Toy manufacturing and entertainment company (NASDAQ:MAT) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 3.9% year on year to $1.84 billion. Its GAAP profit of $1.09 per share was 16.3% above analysts’ consensus estimates.

Is now the time to buy Mattel? Find out by accessing our full research report, it’s free.

Mattel (MAT) Q3 CY2024 Highlights:

- Revenue: $1.84 billion vs analyst estimates of $1.86 billion (in line)

- EPS: $1.09 vs analyst estimates of $0.94 (16.3% beat)

- EBITDA: $584.4 million vs analyst estimates of $517.3 million (13% beat)

- EBITDA guidance for the full year is $1 billion at the midpoint, slightly below analyst estimates of $1.01 billion

- Gross Margin (GAAP): 53.1%, up from 51% in the same quarter last year

- Operating Margin: 26.5%, in line with the same quarter last year

- EBITDA Margin: 31.7%, up from 30.2% in the same quarter last year

- Free Cash Flow Margin: 3.5%, down from 10.5% in the same quarter last year

- Market Capitalization: $6.16 billion

Ynon Kreiz, Chairman and CEO of Mattel, said: “We continue to execute on our multi-year strategy to grow our IP-driven toy business and expand our entertainment offering. In line with our priorities this year, we continue to improve profitability, expand Gross Margin, and generate significant cash flow. We expect topline growth in the fourth quarter driven by a good holiday season, market share gains and a toyetic theatrical slate and are well positioned for long-term growth and shareholder value creation.”

Company Overview

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ:MAT) is a global children's entertainment company specializing in the design and production of consumer products.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Sales Growth

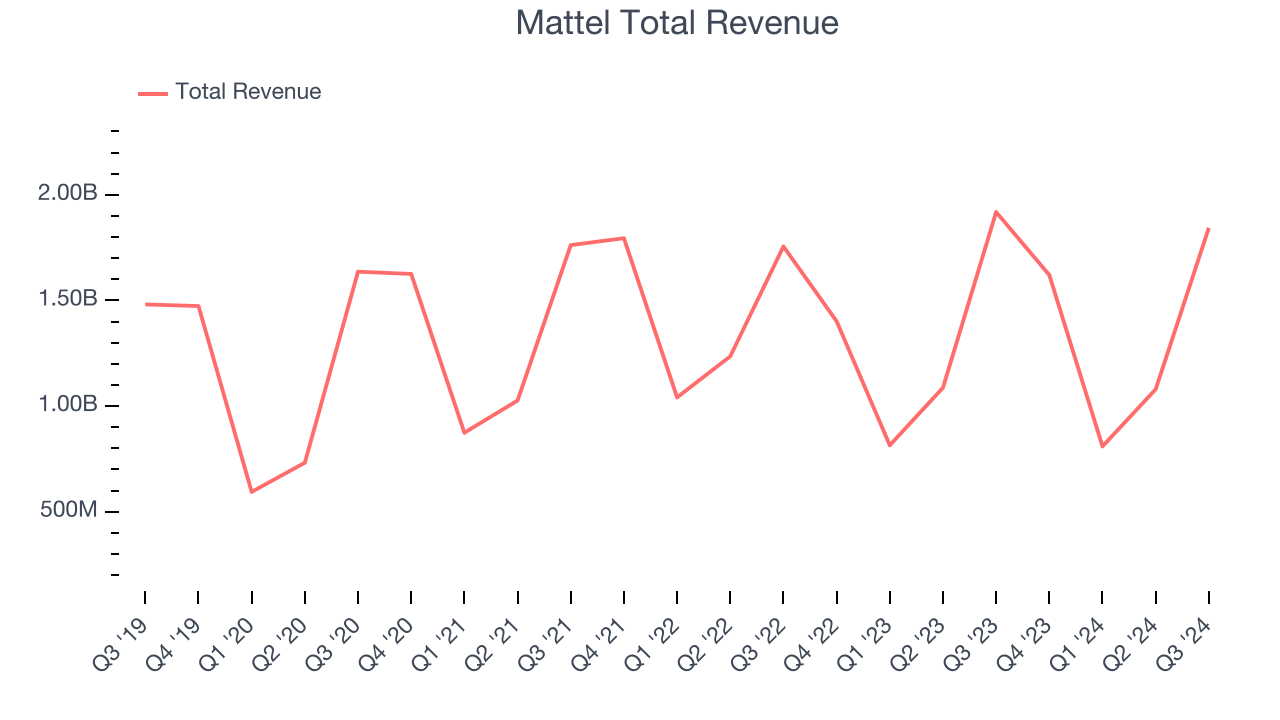

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Mattel’s 3.3% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Mattel’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.2% annually.

This quarter, Mattel reported a rather uninspiring 3.9% year-on-year revenue decline to $1.84 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, an acceleration versus the last two years. While this projection illustrates the market thinks its newer products and services will spur better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

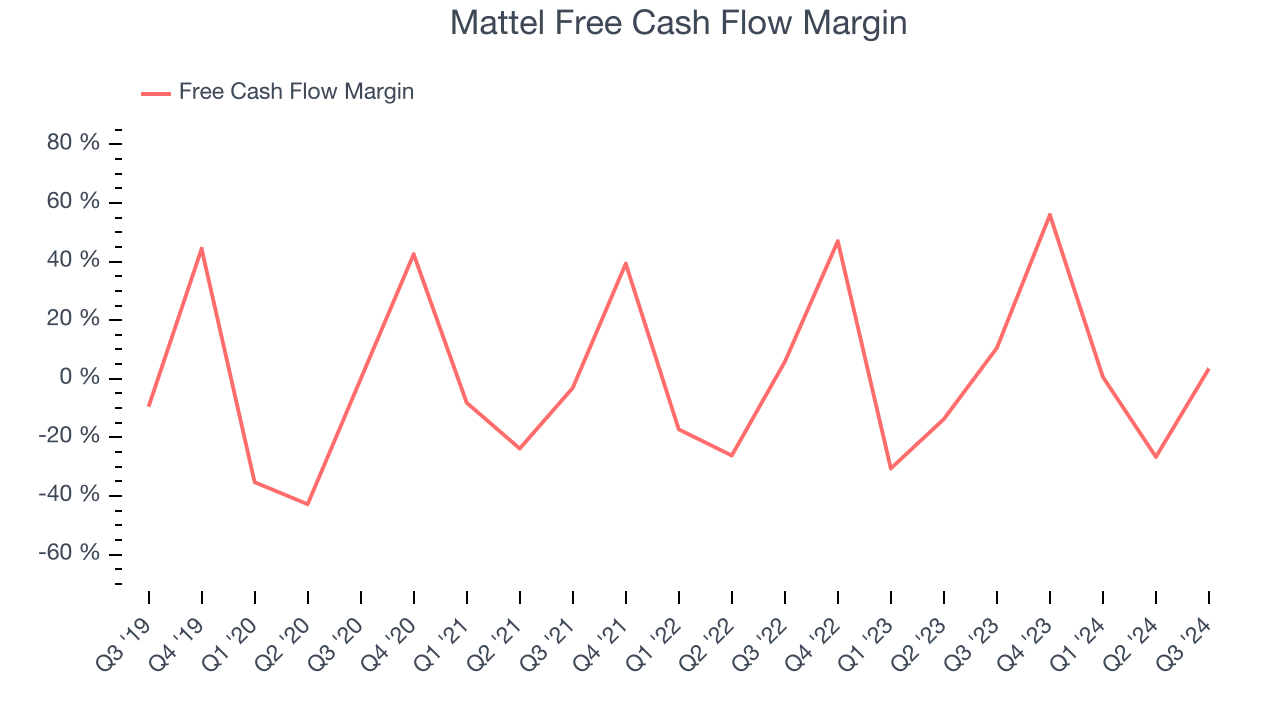

Mattel has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.9% over the last two years, slightly better than the broader consumer discretionary sector.

Mattel’s free cash flow clocked in at $64.4 million in Q3, equivalent to a 3.5% margin. The company’s cash profitability regressed as it was 7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Mattel’s Q3 Results

We enjoyed seeing Mattel exceed analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue unfortunately missed. Overall, this quarter had some key positives. The stock traded up 3% to $18.31 immediately after reporting.

So do we think Mattel is an attractive buy at the current price?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.