Cosmetics company e.l.f. Beauty (NYSE:ELF) announced better-than-expected revenue in Q3 CY2024, with sales up 39.7% year on year to $301.1 million. The company expects the full year’s revenue to be around $1.33 billion, close to analysts’ estimates. Its non-GAAP profit of $0.77 per share was also 79.3% above analysts’ consensus estimates.

Is now the time to buy e.l.f.? Find out by accessing our full research report, it’s free.

e.l.f. (ELF) Q3 CY2024 Highlights:

- Revenue: $301.1 million vs analyst estimates of $289.5 million (4% beat)

- Adjusted EPS: $0.77 vs analyst estimates of $0.43 (79.3% beat)

- EBITDA: $69.33 million vs analyst estimates of $45.03 million (54% beat)

- The company lifted its revenue guidance for the full year to $1.33 billion at the midpoint from $1.29 billion, a 2.7% increase

- Management raised its full-year Adjusted EPS guidance to $3.47 at the midpoint, a 2.5% increase

- EBITDA guidance for the full year is $306 million at the midpoint, above analyst estimates of $302.5 million

- Gross Margin (GAAP): 71.1%, in line with the same quarter last year

- Operating Margin: 9.3%, down from 18.6% in the same quarter last year

- EBITDA Margin: 23%, down from 28% in the same quarter last year

- Free Cash Flow Margin: 3.1%, down from 12.6% in the same quarter last year

- Market Capitalization: $6.04 billion

“Q2 marked another quarter of consistent, category-leading growth. In Q2, we delivered 40% net sales growth, fueled by 195 basis points of market share gains in the U.S. and 91% net sales growth internationally,” said Tarang Amin, CEO of e.l.f.

Company Overview

e.l.f. Beauty (NYSE:ELF), which stands for ‘eyes, lips, face’, offers high-quality beauty products at accessible price points.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

e.l.f. is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

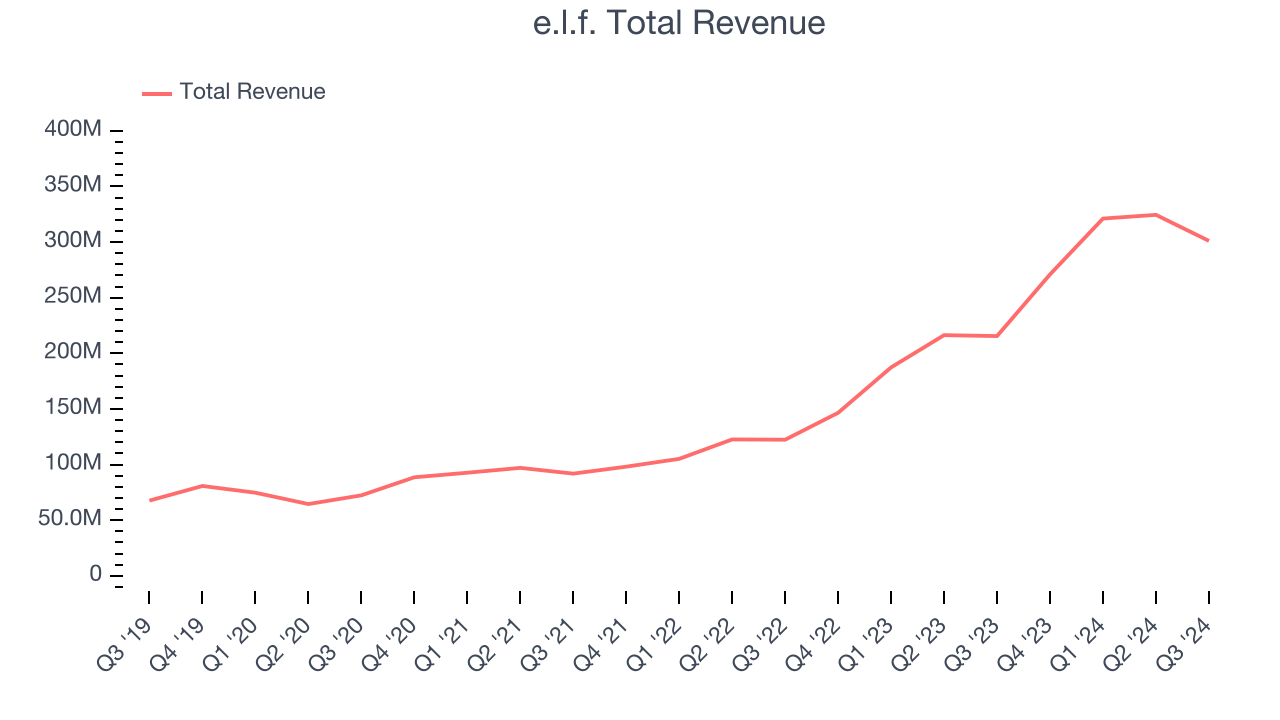

As you can see below, e.l.f.’s 48.7% annualized revenue growth over the last three years was incredible. This is encouraging because it shows e.l.f.’s had strong demand, a helpful starting point.

This quarter, e.l.f. reported wonderful year-on-year revenue growth of 39.7%, and its $301.1 million of revenue exceeded Wall Street’s estimates by 4%.

Looking ahead, sell-side analysts expect revenue to grow 15% over the next 12 months, a deceleration versus the last three years. This projection is still commendable and indicates the market sees success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

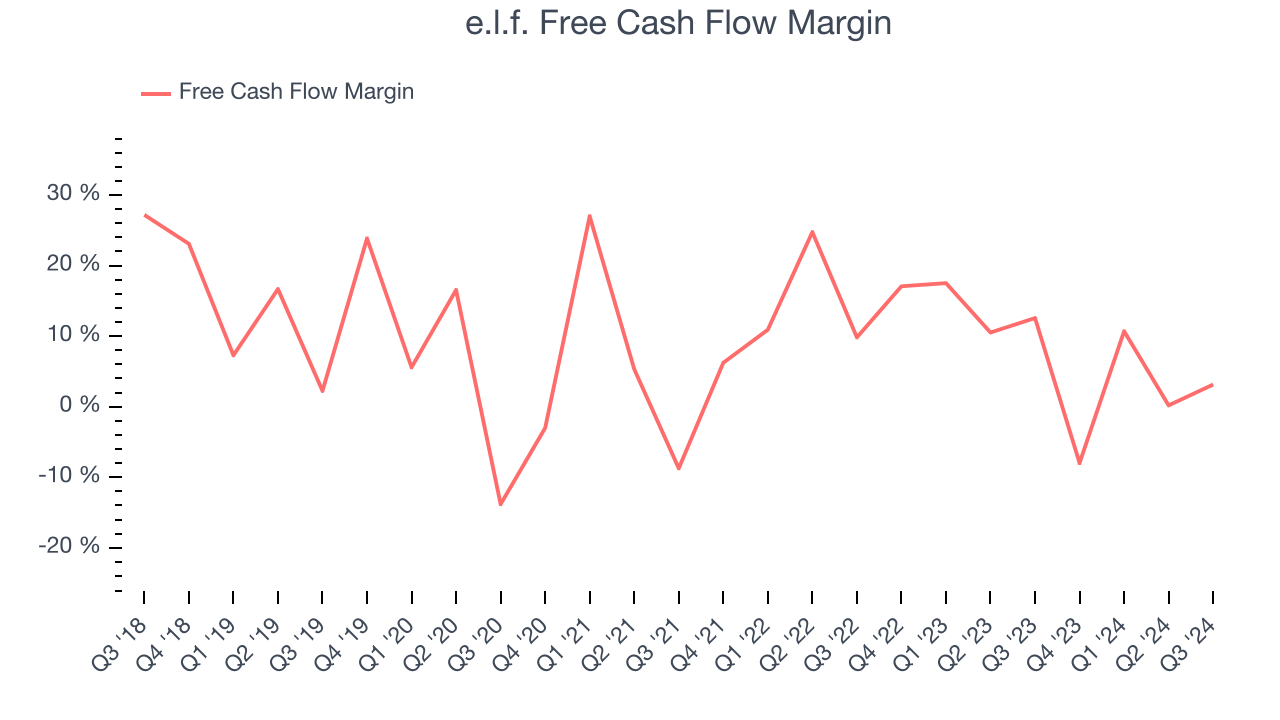

e.l.f. has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.6% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that e.l.f.’s margin dropped by 12.2 percentage points during that time. e.l.f.’s two-year free cash flow profile was compelling, but shareholders are surely hoping for its trend to reverse. Continued declines could signal that the business is becoming more capital-intensive.

e.l.f.’s free cash flow clocked in at $9.45 million in Q3, equivalent to a 3.1% margin. The company’s cash profitability regressed as it was 9.4 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

Key Takeaways from e.l.f.’s Q3 Results

We were impressed by how significantly e.l.f. blew past analysts’ revenue, EBITDA, and EPS expectations this quarter. We were also glad it raised its revenue and EBITDA guidance. Overall, we think this was a good quarter with some key metrics above expectations. The stock traded up 15.1% to $120 immediately following the results.

Sure, e.l.f. had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.