Wrapping up Q1 earnings, we look at the numbers and key takeaways for the surgical equipment & consumables - specialty stocks, including Integra LifeSciences (NASDAQ: IART) and its peers.

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

The 4 surgical equipment & consumables - specialty stocks we track reported a slower Q1. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.6% since the latest earnings results.

Weakest Q1: Integra LifeSciences (NASDAQ: IART)

Founded in 1989 as a pioneer in regenerative medicine technology, Integra LifeSciences (NASDAQ: IART) develops and manufactures medical technologies for neurosurgery, wound care, and surgical reconstruction, including regenerative tissue products and surgical instruments.

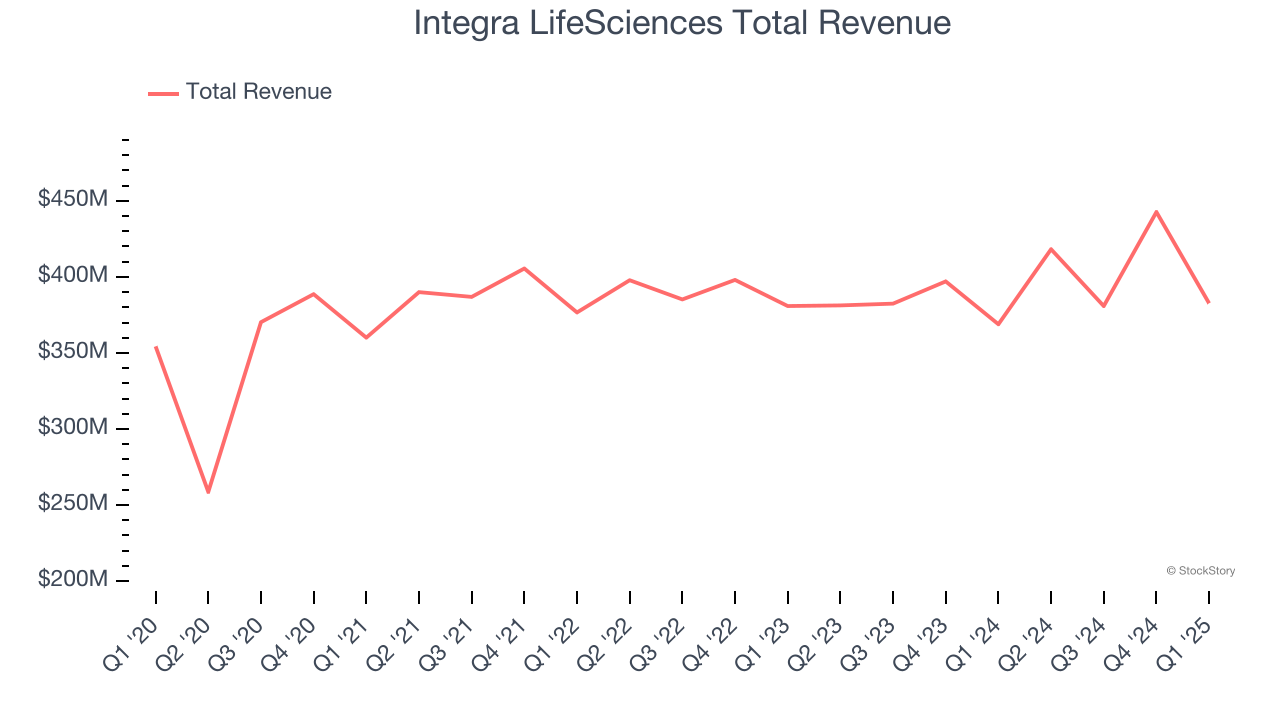

Integra LifeSciences reported revenues of $382.7 million, up 3.7% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a miss of analysts’ EPS estimates.

“We remain laser focused on strengthening our quality systems, improving supply reliability, and driving operational excellence. There remains significant work ahead, but we are continuing to put the processes and people in place to execute on our comprehensive Compliance Master Plan and build a foundation for sustainable performance. With the launch of our Transformation and Program Management Office and the addition of key leadership, including in global operations, we are driving improved accountability and execution across the enterprise to deliver meaningful long-term value for patients, customers, and shareholders,” said Mojdeh Poul, president and chief executive officer.

Integra LifeSciences delivered the weakest full-year guidance update of the whole group. The stock is down 22.5% since reporting and currently trades at $13.03.

Read our full report on Integra LifeSciences here, it’s free.

Best Q1: Intuitive Surgical (NASDAQ: ISRG)

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ: ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

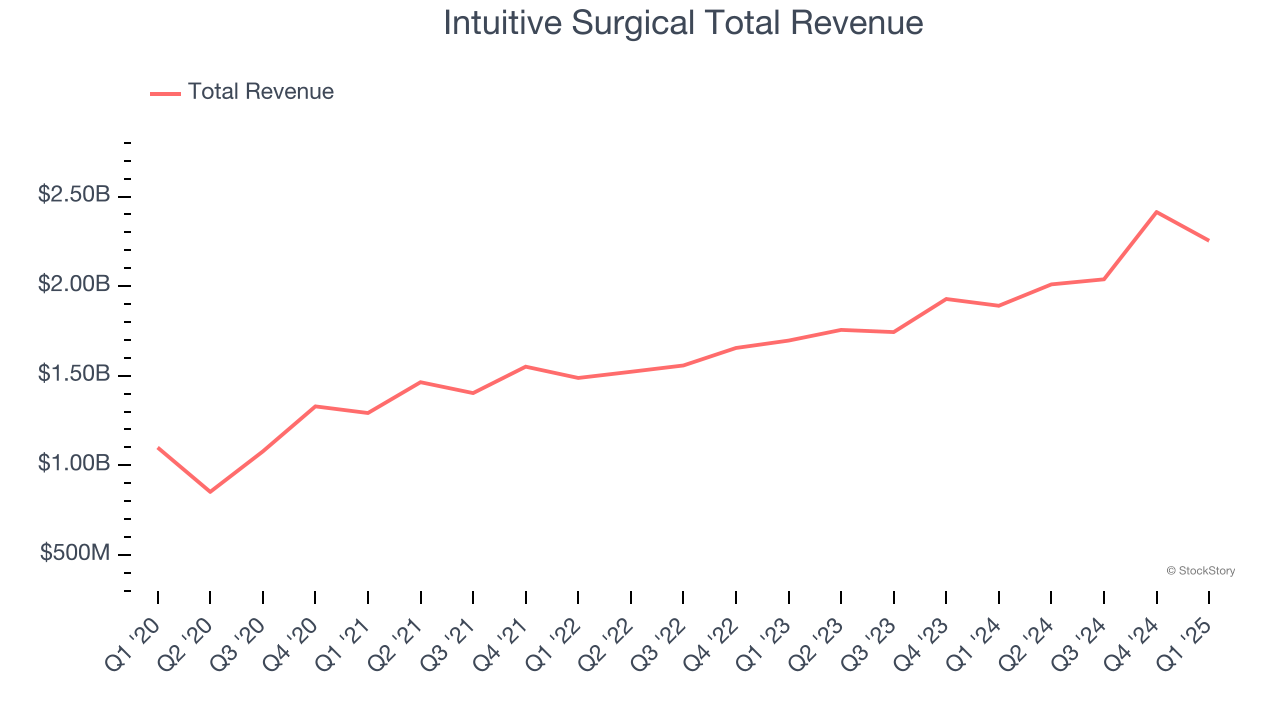

Intuitive Surgical reported revenues of $2.25 billion, up 19.2% year on year, outperforming analysts’ expectations by 3.1%. The business had a satisfactory quarter with a decent beat of analysts’ EPS estimates but a miss of analysts’ sales volume estimates.

Intuitive Surgical achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 15.5% since reporting. It currently trades at $553.

Is now the time to buy Intuitive Surgical? Access our full analysis of the earnings results here, it’s free.

Teleflex (NYSE: TFX)

With a portfolio spanning from vascular access catheters to minimally invasive surgical tools, Teleflex (NYSE: TFX) designs, manufactures, and supplies single-use medical devices used in critical care and surgical procedures across hospitals worldwide.

Teleflex reported revenues of $700.7 million, down 5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and constant currency revenue in line with analysts’ estimates.

Teleflex delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 11.3% since the results and currently trades at $121.44.

Read our full analysis of Teleflex’s results here.

LeMaitre (NASDAQ: LMAT)

Founded in 1983 and named after a pioneering vascular surgeon, LeMaitre Vascular (NASDAQGM:LMAT) develops and manufactures specialized medical devices used by vascular surgeons to treat peripheral vascular disease and other circulatory conditions.

LeMaitre reported revenues of $59.87 million, up 12% year on year. This result topped analysts’ expectations by 3.7%. Aside from that, it was a satisfactory quarter as it also recorded a solid beat of analysts’ organic revenue estimates but a miss of analysts’ EPS estimates.

LeMaitre achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 8.2% since reporting and currently trades at $82.86.

Read our full, actionable report on LeMaitre here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.