Real estate technology company eXp World (NASDAQ: EXPI) missed Wall Street’s revenue expectations in Q1 CY2025 as sales only rose 1.3% year on year to $954.9 million. Its GAAP loss of $0.07 per share was significantly below analysts’ consensus estimates.

Is now the time to buy eXp World? Find out by accessing our full research report, it’s free.

eXp World (EXPI) Q1 CY2025 Highlights:

- Revenue: $954.9 million vs analyst estimates of $994.8 million (1.3% year-on-year growth, 4% miss)

- EPS (GAAP): -$0.07 vs analyst estimates of -$0.01 (significant miss)

- Adjusted EBITDA: $2.16 million vs analyst estimates of $11.96 million (0.2% margin, 82% miss)

- Operating Margin: -1.1%, in line with the same quarter last year

- Free Cash Flow Margin: 3.9%, down from 6.3% in the same quarter last year

- Market Capitalization: $1.33 billion

“We’re entering 2025 from a position of strength. eXp has built one of the most comprehensive, tech-enabled agent value stack in the industry – one that’s driving record International agent productivity and empowering entrepreneurs at scale,” said Glenn Sanford, Founder, Chairman and CEO of eXp World Holdings.

Company Overview

Founded in 2009, eXp World (NASDAQ: EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

Sales Growth

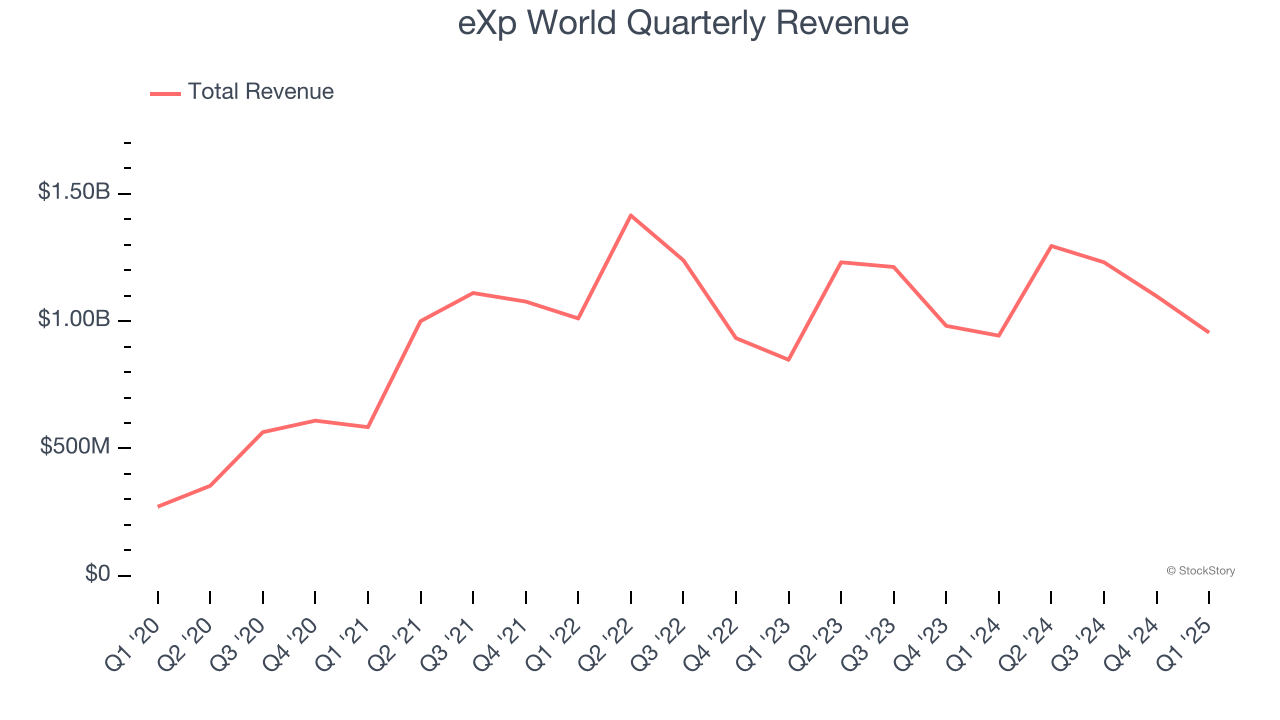

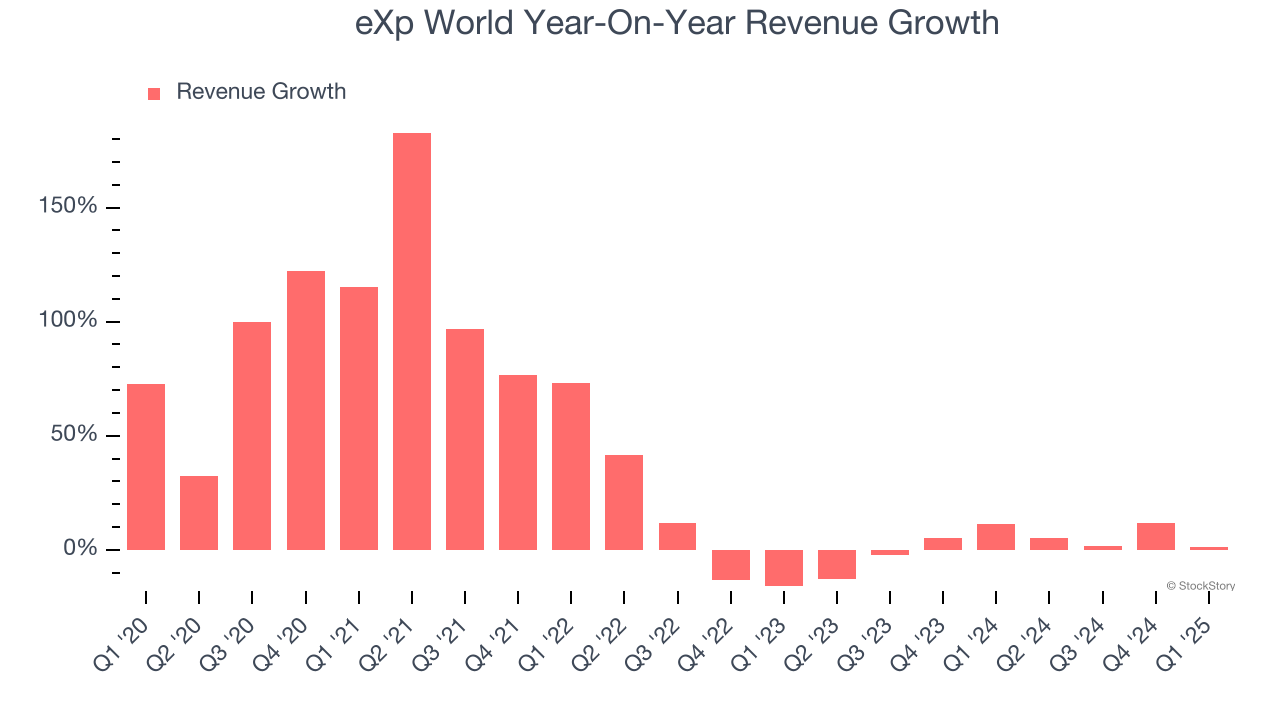

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, eXp World’s sales grew at an incredible 33.1% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. eXp World’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.6% over the last two years was well below its five-year trend.

This quarter, eXp World’s revenue grew by 1.3% year on year to $954.9 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

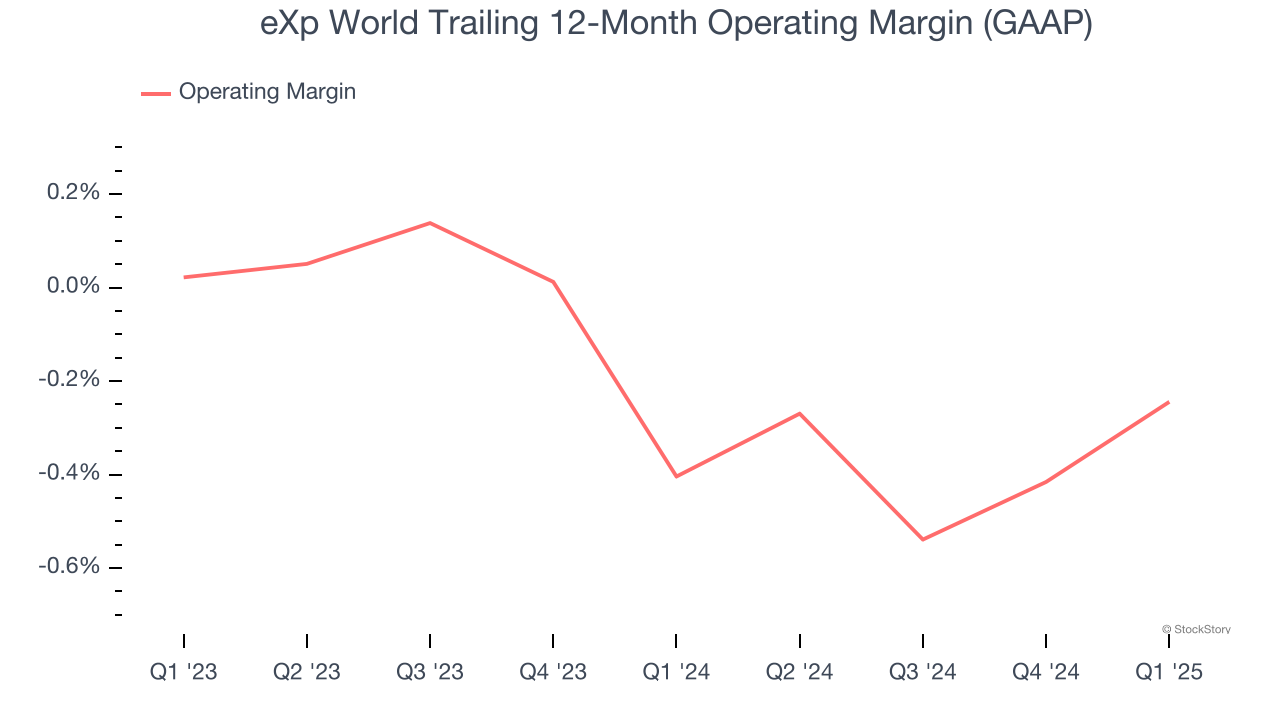

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

eXp World’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same. The company broke even over the last two years, inadequate for a consumer discretionary business. Its large expense base and inefficient cost structure were the main culprits behind this performance.

This quarter, eXp World generated a negative 1.1% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

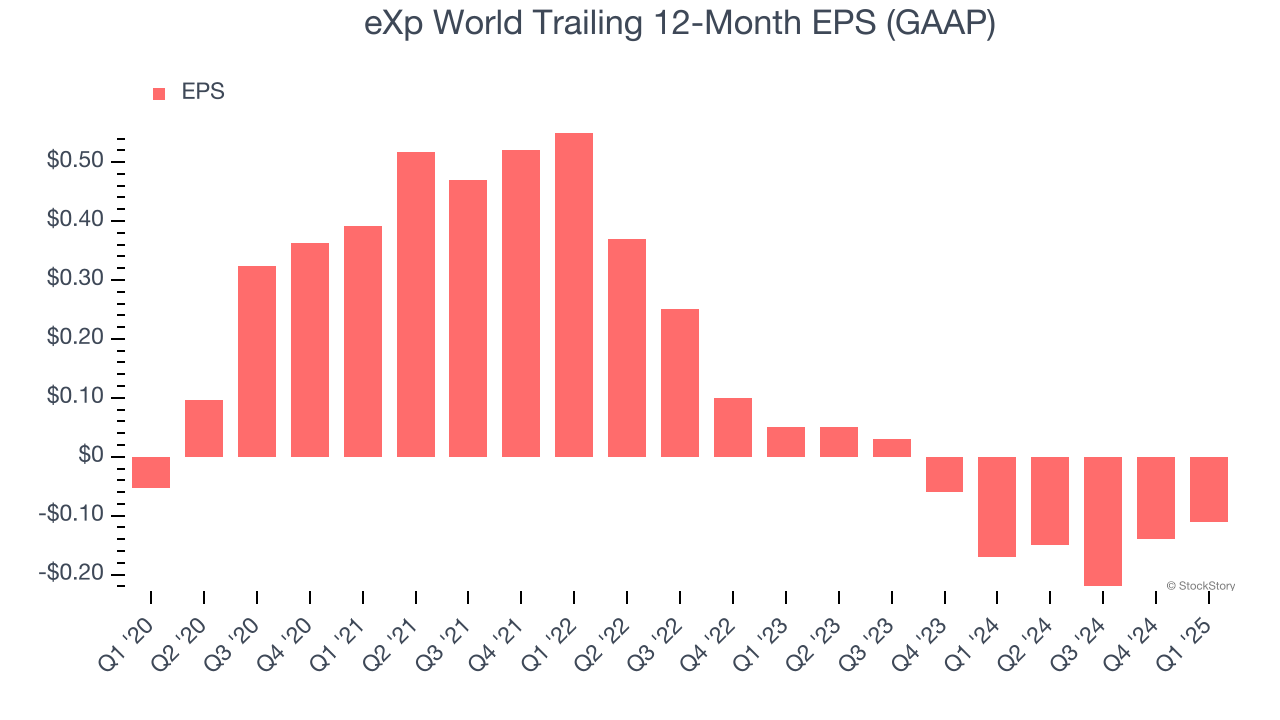

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

eXp World’s earnings losses deepened over the last five years as its EPS dropped 15.4% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, eXp World’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, eXp World reported EPS at negative $0.07, up from negative $0.10 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast eXp World’s full-year EPS of negative $0.11 will reach break even.

Key Takeaways from eXp World’s Q1 Results

We struggled to find many positives in these results as its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2% to $8.50 immediately following the results.

eXp World underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.