Telecommunications giant Verizon (NYSE: VZ) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 1.5% year on year to $33.49 billion. Its non-GAAP profit of $1.19 per share was 3.6% above analysts’ consensus estimates.

Is now the time to buy Verizon? Find out by accessing our full research report, it’s free.

Verizon (VZ) Q1 CY2025 Highlights:

- Revenue: $33.49 billion vs analyst estimates of $33.33 billion (1.5% year-on-year growth, in line)

- Subscribers: Loss of 289,000 monthly bill-paying wireless subscribers (miss)

- Adjusted EPS: $1.19 vs analyst estimates of $1.15 (3.6% beat)

- Adjusted EBITDA: $12.56 billion vs analyst estimates of $12.34 billion (37.5% margin, 1.7% beat)

- Operating Margin: 23.8%, up from 22.8% in the same quarter last year

- Free Cash Flow Margin: 10.9%, up from 8.2% in the same quarter last year

- Market Capitalization: $180.7 billion

Company Overview

Formed in 1984 as Bell Atlantic after the breakup of Bell System into seven companies, Verizon (NYSE: VZ) is a telecom giant providing a range of communications and internet services.

Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Sales Growth

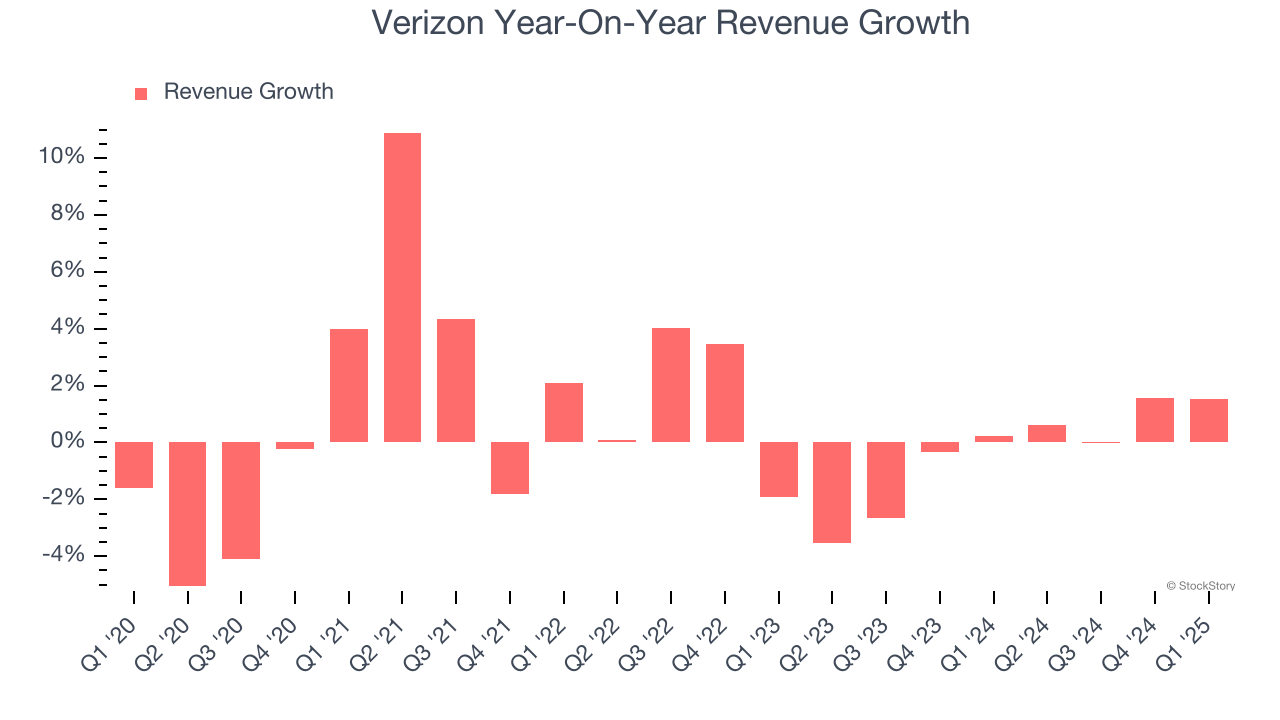

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Verizon struggled to consistently increase demand as its $135.3 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Just like its five-year trend, Verizon’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, Verizon grew its revenue by 1.5% year on year, and its $33.49 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Verizon’s operating margin has been trending up over the last 12 months and averaged 19.3% over the last two years. On top of that, its profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q1, Verizon generated an operating profit margin of 23.8%, up 1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Verizon, its EPS declined by 1% annually over the last five years while its revenue was flat. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q1, Verizon reported EPS at $1.19, up from $1.15 in the same quarter last year. This print beat analysts’ estimates by 3.6%. Over the next 12 months, Wall Street expects Verizon’s full-year EPS of $4.63 to grow 1.8%.

Key Takeaways from Verizon’s Q1 Results

While revenue was in line, subscriber losses were worse than expected, and this weighed on shares as the market worried about intensifying competition. The stock traded down 4.3% to $41.10 immediately following the results.

So should you invest in Verizon right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.