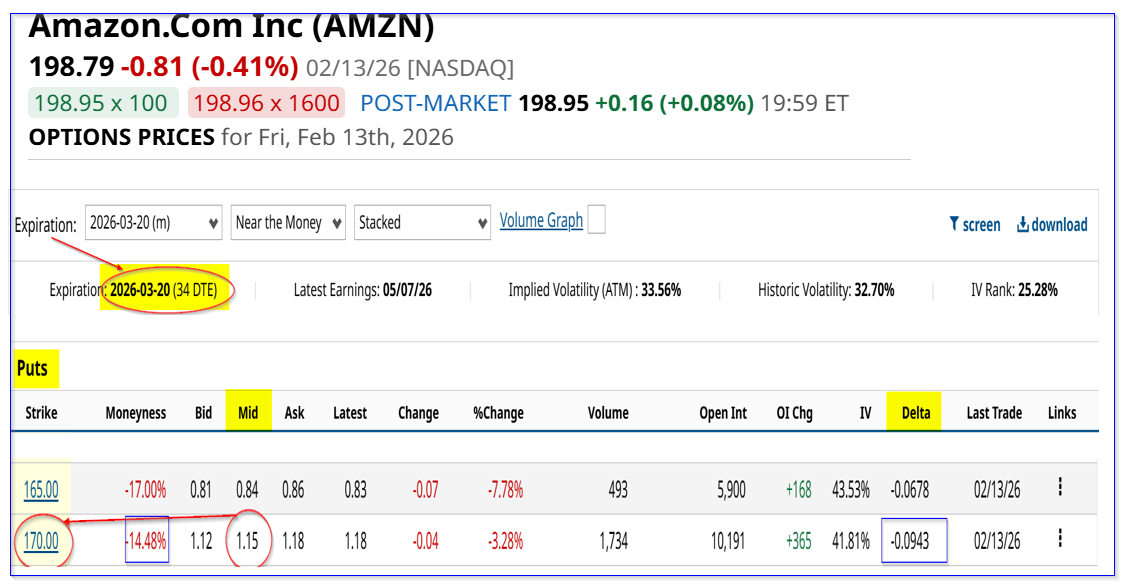

OTM Puts. Another way to do this is to short deep out-of-the-money (OTM) puts. For example, the $170 puts expiring March 20, 2026, almost 15% lower, have a midpoint premium of $1.15.

That provides an investor with an immediate yield of 0.6765% (i.e., $1.15/$170) over the next month. Meanwhile, even if AMZN closes at $170, the investor has a lower breakeven buy-in point of $168.85 ($170-$1.15), which is 15.0% lower than Friday's close.

So, which is the better play? Let's look at the expected returns (ER).

Expected Returns (ER)

Let's say there is just a 40% chance that AMZN hits $170 in one month. That means there is a 60% chance it could be higher than that.

That implies there is a 60% chance it stays at today's price, or roughly $200.

Here is the expected return (ER) for the ATM play:

$170: 0.40 x -($2.75/$200) = $0.40 x -1.375% = -0.55%

$200: 0.60 x $0 capital loss +$2.25/$200 = 0.60 x 1.125% yield = 0.675%

So, the expected return (ER) is: -0.55% + 0.675% = 0.125% over the next month.

However, the one-month yield from the $170 OTM short-put play is higher: 0.6765%. So, its expected return is better than the conservative ATM play above.

The bottom line here is that, given Amazon's high put option yields, it makes sense to short out-of-the-money (OTM) puts with strike prices almost 15% below today's price.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart