All News about 7-10 Year Treasury Bond Ishares ETF

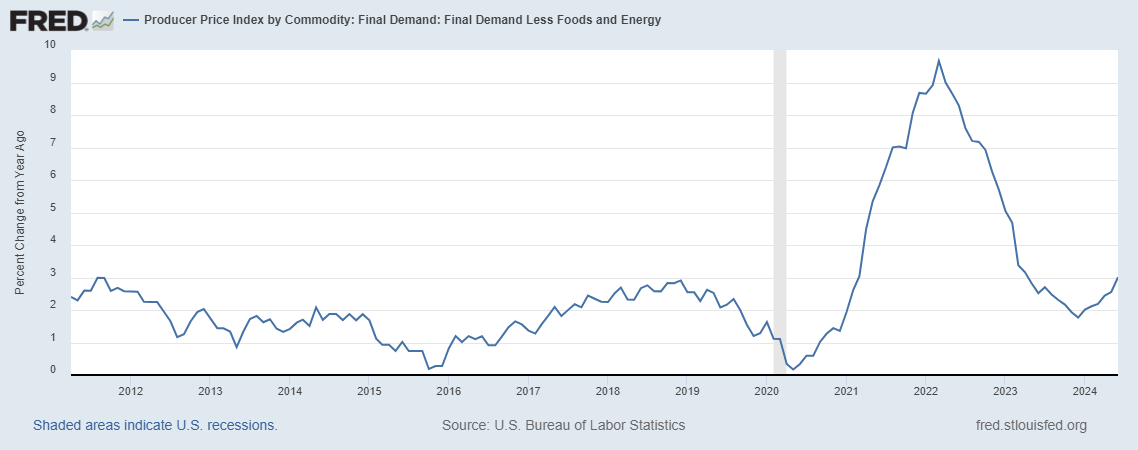

Has The Neutral Rate Of Interest Increased?

July 19, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Euro Trades Quietly Ahead Of ECB Meeting

July 18, 2024

Via Talk Markets

Markets Confident That Rate Cuts Will Start In September

July 15, 2024

Via Talk Markets

Nasdaq Pukes To Worst Day Versus Small Caps In 22 Years, Gold Soars Near Record High After Soft CPI

July 11, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Today's Battle: Soft US CPI Vs, Stretched Momentum Indicators And Two Fed Cuts Discounted

July 11, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

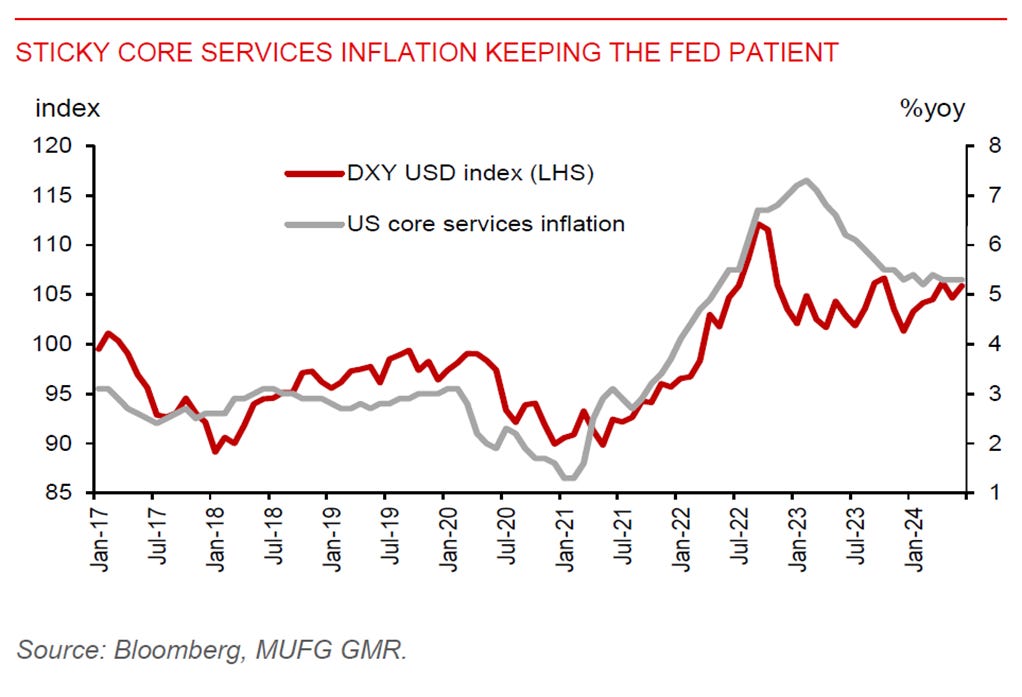

Forex: All Eyes Are On Service Inflation

July 11, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Free News Feed

Get our RSS Feed!

© Copyright 2008 StreetInsider.com

Custom Website Design by Active Media Architects

Custom Website Design by Active Media Architects