Headline News about 7-10 Year Treasury Bond Ishares ETF

Asia Morning Bites For Thursday, Sept 19

September 18, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Financial Markets Report For Tuesday, Sept 17

September 17, 2024

Via Talk Markets

Speculator Extremes: Yen, VIX, Cotton & WTI Crude Oil Top Bullish & Bearish Positions

September 15, 2024

Via Talk Markets

Topics

Stocks

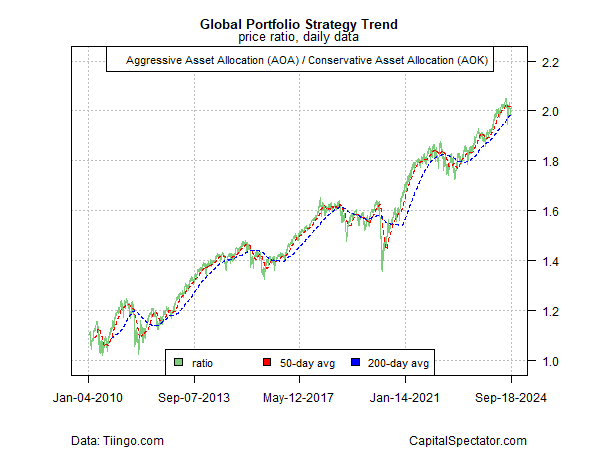

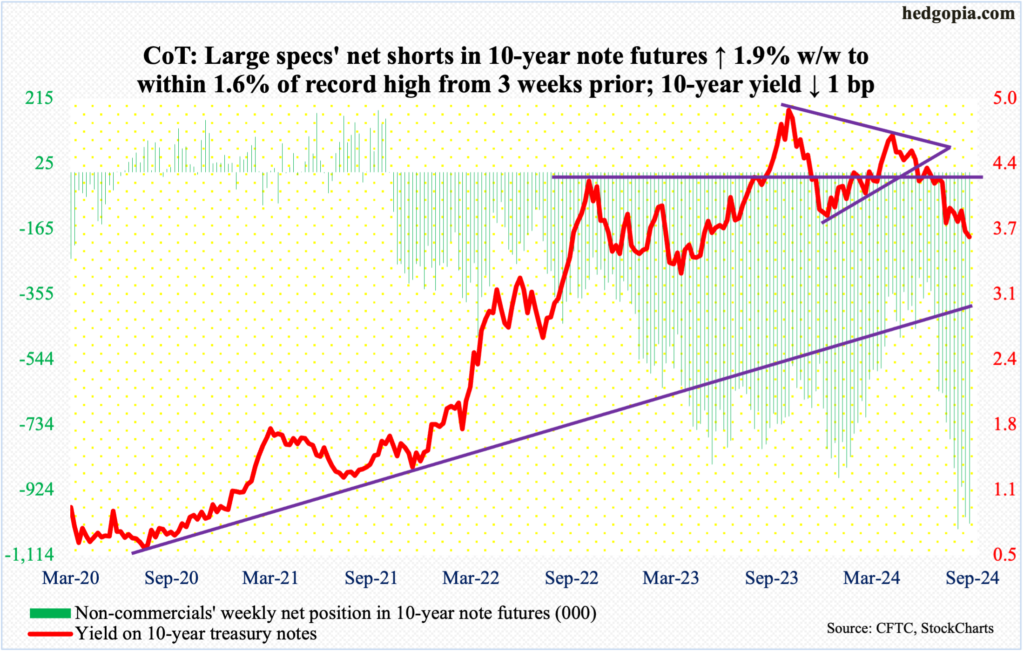

CoT On The Future Through Futures, Hedge Funds Positioning

September 15, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

The Beautiful Dreams Of Lower Interest Rates

September 13, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Here's Why Treasury ETFs Are Scaling New Highs

September 12, 2024

Via Talk Markets

Exposures

Interest Rates

Stocks Rally Back In A Roller Coaster Session

September 11, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

The Stocks Markets One Day Rally Appears To Be Over

September 10, 2024

Via Talk Markets

Consolidative Tuesday: Sept 10

September 10, 2024

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Free News Feed

Get our RSS Feed!

© Copyright 2008 StreetInsider.com

Custom Website Design by Active Media Architects

Custom Website Design by Active Media Architects