Over the past six months, Valley National Bank’s shares (currently trading at $8.95) have posted a disappointing 12.3% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Valley National Bank, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Valley National Bank Not Exciting?

Despite the more favorable entry price, we're cautious about Valley National Bank. Here are three reasons why you should be careful with VLY and a stock we'd rather own.

1. Revenue Tumbling Downwards

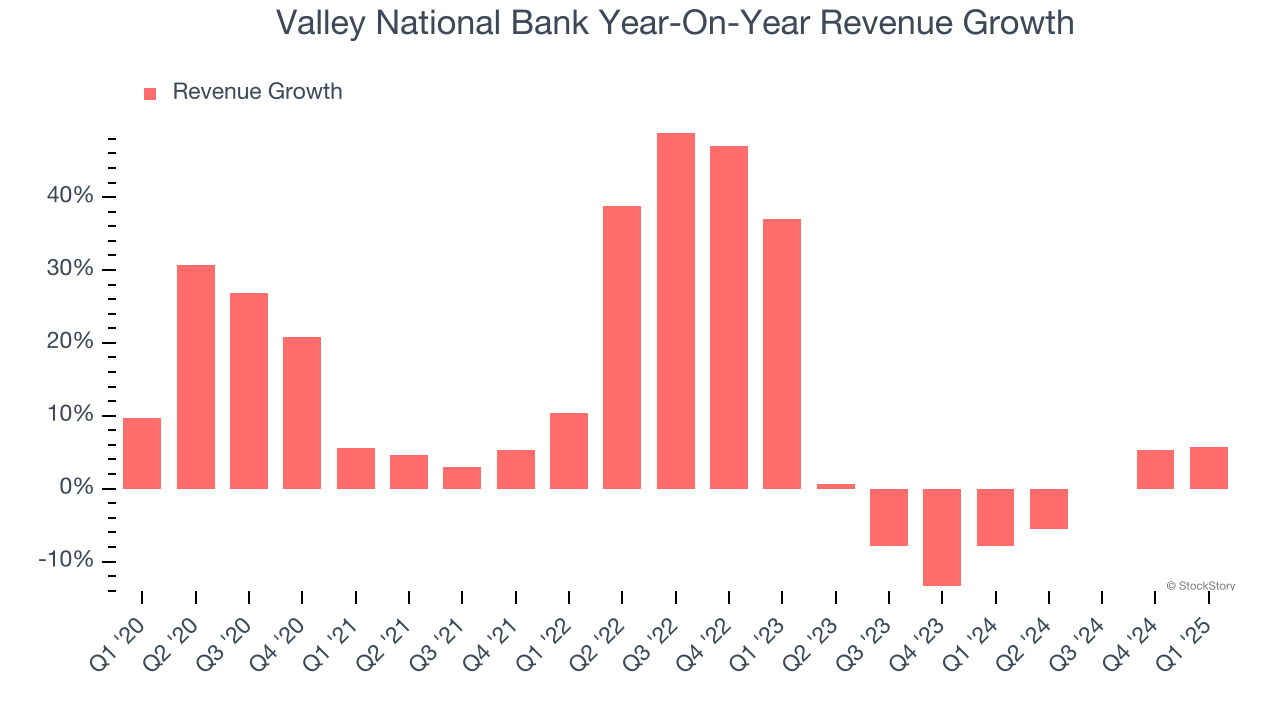

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, inflation readings, and industry trends. Valley National Bank’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.1% over the last two years.

2. Deteriorating Efficiency Ratio

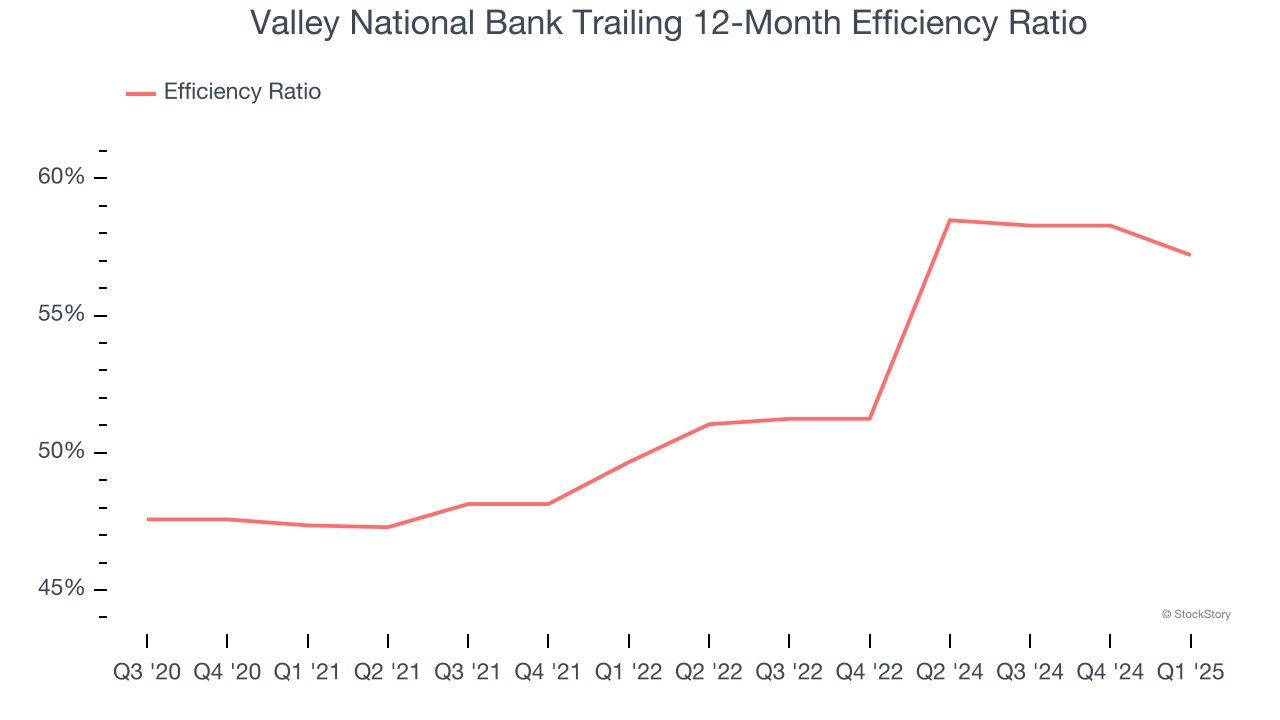

The underlying profitability of top-line growth determines the actual bottom-line impact. Banking institutions measure this dynamic using the efficiency ratio, which is calculated by dividing non-interest expenses like personnel, facilities, technology, and marketing by total revenue.

Investors place greater emphasis on efficiency ratio movements than absolute values, understanding that expense structures reflect revenue mix variations. Lower ratios represent better operational performance since they show banks generating more revenue per dollar of expense.

Over the last four years, Valley National Bank’s efficiency ratio has swelled by 9.9 percentage points, hitting 57.2% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually a bad sign in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

3. EPS Trending Down

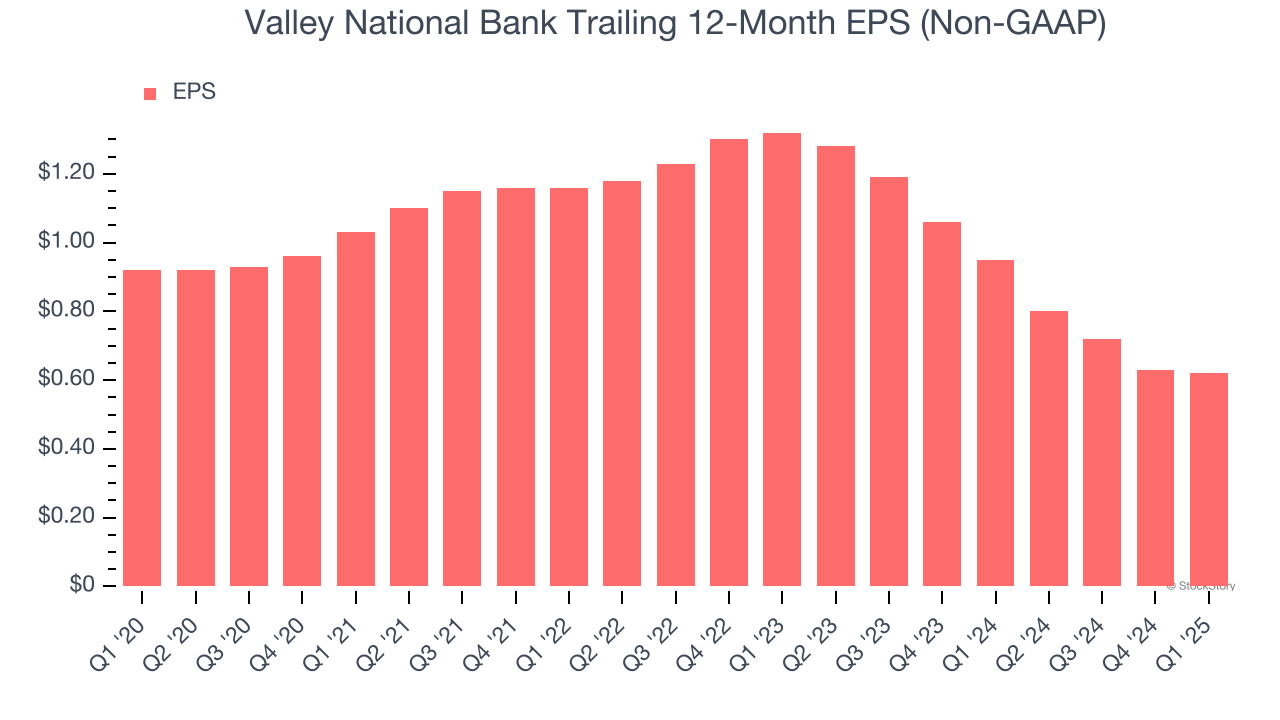

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Valley National Bank, its EPS declined by 7.6% annually over the last five years while its revenue grew by 11.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Valley National Bank isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 0.7× forward P/B (or $8.95 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.