Headline News about Short Treasury Bond Ishares ETF

Via Benzinga

Momentum And Large-Cap Growth Still Lead Equity Factor Returns

August 28, 2024

Via Talk Markets

Topics

ETFs

S&P 500 Index Funds See Largest Weekly Outflow on Record

June 14, 2024

Via Talk Markets

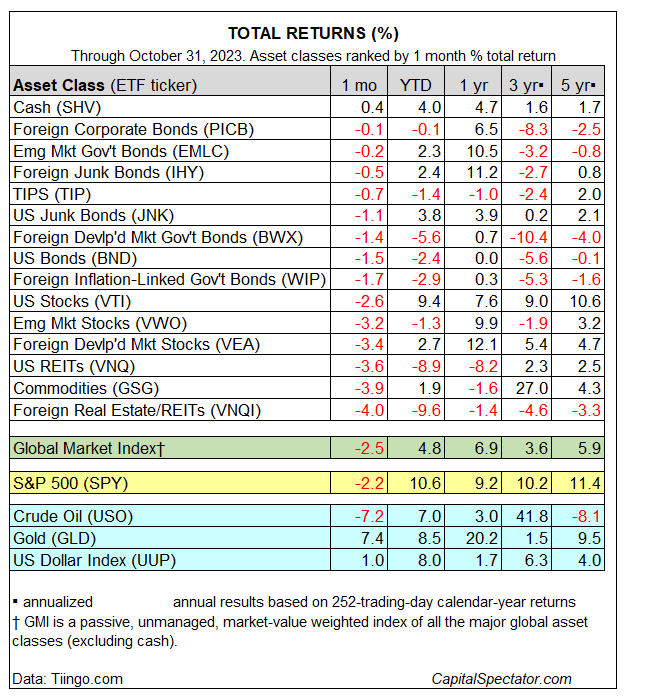

Major Asset Classes: September 2023 - Performance Review

October 02, 2023

Via Talk Markets

Topics

ETFs

Investors Bet $7B On Ultra-Short Term Bond ETFs, Chase 5% Returns Amid Market Volatility

August 31, 2023

Via Benzinga

Topics

ETFs

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Free News Feed

Get our RSS Feed!

© Copyright 2008 StreetInsider.com

Custom Website Design by Active Media Architects

Custom Website Design by Active Media Architects