Online payroll and human resource software provider Paycor (NASDAQ:PYCR) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 16.6% year on year to $167.5 million. The company expects next quarter’s revenue to be around $177 million, close to analysts’ estimates. Its non-GAAP profit of $0.10 per share was also 30.1% above analysts’ consensus estimates.

Is now the time to buy Paycor? Find out by accessing our full research report, it’s free.

Paycor (PYCR) Q3 CY2024 Highlights:

- Revenue: $167.5 million vs analyst estimates of $162.2 million (3.3% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.08 (30.1% beat)

- Adjusted Operating Income: $22.8 million vs analyst estimates of $18.04 million (26.4% beat)

- The company slightly lifted its revenue guidance for the full year to $729.5 million at the midpoint from $725.5 million

- Gross Margin (GAAP): 64.6%, in line with the same quarter last year

- Operating Margin: -8.5%, up from -16.3% in the same quarter last year

- Free Cash Flow was -$22.92 million, down from $37.27 million in the previous quarter

- Billings: $166.9 million at quarter end, up 16.2% year on year

- Market Capitalization: $2.90 billion

“Paycor had an impressive start to the year, delivering 17% revenue growth year-over-year,” said Raul Villar, Jr., Chief Executive Officer of Paycor.

Company Overview

Found in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

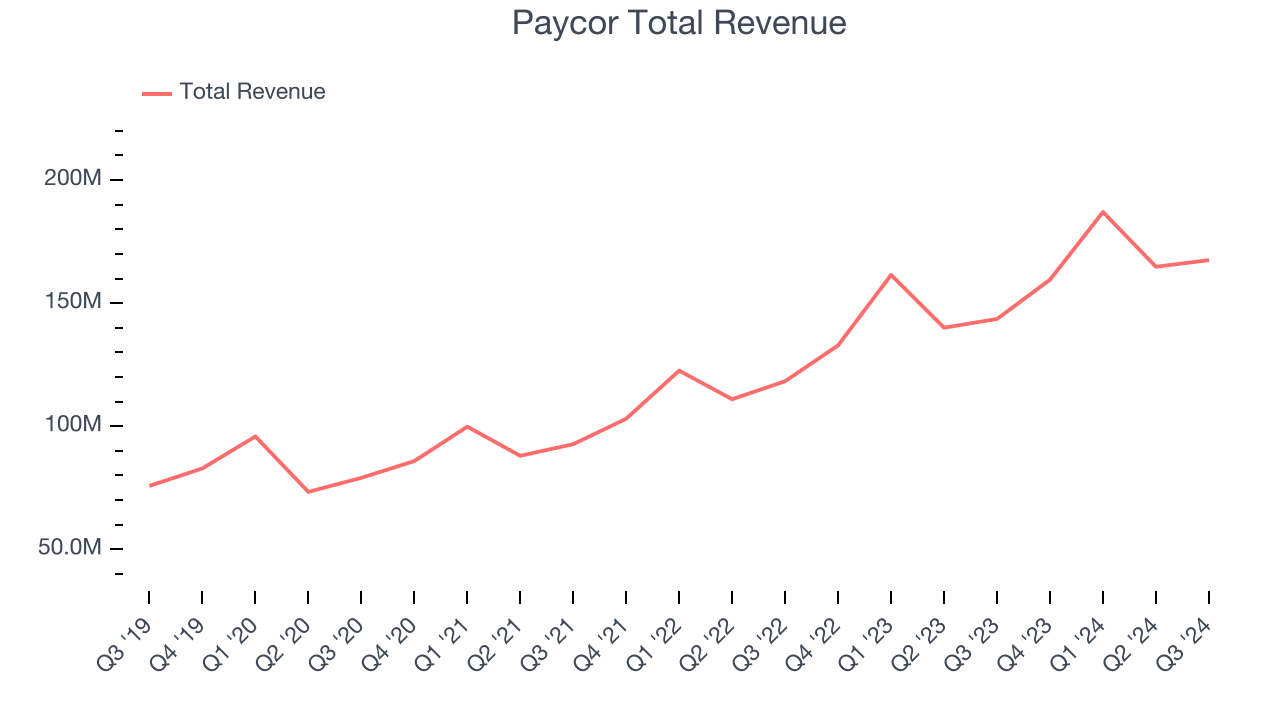

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Paycor’s 22.8% annualized revenue growth over the last three years was decent. This is a useful starting point for our analysis.

This quarter, Paycor reported year-on-year revenue growth of 16.6%, and its $167.5 million of revenue exceeded Wall Street’s estimates by 3.3%. Management is currently guiding for a 10.9% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates the market thinks its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

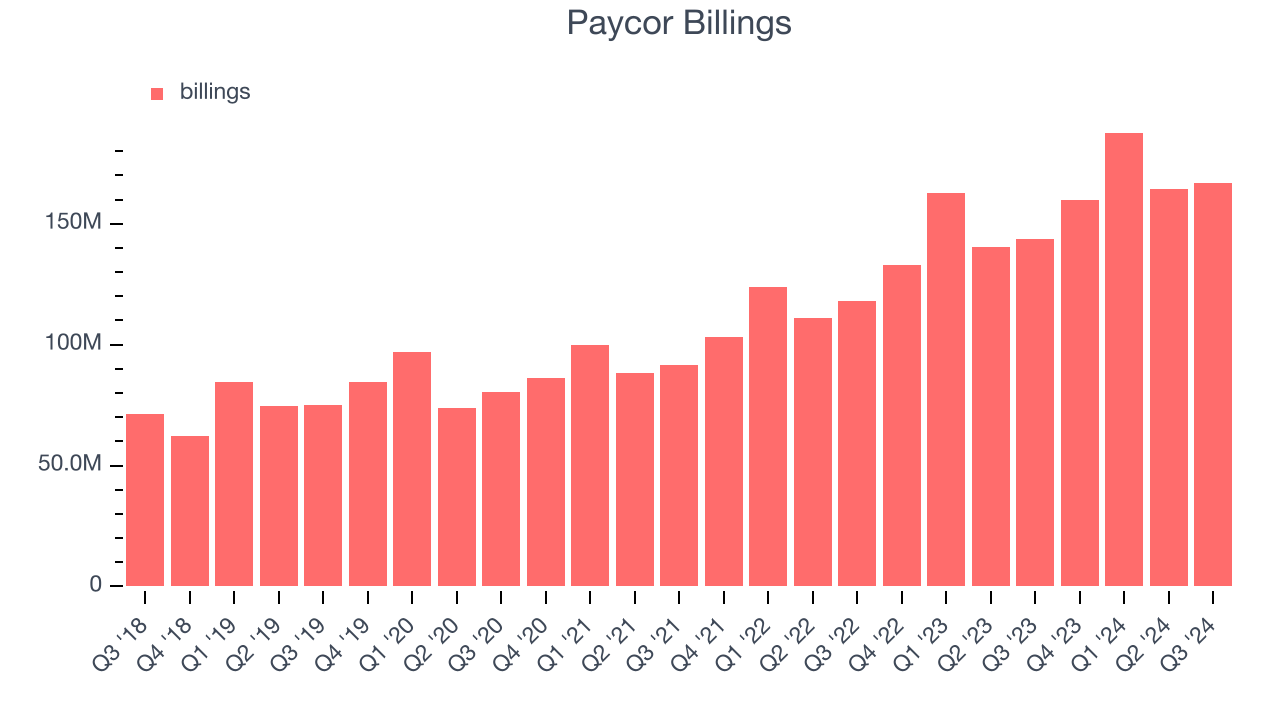

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Paycor’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Paycor’s billings growth has been solid, averaging 17.2% year-on-year increases and punching in at $166.9 million in the latest quarter. This performance was in line with its revenue growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Paycor is very efficient at acquiring new customers, and its CAC payback period checked in at 27.8 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Paycor’s Q3 Results

We enjoyed seeing Paycor exceed analysts’ billings expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly underwhelmed. Overall, this quarter had some key positives. The stock traded up 3.2% to $17.20 immediately after reporting.

Big picture, is Paycor a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.