Education company Lincoln Educational (NASDAQ:LINC) announced better-than-expected revenue in Q3 CY2024, with sales up 14.8% year on year to $114.4 million. The company’s full-year revenue guidance of $432.5 million at the midpoint came in 1.2% above analysts’ estimates. Its GAAP profit of $0.13 per share was also 40.5% above analysts’ consensus estimates.

Is now the time to buy Lincoln Educational? Find out by accessing our full research report, it’s free.

Lincoln Educational (LINC) Q3 CY2024 Highlights:

- Revenue: $114.4 million vs analyst estimates of $110.8 million (3.3% beat)

- EPS: $0.13 vs analyst estimates of $0.09 (40.5% beat)

- EBITDA: $10.24 million vs analyst estimates of $10.79 million (5.2% miss)

- The company lifted its revenue guidance for the full year to $432.5 million at the midpoint from $426.5 million, a 1.4% increase

- EBITDA guidance for the full year is $42 million at the midpoint, above analyst estimates of $40.47 million

- Gross Margin (GAAP): 58%, up from 56.7% in the same quarter last year

- Operating Margin: 5.1%, up from 2% in the same quarter last year

- EBITDA Margin: 8.9%, up from 6.2% in the same quarter last year

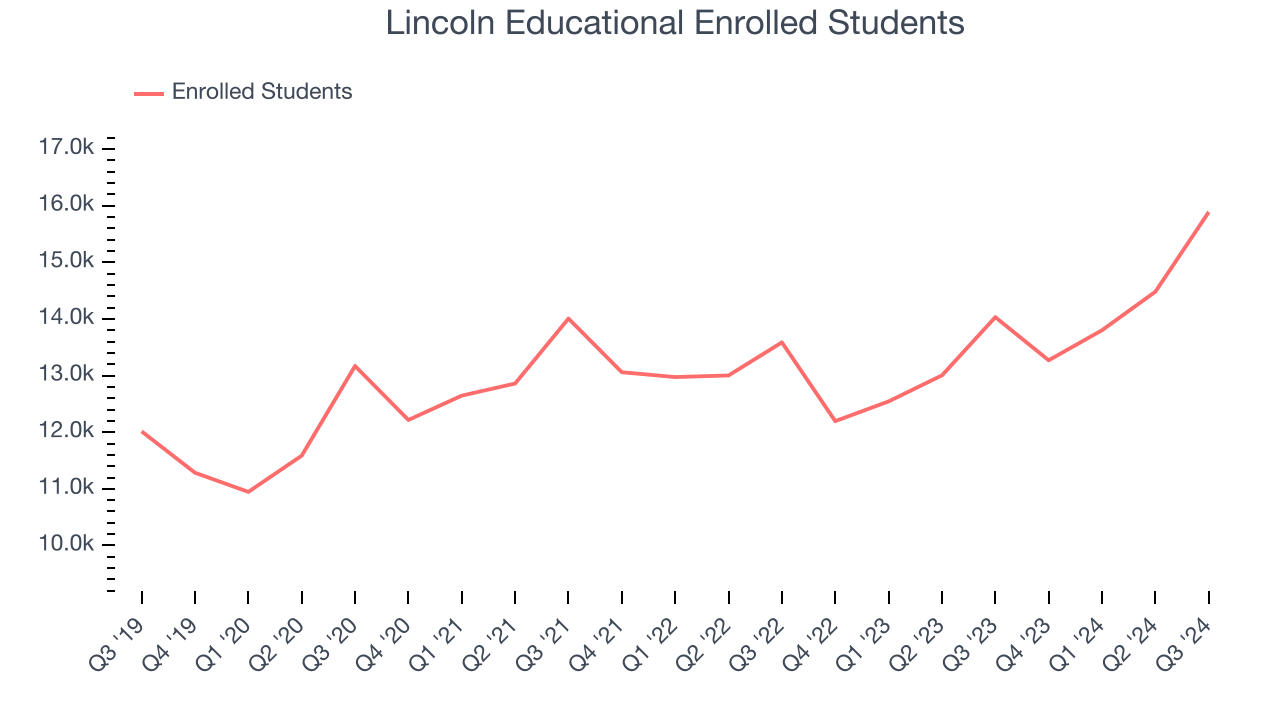

- Enrolled Students: 15,887, up 1,856 year on year

- Market Capitalization: $509.9 million

“Lincoln’s third quarter performance illustrates how well our team is serving America’s growing interest in educational alternatives to a traditional four-year college degree while helping employers fill their workforce skills gap,” said Scott Shaw, President & CEO.

Company Overview

Established in 1946, Lincoln Educational (NASDAQ:LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Sales Growth

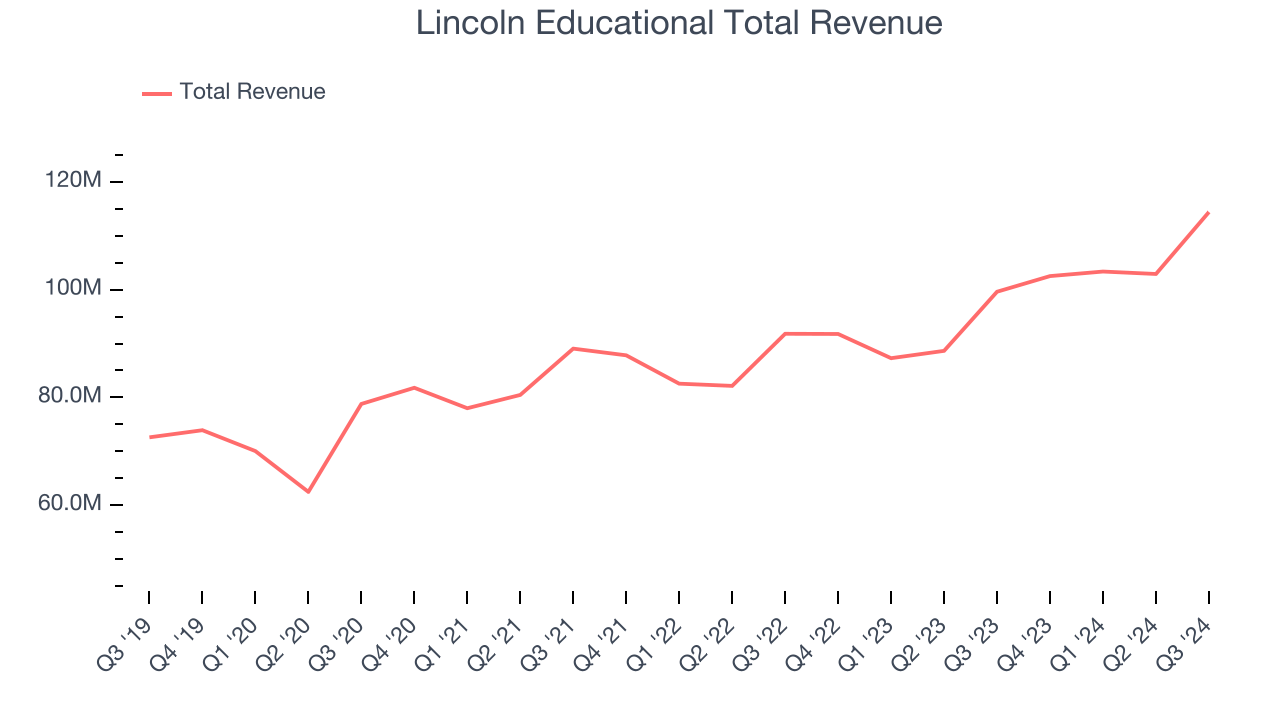

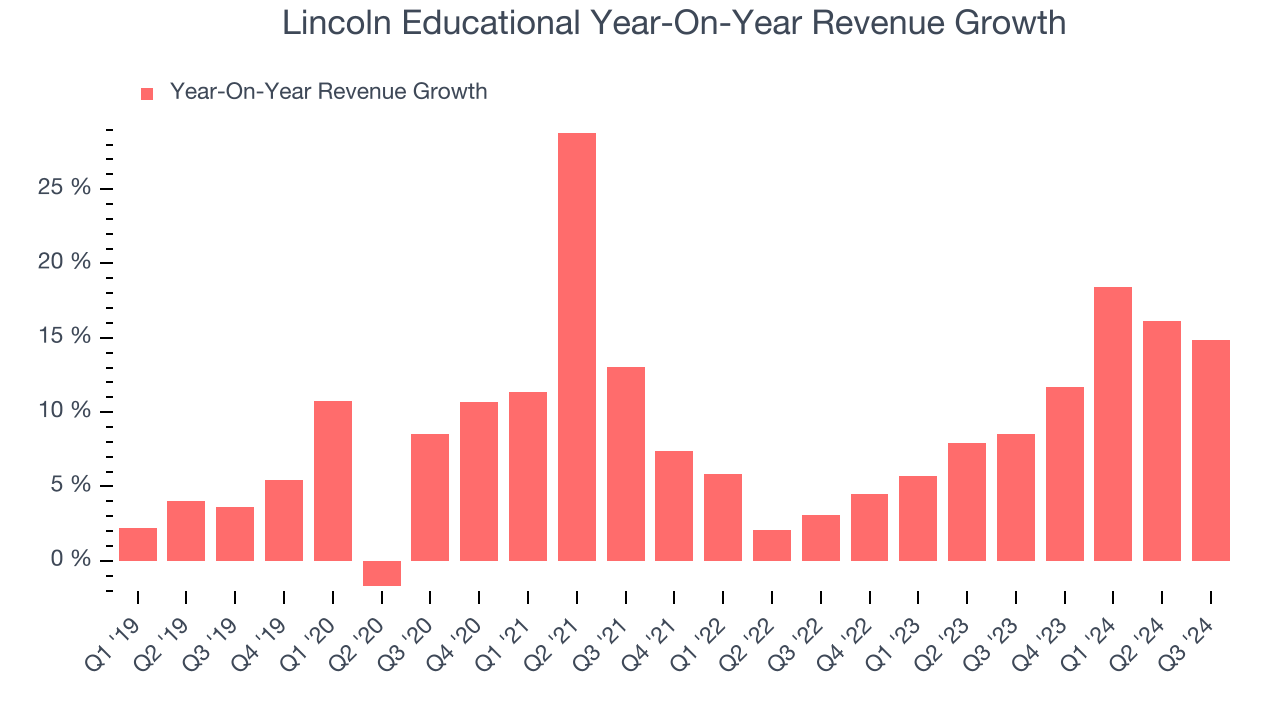

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Lincoln Educational grew its sales at a tepid 9.4% compounded annual growth rate. This shows it couldn’t expand in any major way, a sign of lacking business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Lincoln Educational’s annualized revenue growth of 10.9% over the last two years is above its five-year trend, but we were still disappointed by the results.

Lincoln Educational also discloses its number of enrolled students, which reached 15,887 in the latest quarter. Over the last two years, Lincoln Educational’s enrolled students averaged 4.6% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Lincoln Educational reported year-on-year revenue growth of 14.8%, and its $114.4 million of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

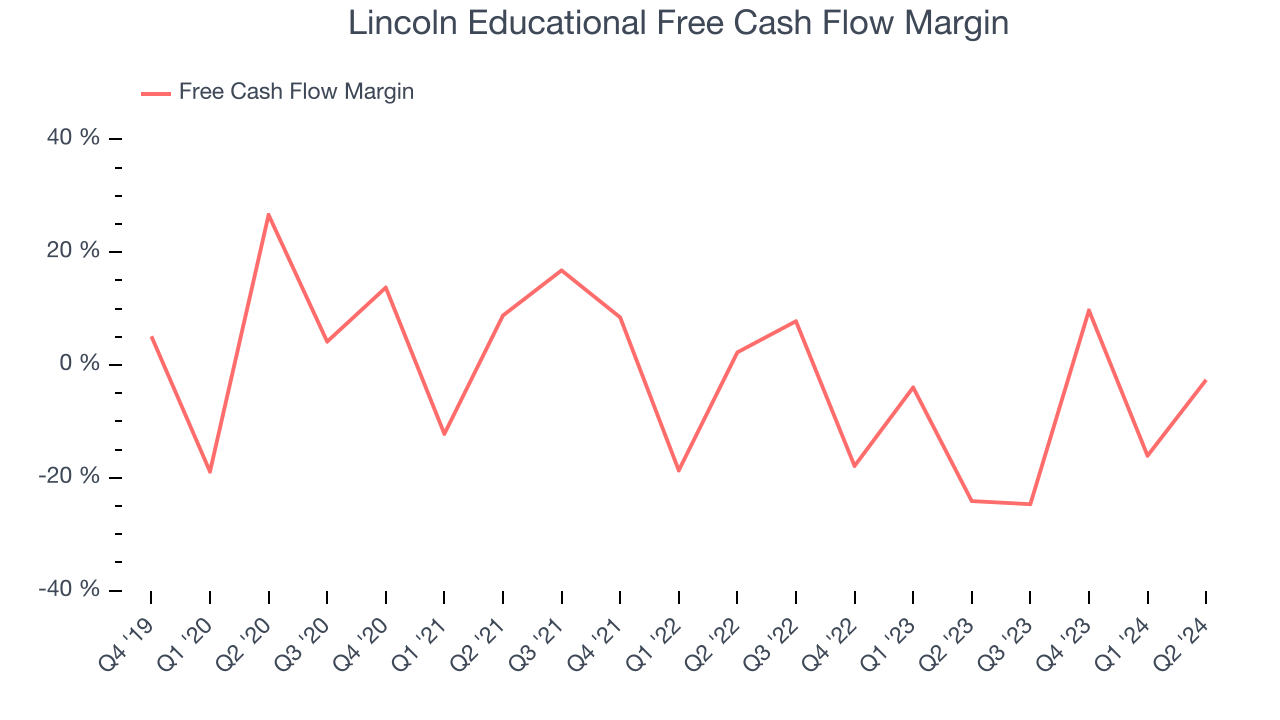

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Lincoln Educational’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 11.1%, meaning it lit $11.13 of cash on fire for every $100 in revenue.

Key Takeaways from Lincoln Educational’s Q3 Results

We were impressed by how significantly Lincoln Educational blew past analysts’ revenue and EPS expectations this quarter. We were also excited it lifted its full-year revenue guidance. Overall, this was a solid quarter with some key metrics above expectations. The stock traded up 10.2% to $17.87 immediately following the results.

Lincoln Educational had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.