Even during a down period for the markets, Torrid has gone against the grain, climbing to $5.15. Its shares have yielded a 27.5% return over the last six months, beating the S&P 500 by 30.8%. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Torrid, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Torrid Will Underperform?

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why you should be careful with CURV and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

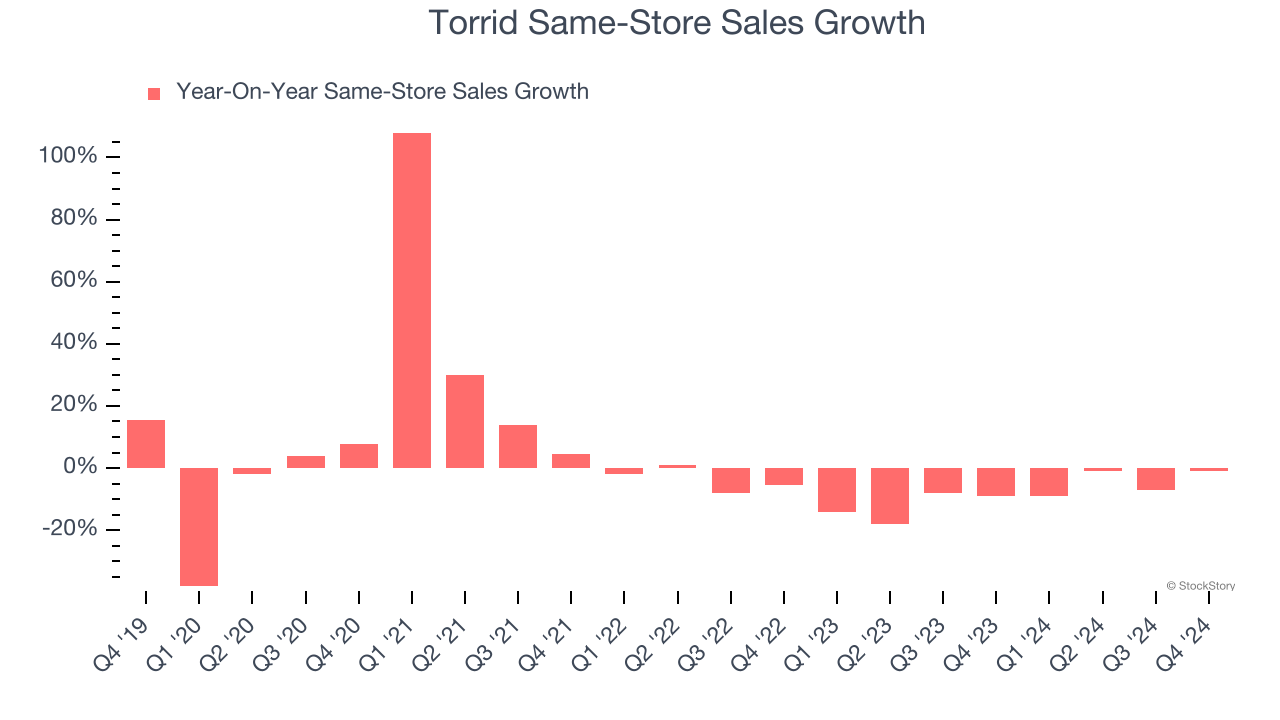

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Torrid’s demand has been shrinking over the last two years as its same-store sales have averaged 8.3% annual declines.

2. Fewer Distribution Channels Limit its Ceiling

With $1.10 billion in revenue over the past 12 months, Torrid is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

3. EPS Trending Down

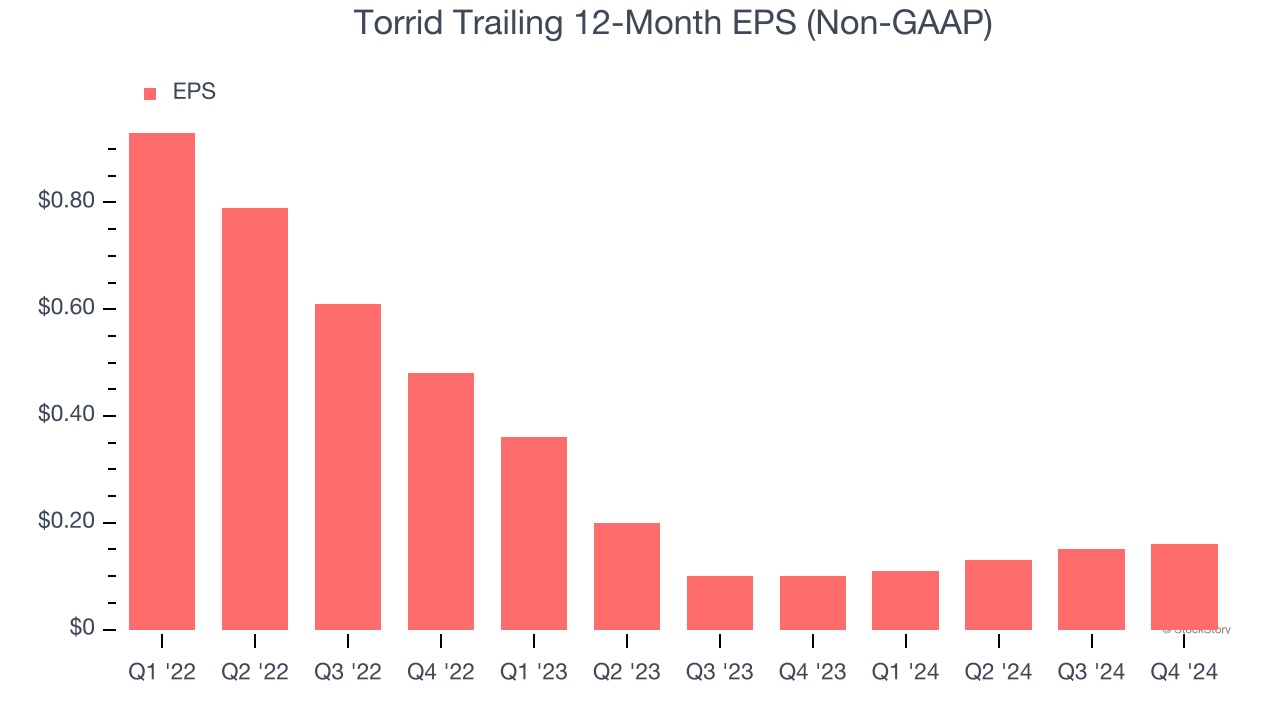

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Torrid’s full-year EPS dropped significantly over the last three years. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS because it could imply changing secular trends and preferences. If the tide turns unexpectedly, Torrid’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Torrid falls short of our quality standards. With its shares outperforming the market lately, the stock trades at 22.5× forward P/E (or $5.15 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Torrid

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.