What a brutal six months it’s been for Tilray. The stock has dropped 22% and now trades at $1.42, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Tilray, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than TLRY and a stock we'd rather own.

Why Do We Think Tilray Will Underperform?

One of the first federally licensed companies to produce and distribute cannabis, Tilray (NASDAQ:TLRY) is a provider of cannabis and wellness products.

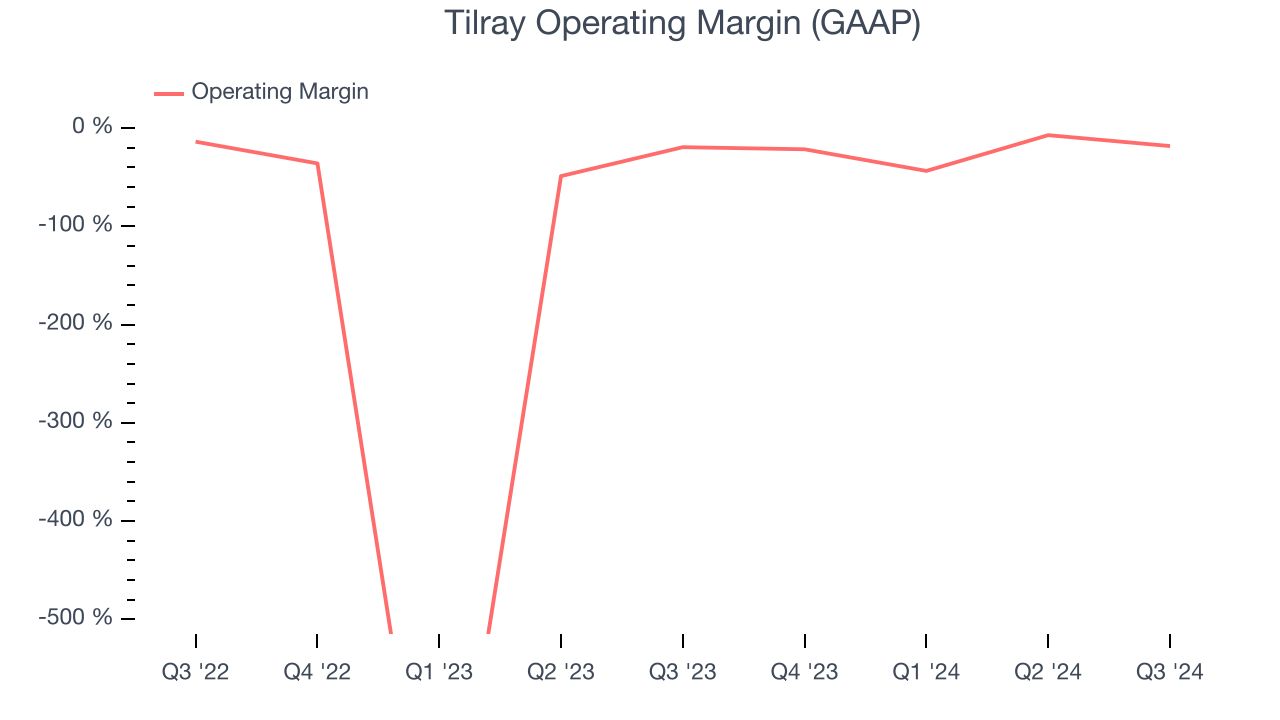

1. Operating Losses Sound the Alarms

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, Tilray was one of them over the last two years as its high expenses contributed to an average operating margin of negative 107%.

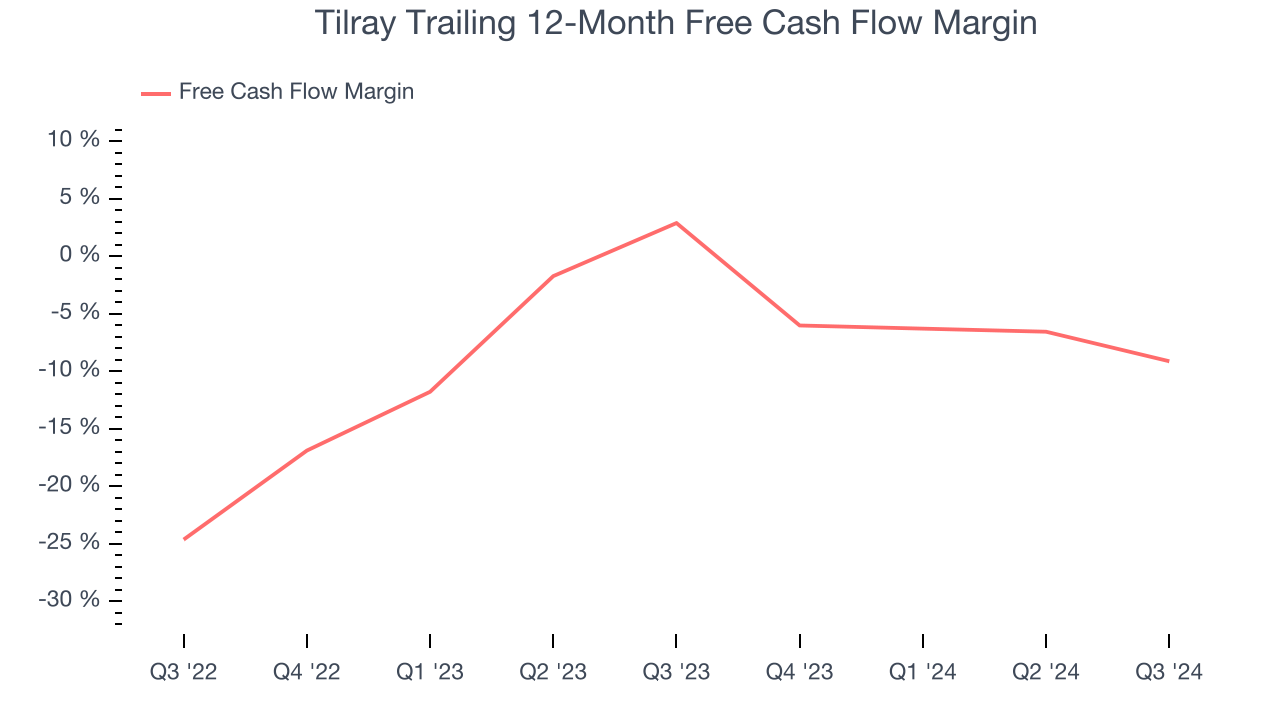

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Tilray’s margin dropped by 12 percentage points over the last year. If this trend continues, it could signal it’s becoming a more capital-intensive business. Tilray’s free cash flow margin for the trailing 12 months was negative 9.1%.

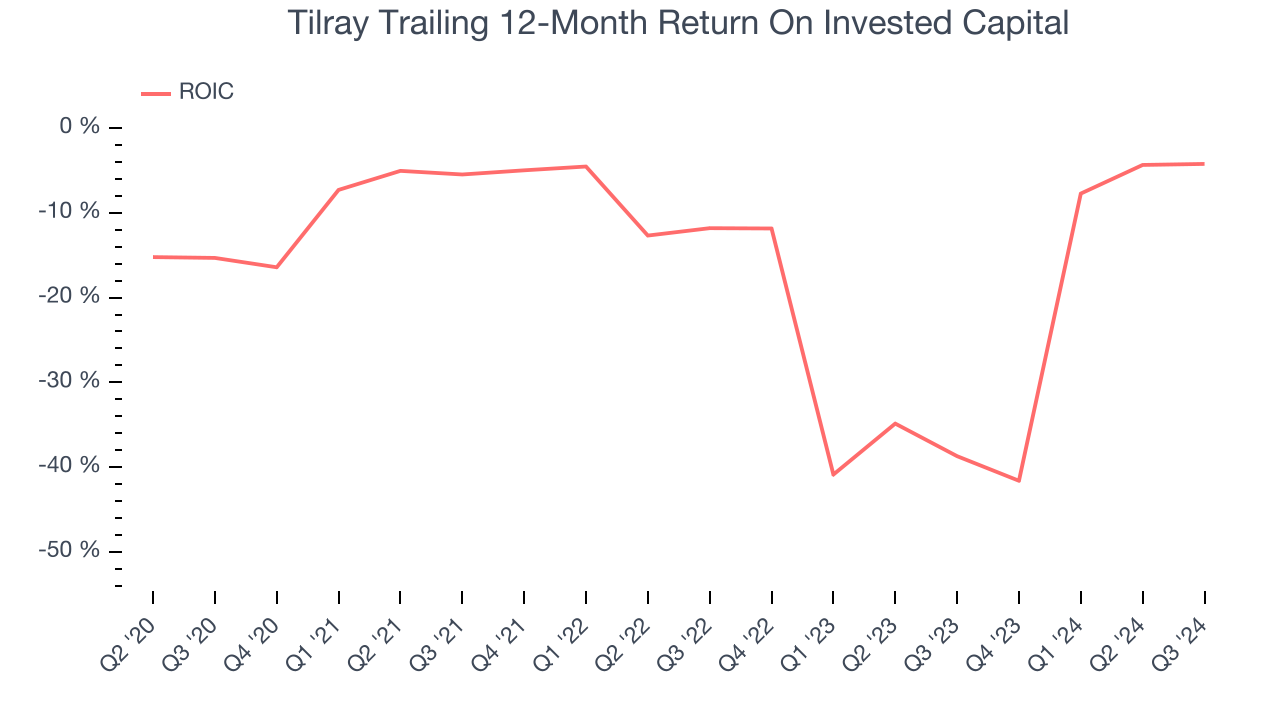

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Tilray’s five-year average ROIC was negative 15.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Final Judgment

We see the value of companies helping consumers, but in the case of Tilray, we’re out. Following the recent decline, the stock trades at 20.1x forward EV-to-EBITDA (or $1.42 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of Tilray

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.