Although the S&P 500 is down 3.3% over the past six months, Post’s stock price has fallen further to $108.01, losing shareholders 9.5% of their capital. This may have investors wondering how to approach the situation.

Is now the time to buy Post, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Post Not Exciting?

Even with the cheaper entry price, we don't have much confidence in Post. Here are three reasons why we avoid POST and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

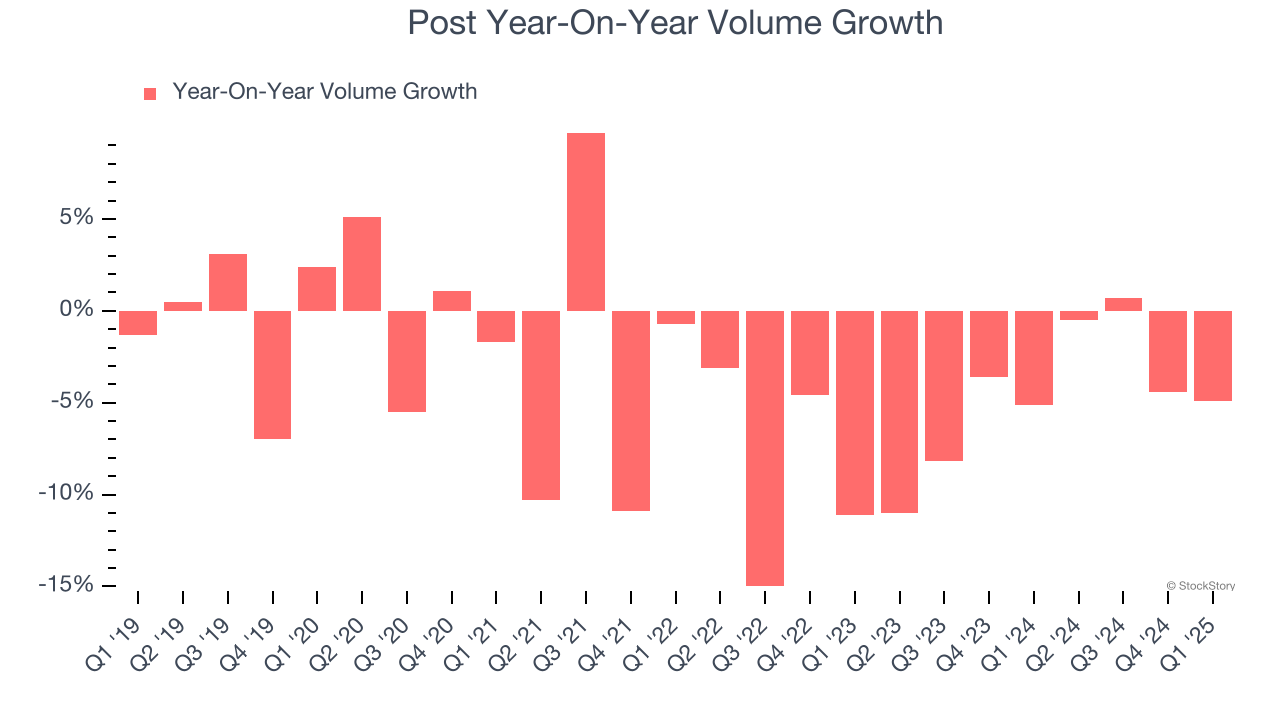

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Post’s average quarterly sales volumes have shrunk by 4.6% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Post’s revenue to stall, a deceleration versus its 13.8% annualized growth for the past three years. This projection is underwhelming and suggests its products will see some demand headwinds.

3. Previous Growth Initiatives Haven’t Impressed

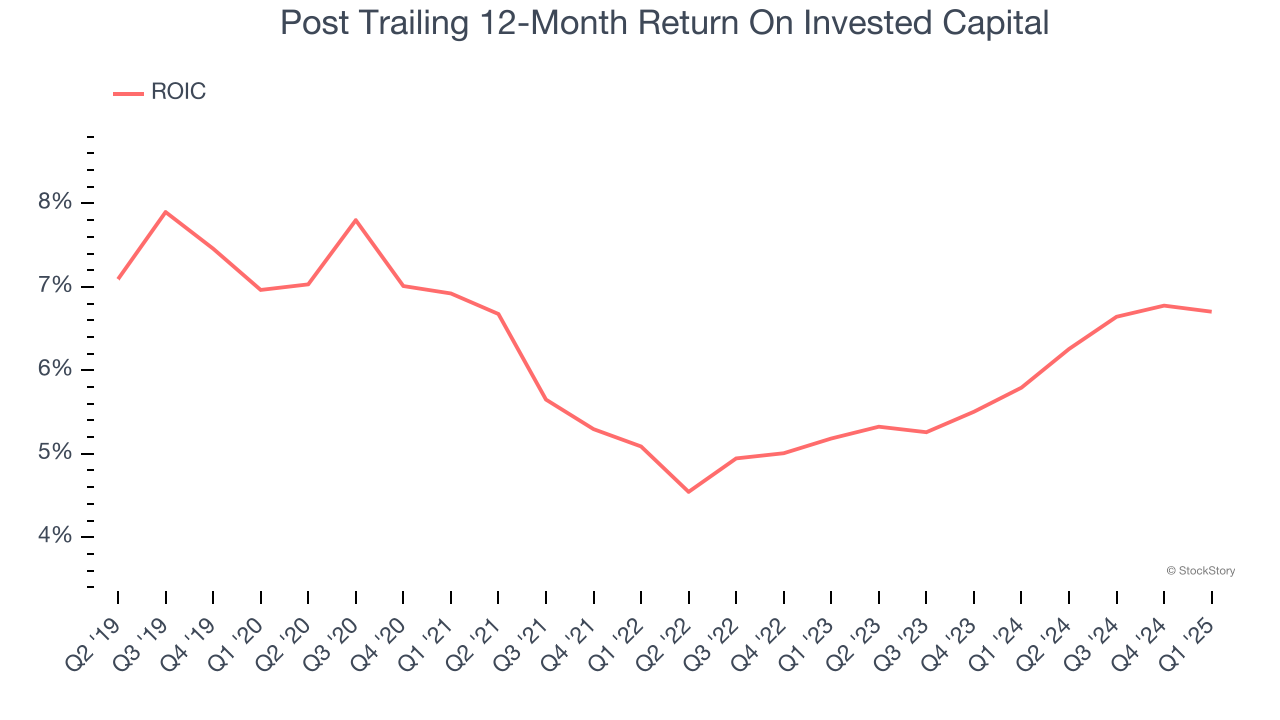

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Post historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.9%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

Post isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 15.2× forward P/E (or $108.01 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Post

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.